By John Engel

New Canaan is going through its annual budget review. There are two parts to the budget: operating and capital. The Selectmen have recommended a School budget of $114 million, up 4.6%, and a Town budget of $43 million, up 4.3%. The town council will cut that further. Most of the budget is locked in, the result of union negotiations, contracted services, insurance premiums, and debt service. Not much of the budget is discretionary. The biggest part of the discretionary budget is capital, and capital projects are bonded. Anything that costs more than $50,000 and lasts more than a few years is capitalized. Most citizens are unaware that our town government publishes a list of all the capital priorities for the next few years (on page 118 of the selectman’s recommended budget, found on the town website.) Two current capital projects are the removal of Irwin House and the expansion of the Powerhouse Theater in Waveny.

As interest rates rise nationally, New Canaan finds itself re-financing our low-interest debt at higher and higher rates. We borrow for new (the Library), to improve (the Police Station), and to repair (Waveny roofs). We buy them, bond them, and bond them again when they wear out. Debt service is proposed at $1.73 million for tax-supported capital and another $18.11 million for debt service. This column is mostly about debt service.

Moody’s is a rating agency that assigns credit ratings to New Canaan’s bonds. The rating scale runs from Aaa to C, with Aaa being the highest quality. New Canaan enjoys a triple-A rating because:

“The Aaa rating reflects the town’s large tax base with exceptionally strong income and wealth levels, healthy financial position following several years of operating surpluses and manageable long-term liabilities… The stable outlook reflects the expectation that the town’s financial position will remain healthy due to strong management, stable revenues supported by strong property tax collections and low fixed costs.”

Moody’s is reviewing us today. The implication is that if Moody’s ever loses confidence in the underlying real estate values here, they might lower our rating, and New Canaan would pay a higher interest rate in the market on the next round of bonds. That’s why I was asked by the First Selectman this morning for an opinion on the New Canaan Real Estate market.

How’s the market? If you are a Realtor dependent on commissions, it’s pretty bleak. You might focus on the 16% decrease in transactions and flat dollar volume of sales these past two years. Homeowners are optimistic, focused on price and liquidity: what’s my home worth and how long will it take to sell? (micro-economics) But our town officials and their rating agency are more interested in macro-economics: the health of the whole town, risks, trends, and long-term projections. This boils down to real estate values and their confidence in residents’ ability to pay our property taxes. One thing Moody’s pays attention to is that while the budgeted tax collection rate is 98.5% of all taxes, we collect 99.8% of all taxes owed. This says a lot about our residents’ ability to pay and our confidence in real estate.

A thought exercise: If our property values were to double because of scarcity but jobs and wages failed to keep pace, they’d call that a recession. We’d see a lagging effect before inability to pay was reflected in declining real estate values. One early indication would be an increase in inventory levels. We aren’t seeing that, yet. Or an increase in average-days-on-market: not seeing that. Finally, we’d see a decrease in the percentage of list price achieved: not an issue. It’s currently 100% here and throughout Fairfield County. If, finally, these cracks become apparent, we should see a decrease in average and median price. These are the signs we look for. Today, I set out to produce the charts that might help our town officials and the folks at Moody’s better understand whether New Canaan should remain triple-A.

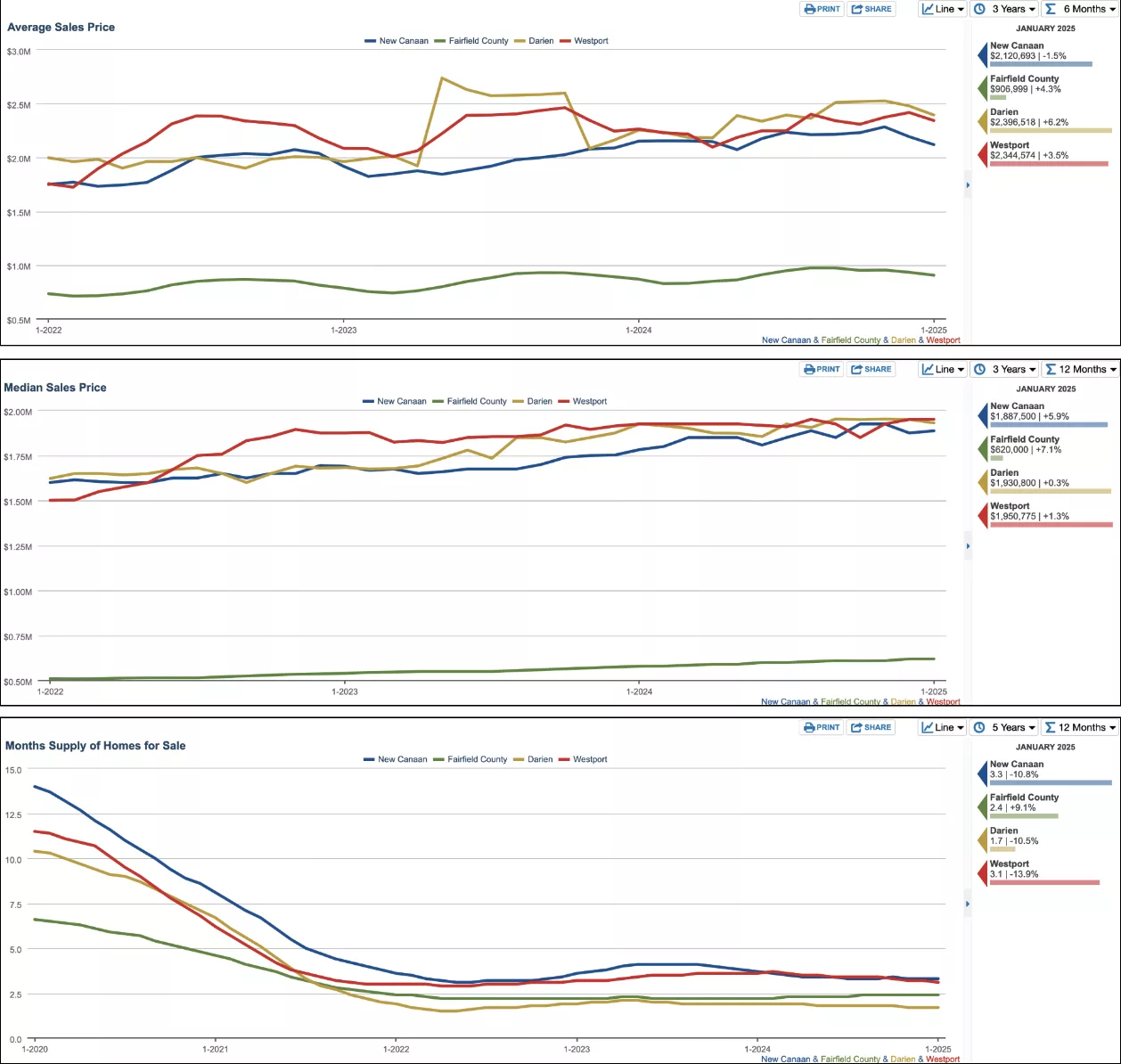

Average Sales Price, where each data point represents six months of activity (strips out seasonality). It appears that New Canaan and her peer towns Westport and Darien are all on a flat trajectory, maintaining average sales prices over $2 million consistently for the last 18 months. These three towns move together, competing for the same buyer. Therefore, if one were discovered to be an obvious bargain, that bargain would not last very long. Such is the case now with New Canaan, down 1.5% in average price year over year. Any gains were given back in the last three months, and the three-year trend line is positive for all three towns and Fairfield County as a whole.

Median Sales Price, where each data point represents 12 months of activity, better illustrates this tendency to move together, with New Canaan rising 5.9% year-over-year and Darien and Westport showing smaller gains. The three towns, with similar tax rates and similarly rated schools, have median prices within 2% of each other.

Months’ supply of Homes for Sale is currently at 3.3 months’ supply, down 10.8% year-over-year, and below the target six months we look for in a balanced market. Consider the relationship between the three graphs: the number of homes for sale dropped by 20%, prices rose by 5.9%, and months’ supply dropped by 10% during the same period. Moody’s might be correct in assuming that New Canaan’s near-future self looks like Darien today: inventory cut by half (17 houses), month’s supply cut in half (1.7 months), and prices up another 10% ($2.2 million).

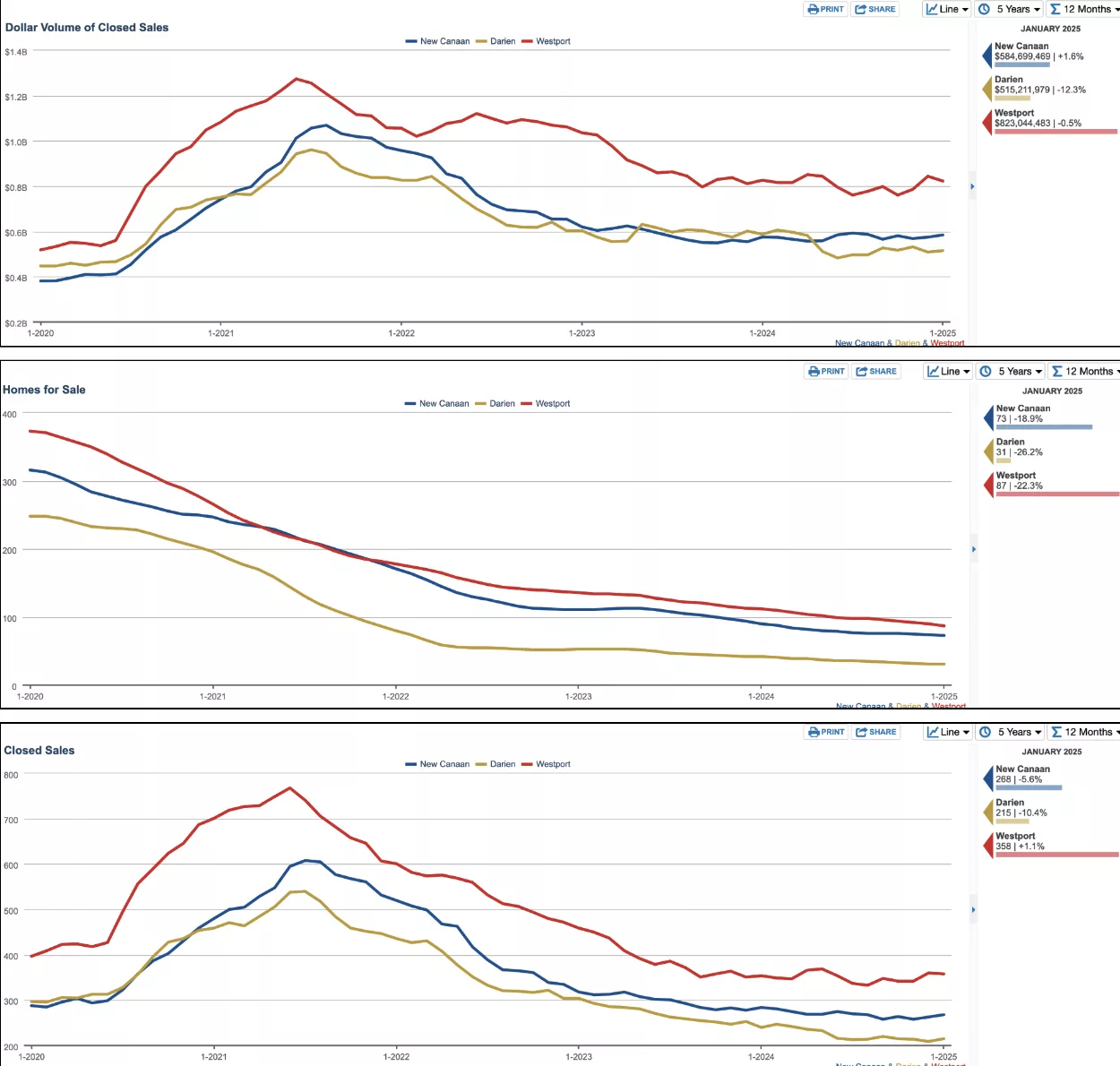

The Dollar Volume of Closed Sales has been steady for the last two years and is expected to persist. This reflects a slight rise in price along with a slight decline in transactions. Rising prices are good for the New Canaan Grand List, while fewer transactions are bad for the State (.75% – 2.25%) and to a lesser extent the Town (.25%) portion of conveyance taxes.

Homes for Sale is down 18.9% year-over-year, not quite as bad as peer towns Darien and Westport but still pretty bad.

The Number of Closed Sales is down 5.6% in New Canaan, a close parallel to the decrease in inventory levels.

We mustn’t take it for granted that rating agencies will always give us a pass. On August 5, 2011, a Friday afternoon, rating agency S&P announced their first ever downgrade to U.S. sovereign debt, lowering the rating to AA+ with a negative outlook. My New Canaan neighbor was running S&P at the time and said it was a really, really tough time for the raters and rated.

Conclusion

The data suggests that New Canaan’s real estate market remains stable, with rising prices and limited inventory supporting the town’s financial health. While transaction volume has softened, key indicators — such as price trends, tax collection rates, and supply constraints — reinforce confidence in the town’s long-term outlook. As long as these fundamentals remain intact, New Canaan’s triple-A bond rating should hold, ensuring continued fiscal strength and favorable borrowing conditions for future capital projects.

John Engel is a broker on the Engel Team at Douglas Elliman and each Thursday at 3pm he co-hosts a live show on real estate. Recent shows included Panama, Airbnb, Sarasota, Dubai, Austin, Vermont and the Middle East investor. John’s guest on the show collects waterfront vacation apartments in Florida and Texas, 27 at last count, and claims they produce a 30% return. Not a bad way to make a living.