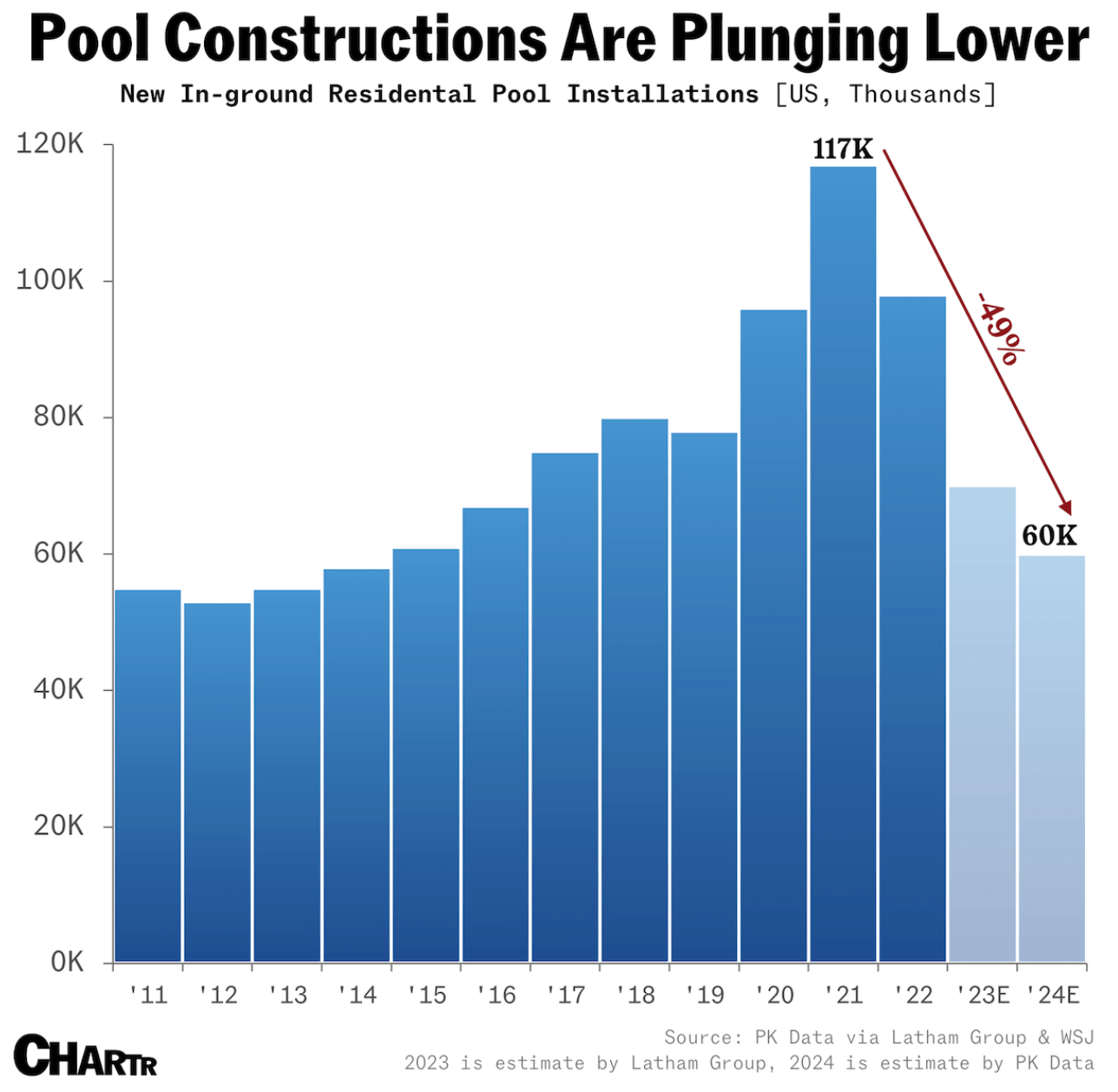

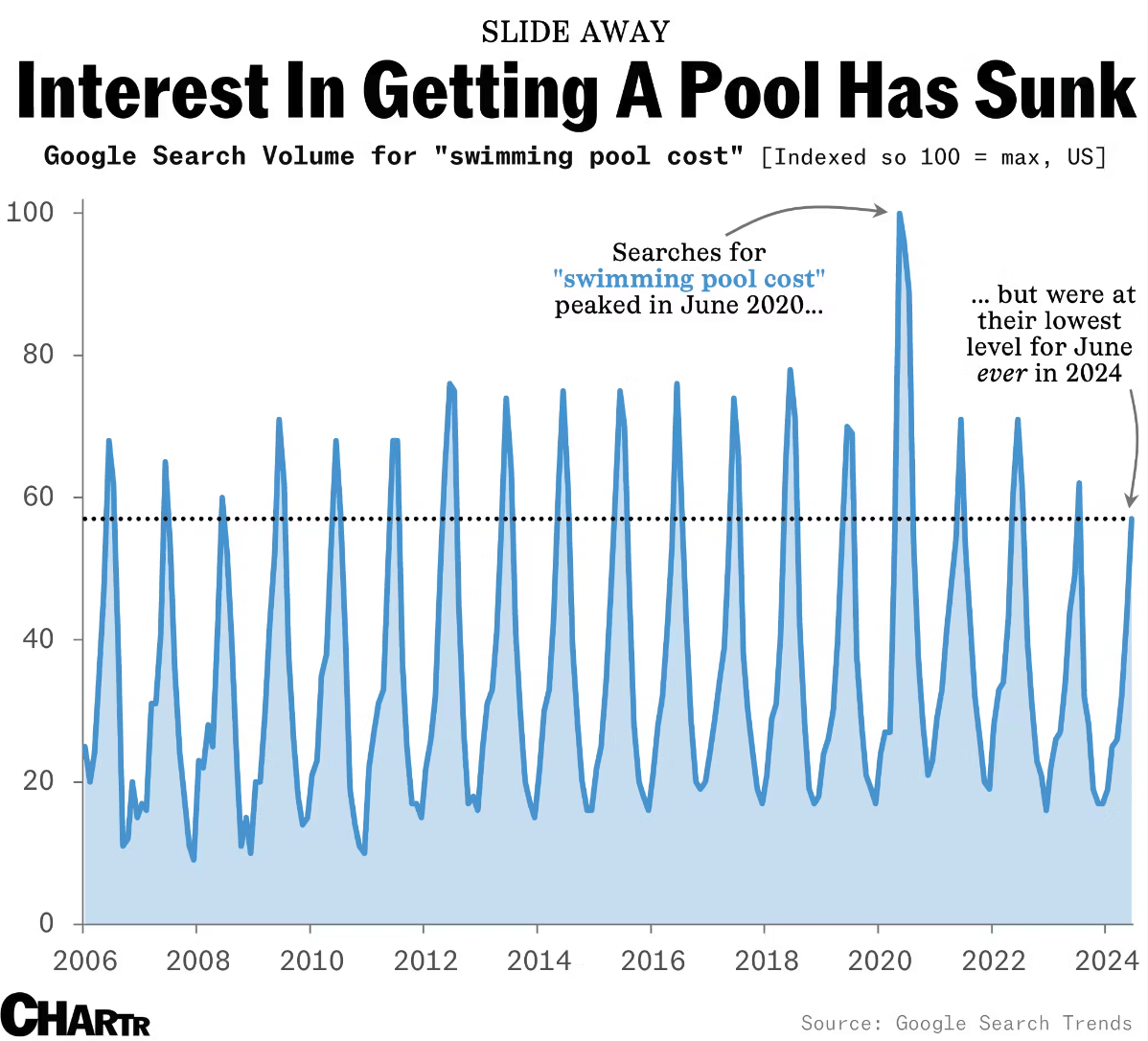

Pool construction is down 49% since peaking during the pandemic, 2021. And searches in Google for “swimming pool cost” is also down 40% since 2020, now at their lowest levels in a decade. Pool Corp estimates that the cost of a new pool nationally has risen 72% in the last 5 years (2019-2024) to $74,000. They say demand has decreased 23% in the past year and anticipate another 15-20% drop in 2024. While homeowners were willing to tap into home equity to finance a pool in a low-interest rate environment, fewer are now.

The reasons are both behavioral and economic: Now that we can travel, many of us get our pool fix while on vacation or at the local club or town pool. With rising inflation and interest rates consumers seem to be increasingly sensitive to the rapidly rising cost of building and maintaining a pool. A third reason that does not get talked about very much is regulatory. While many say it’s high priority and worth the cost, for some the complicated approval process is a bridge too far. My $5 million sale last year was held up until the survey was completed, the pool designed, and the permit approved by 4 building departments, a process that took 3 months. I am working with two buyers now for whom a pool is at the top of their priority list. Estimates for $180,000 – $240,000 to put in a pool are common in our area and many buyers budget for that. But, when local and state regulations regarding wetlands, setbacks, and coverage complicate the picture, or the pool conflicts with a required “code-complying reserve septic area” then costs go up. I know of one New Canaan family that sold their house in 2022 when they got pool estimates approaching $500,000. That sounds like a lot until you budget for navigating challenging topography and require engineering genius on the team. Beautiful stonework can easily reach 6 figures, not to mention potential wetlands restoration. The $500,000 pool is a thing.

It was not long ago that pools added little or no value. Some of my neighbors filled in their pools. One reason for growth of the pool market is the excitement and ease of use over advanced technology. This isn’t your grandmother’s pool. Today’s pools have better filtration, are safer, with fewer chemicals, automated chemistry testing, monitoring and operation, often with robotic cleaners, retractable covers, variable speed pumps and LED lighting. (and why not add an outdoor wide-screen TV and sound system?) WillyGoat.com offers a 42-foot waterslide for $37,900 plus installation but check with your insurance company first. Only 10%-20% of insurers will cover a diving board or slide. One of the challenges of owning a pool is maintenance. In my own experience the $15,000 retractable cover was a major part of the solution. It meant a warmer, cleaner pool, a longer pool season, fewer maintenance visits, less chlorine, and knowledge that the pool would be leaf-free on Saturday.

One exciting new development in pools is the shipping-container pool. Costs depend on the pool size and features. I priced the most expensive, a 40’ x 12’ in-ground container pool on Modpools.com and it came out to $74,000. I know of one Modpool in New Canaan and the owner absolutely loves it, installed it in a weekend with a forklift for half that much. Half the expense of most pools is in the stonework, patios and fence.

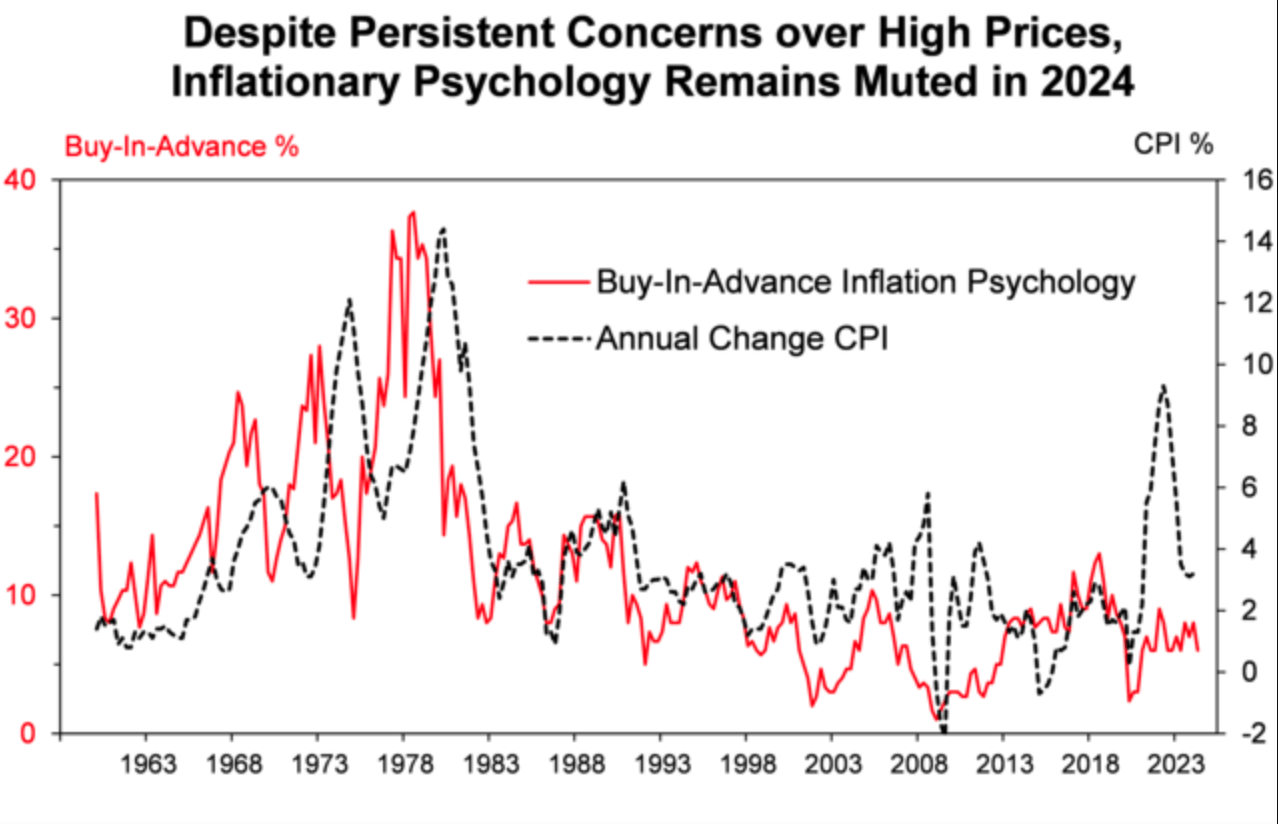

Vacation? What vacation? The new normal is a 365-day market during times of high demand and low inventory. Consider that we only have 89 houses and condos on the market, in the last 30 days we’ve see 18 properties go under contract, 12 more accepted offers but are not yet signed, and 40 properties closed. 4 listings were cancelled, 2 were withdrawn and 2 expired. There were only 15 new listings in the first half of July. That is a busy market. Increasingly, it seems the obstacle getting in the way of new listing activity, the friction, is the inability to find somewhere to go, not interest rates, not the lock-in effect of sweet mortgages, not the stock market, not the jobs report. That being said the Consumer Price Index (CPI) went down .1% this month (and .3% annually to 3.0%, the jobs report was revised downward, and consumer sentiment “remains stubbornly subdued”. Long run inflation expectations came in at 2.9% “remarkably stable over the last three years,” according to the University of Michigan’s Survey of Consumers.

Notes from the Monday meeting: I just got a call from a New Yorker who wants to buy a Midcentury Modern House (don’t we all?) and we had the conversation about buyer-brokerage. I told him he could continue to call listing agents, unrepresented, but he wants my help he must sign a buyer-brokerage agreement up-front. This is not a new law, it’s an old law with new teeth. Buyer-broker commission is spelled out in the agreement and if it’s not paid by the seller then it is the responsibility of the buyer. The buyer will know this BEFORE making an offer, so the buyer can adjust his offer accordingly. The economics should be the same. What’s changed is the MLS will no longer publish buyer-broker compensation as of August 15, requiring agents and buyers to communicate that information some other way. In the next few weeks I’ll be interviewing Michael Barbaro, the President of SmartMLS on my Boroughs & Burbs podcast (Thursdays at 3pm) so we can explore this further. The public and agents are invited to weigh-in.

Radon and mold continue to get in the way of house sales causing one agent to remark, “We are the only society that eats flaming hot Cheetos and worries about radon” Yes, we do. Another agent reported open houses every weekend, saying, “Most of the realtors are on vacation. It’s an ideal time, a self-serve market.”

John Engel is a Broker with the Engel Team at Douglas Elliman and he has a wedding coming up Labor Day Weekend at St. Aloysius and Waveny. Francos is providing the wine. Rosie’s is baking. The band has a horn section. To make it an all-New Canaan affair John may sneak over to New England Academy of Dance to get some dance lessons.