By John Engel

In the wake of the election the nation’s attention again turns to taxes. The Tax Cut and Jobs Act of 2018 (TCJA) was the most significant tax change of the first Trump administration, profoundly affecting housing markets across the country. At the end of 2025 the TCJA is set to expire, and its extension or elimination is bound to again reshape the real estate landscape. Let’s begin by looking at the major tenets of this $4 trillion piece of legislation and what its expiration portends:

1. Standard Deductions were doubled, now $24,000 for married joint filers.

2. Individual Tax Brackets were lowered. Top brackets dropped from 39.6% to 37%

3. The Child Tax credit doubled to $2000 per child. The phaseout thresholds rose.

4. State and Local Tax deduction was capped at $10,000, a killer for high-tax states.

5. The Estate and Gift tax exclusion amount doubled to $10 million.

6. The Qualified Business Income (QBI) deduction was created for small businesses.

It’s important to note that this $4 trillion tax change has had a large and inflationary effect on the housing market nationally, and locally. The median price of a single-family home in the U.S. has risen about 40% since the tax was enacted, peaking at $480,000 before receding to $417,000. The average citizen paid $2,826 in property taxes at the close of 2023, up about 24% but not enough to notice #4, the capping of the SALT tax deduction. This cap on SALT did damage to housing markets where taxes exceed $10,000 (particularly New York, California and right here in Fairfield County, Connecticut) and pushed people to low-tax areas. Six years later, with property taxes rising in low-tax markets in Texas, Florida and the Carolinas are we seeing benefit of moving to a low-tax state diminished? Do taxes matter? Prices in several of those fast-growing markets have risen and recent purchases are taxed at the new market rate, now exceeding the $10,000 cap. In Florida and Connecticut the average tax rate remained at .89% and 2.15%. In Texas the rate rose 16% from 1.6% to 1.9% and in New York it rose 25% from 1.3% to 1.73%.

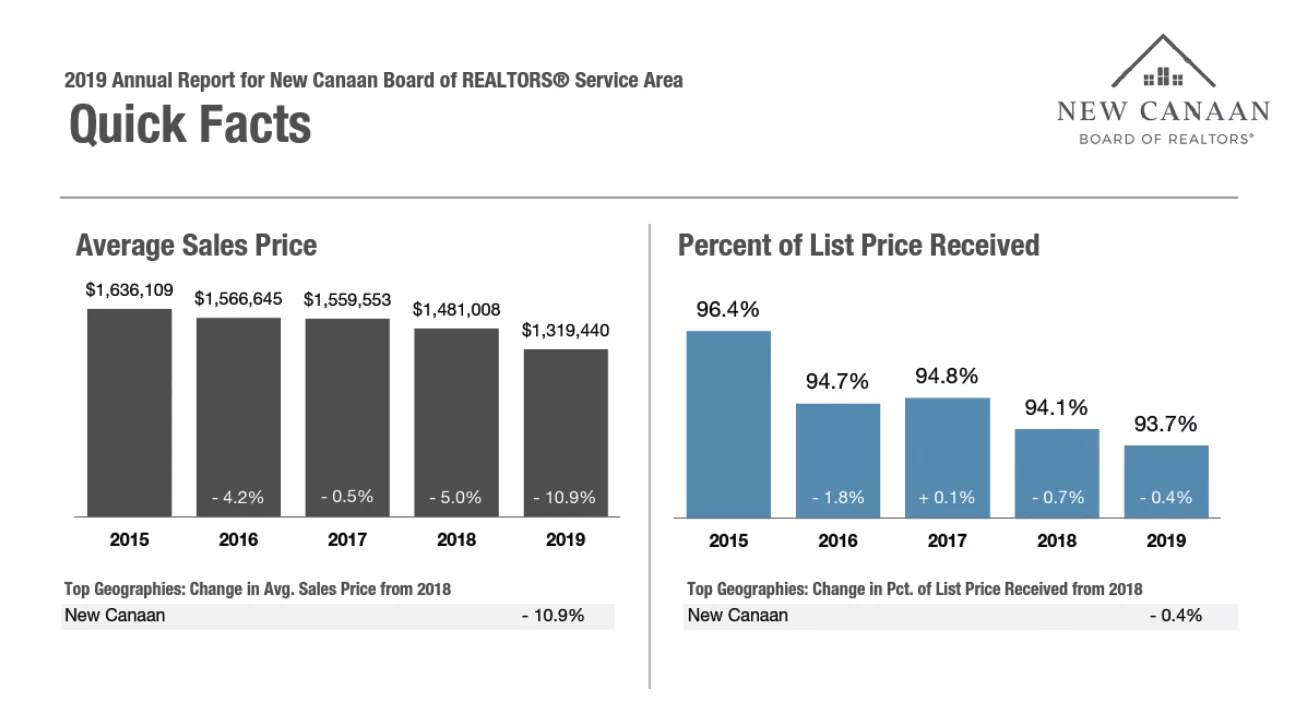

I looked back to the first full year after the tax went into effect. New Canaan was already in a 5-year period of (modest) contraction. Our average and median prices had fallen in 2019 ($1.322 million and $1.150 million) as well as the percent of list price received (93.7%). We saw a modest decline in real estate value in each of the previous 4 years, 2015-2018, but the SALT cap limits exacerbated the problem, a delicate situation resulting in a $150,000 decrease in the average sale price in New Canaan in one year.

The second factor was the revaluation. In the previous healthy 5-year cycle the Grand List did its normal thing, rising by 2% per year as new homes were built, and older homes were improved. The -7.3% contraction experienced in the 2018 revaluation was painful for many. Homeowner equity was down, the mill rate adjusted, and property taxes for many homeowners changed by more than 20% in that year. Federal tax changes don’t occur in a vacuum; they happened at the same time our local market was distressed. By capping the deduction for real estate taxes at $10,000, the federal government was encouraging the southern migration, punishing all real estate over $800,000.

It took Covid to stimulate a reversal. I say stimulate, not cause, because there were several factors contributing toward the spike in home prices, not the least of which was easy credit, a profound increase in the money supply, and the sudden desire on the part of Millennials to enter the housing market. This, combined with the Work From Home (WFH) movement, fueled significant migration from our high-tax area to Sun Belt states like Texas and Florida.

Now, six years later, with both housing prices and property taxes rising in Texas and New York, tax rates flat but prices rising in Connecticut and Florida, what is the likelihood and what would be the effect of an expiration of the TCJA taxes? What does it look like for this area if we were to gain back the full Salt Tax deduction in the post-covid world of higher inflation, higher rates and tighter monetary policy?

First, we look at likelihood. Some say the SALT cap will be extended despite campaign promises because we can’t afford to roll back the SALT cap. Impact? Probably not much of an impact. While we were initially appalled, with time we accept new taxes. In this column I have described the diminishment of the lock-in effect over time. If you have a low interest rate that you vow you’ll never give up, with time you’re resolve weakens. So too with the SALT tax deduction. The market is not anticipating the elimination of the cap, and most buyers are not factoring it into the price of a new home.

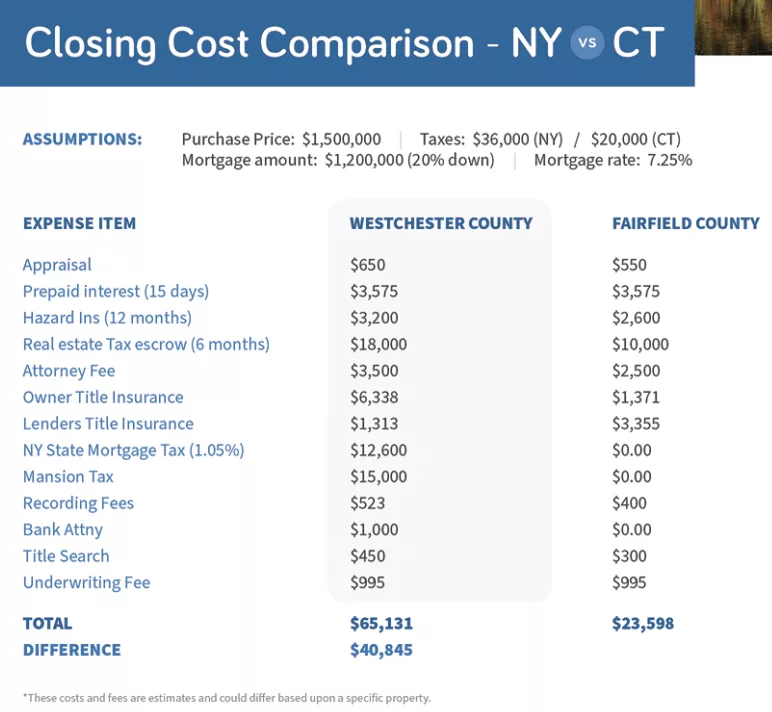

What buyers are talking about are several new taxes that have been introduced in the last few years. Westchester ranks #1 in property taxes in the nation. What about transfer taxes? As you can see in the chart the estimated closing costs of the same $1.5 million house in Westchester County and Fairfield County can differ by over $40,000. Wow. 276% difference. A closer examination reveals the newly enacted New York State mortgage tax (1.05%) and the Mansion Tax (1%) to be the major factors favoring Connecticut, followed by a higher local property tax (.5%), additional title insurance ($2000) and the inclusion of a required bank attorney ($1000). That’s buyer transfer taxes, what about annual? Westchester County has a county property tax. Connecticut does not. In Westchester 8 of 25 towns are now electing to assess taxes at 100% of market value, and reassessments occur annually. In Connecticut all towns assess taxes at 70% of market value every 5 years. Differences in tax policy are having a profound impact at all levels.

Connecticut adopted a Mansion Tax in 2020. We’ve always (I say “always” because Connecticut started taxing real estate in 1650) taxed sellers on sales below $800,000 at .75% and amounts above at 1.25%. Connecticut’s new mansion tax of 2.25% hits the value of a home above $2.5 million. As New Canaan, Darien, Westport are all approaching that figure with the average house (and Greenwich passed the $2.5 million mark about 4 years ago) the mansion tax is becoming more significant to our market with each passing day. Connecticut is now one of only 7 states with a mansion tax. Even California does not have one (but Los Angeles has gotten the ball rolling beginning at $5 million). Even New Jersey only taxes their mansions at the 1% level.

Summary: With housing prices rising In most markets modestly, inflation rising modestly, and rates expected to remain unchanged we get comfortable. Will this frog get too comfortable in a boiling pot? Expect recent and anticipated tax changes, including new transfer taxes, mortgage taxes, SALT deduction limits, and property tax changes to be the hidden but significant factors changing the calculus on housing markets.

John Engel is a broker with the Engel Team at Douglas Elliman and he found a nest of mice in his Christmas tree this week. Only after it was completely decorated and hailed as a masterpiece did the mice start moving. The family hastily erected a makeshift perimeter. Noisemakers were employed to keep the mice pinned down in their defensive positions, and the tree was stripped and evacuated to the porch where the nest was surgically removed. It has been memorialized on TikTok and Instagram because Christmas sometimes throws each of us a curve ball. No mice were harmed. Melissa was permanently scarred.