By John Engel

Last week, I wrote about the resurgence of “pocket listings” — a practice that favors secrecy over transparency. Agents, like hostage negotiators and press secretaries, believe controlling the flow of information makes us better negotiators. However, lack of transparency leads to anxiety for both buyers and sellers who feel they might be leaving money on the table.

Theodore Levitt, the Harvard marketing guru, proved in his seminal work, The Marketing Imagination, that markets work best when there is clarity, trust, and consumer-centric decision-making. Real estate, a high-stakes emotional process, is no different. Sellers think they are patient, but buyers don’t respond to patient. They need a sense of urgency — they need to know they’re competing but also that they have a fair shot.

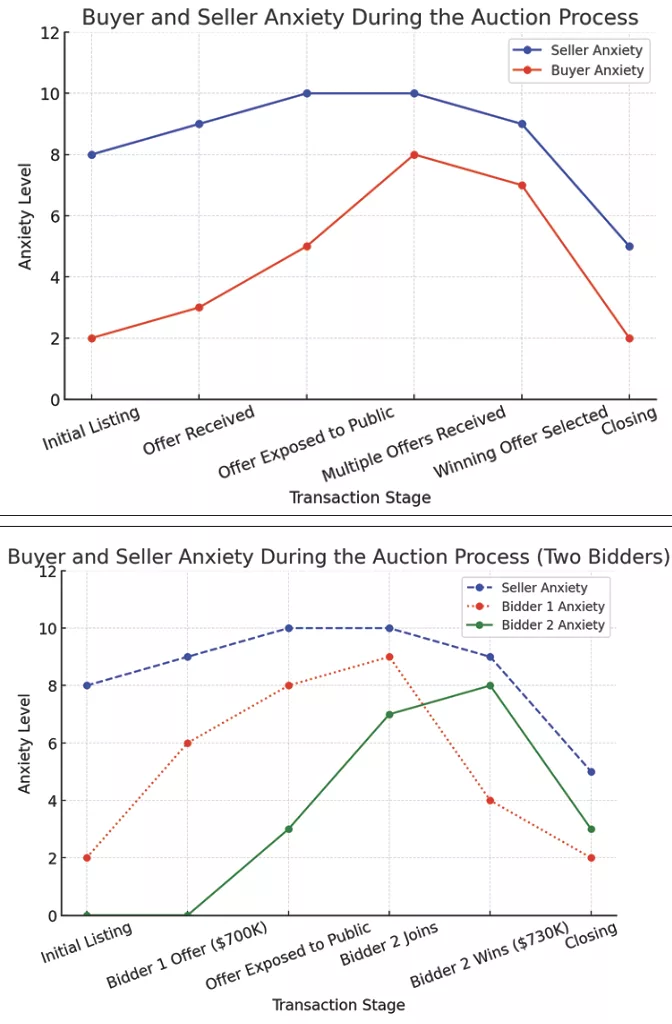

To illustrate the emotional journey of buyers and sellers, consider the top graph at right.

A Case Study in Auction Transparency

This week, we conducted an experiment with a listing using Final Offer, an auction website. The condo had been listed at $745,000 for 110 days. On Friday, we received an offer of $700,000.

Instead of negotiating privately, we used this offer as the springboard for a public auction. The risk? No other offers might come in, forcing us to accept $700,000. But we also had a strong chance of pushing the price closer to asking — or even beyond. I estimated we risked $25k to make $25k.

We accepted the offer of $700,000, contingent on exposing it publicly and allowing 48 hours for other buyers to respond. The listing price was adjusted to $700,000 on the MLS, and all prospects were directed to Final Offer’s “best and final” process.

The Results

• The listing received 776 views and was favorited by 36 people in two days.

• Four buyers scheduled showings over the weekend.

• By Sunday night, we had three offers.

• The winning bid? $730,000 with no contingencies.

• The other bids were held as backups.

What This Tells Us About Buyer and Seller Anxiety

In this auction, sellers experienced peak anxiety when waiting for an offer but remained highly anxious even after an offer was accepted, worried that they were leaving money on the table. Buyers, on the other hand, peaked in anxiety when making offers, afraid of being outbid or overpaying. (See second chart at right.)

Levitt’s insights on consumer behavior are clear: markets function best with transparency and trust. By exposing the offer publicly and allowing real competition, we alleviate uncertainty and provide true price discovery.

The Real Estate Industry’s Trust Problem

After the auction, an Internet troll emailed me, saying the real estate industry is full of “unprofessional persons” and that this process was “repulsive and insulting.” Why? Because our industry has a credibility problem.

Agents don’t trust each other. When I tell an agent I have another bidder, they immediately ask:

• Is it someone from your office?

• Is the offer real, or are you shopping mine?

• Will I get a fair shot at improving my bid?

This lack of trust is why lawsuits and settlements — like the Sitzer/Burnett case — are shaking up the industry. Old-school methods, where agents privately control information, should be giving way to more transparent, buyer-friendly approaches.

The Auction as a Solution

• Buyers need to know they aren’t being played.

• Sellers need confidence they did not leave money on the table.

• Transparency benefits both parties.

Levitt would argue that buyers are not just purchasing a home; they are purchasing certainty and fairness. The auction model is a step in that direction.

Key Takeaways

• Bidder 1 has high anxiety early on that peaks when s/he is outbid and then drops.

• Bidder 2 starts stress-free but anxiety peaks when s/he makes the final bid, and stress declines afterward.

• Sellers stay anxious throughout the process, only relaxing after closing.

• Transparency increases bidder confidence, reducing skepticism about the process.

Levitt’s marketing principles apply here: Buyers don’t just purchase a home; they purchase certainty. This structured auction gave both bidders clarity, even if one lost.

While the open auction isn’t a universal fix, this experiment proved that radical transparency works. The seller didn’t get full asking price, but they got market price. The winning bidder didn’t love raising her bid, but she knew it was necessary to win.

Buyers don’t trust the traditional process. The industry needs to change. While some circumstances warrant use of a pocket listing, buyers are right to be frustrated. If the success of this auction is any indication, the future of real estate might just be more transparent than ever.

Epilogue

A week later, the winning bidder withdrew her bid, and we went to the backup, a phenomenon that happens all too often and should be the subject of a future column. My back-of-the-napkin estimate is that half of all deals fall apart after a buyer wins a multiple-bid situation. I don’t think auction houses have this problem but listing agents certainly do. In evaluating listing agents to list my house, I think one of the most important qualities is finding an agent who will keep the deal together. This requires a combination of skill and experience, of course, but it also puts greater emphasis on communication skills and temperament. But I digress.

Notes from the Monday Meeting

We had a flurry of activity as the season began on schedule, two weeks after Super Bowl weekend. The Engel Team has new deals in the $3’s, another at $2 million, two more at the $1.2 million level, two below $1 million, and a rental in the $7,000 range. We’ve identified about a dozen listings that we expect to bring to market in the next two months ranging from $1 million to $6 million but each of these sellers needs a place to go!

Pricing is challenging during a rising tide, and capes, contemporaries, and colonials are not all performing equally well. In the early season, I see buyers are extra-picky. And why not? Certainly, more will come on.

In this market, well-renovated properties continue to command a premium. We are recommending to (most of) our clients that they do a pre-sale building inspection and engage a stager to make satisfactory offers stick. Stager? While most of us believe our houses present “just fine” without adding a warehouse full of furniture, we are finding that stagers often add tremendous value even when they make few changes and rearrange what’s there. After all, we are approaching peak decision-making season, and we have one chance to make a first impression.

John Engel is a broker with The Engel Team at Douglas Elliman, and he was buying bird seed like crazy until he wasn’t. Forty pounds in late December, 80 pounds more purchased in January. Three feeders, each feeding a dozen birds during daylight hours. Snow? It brings even more birds, as if that were possible. A cardinal eats nearly one pound of birdseed each day while a chickadee eats 250 sunflower seeds per day — 35% of its body weight, the equivalent of John eating 600 granola bars per day.