By John Engel

This week we’ll discuss discount points and assumable loans as two creative ways to approach your next real estate purchase. Purchasing discount points becomes more popular during periods of higher interest rates. It’s a strategy everyone should consider in this “higher-for-longer” environment.

According to Zillow, nearly half (45%) of home buyers with conventional loans in 2022 purchased discount points to lower their interest rates. When is this a good idea? That would depend on the timing in which you live in the home or believe you might refinance the initial interest rate. Purchasing one point, which costs 1% of the loan amount, typically reduces the interest rate by 0.25% to 0.375% of a point. Rate buy-downs subsidized by the seller are always a benefit to the buyer and can also be a much, much more cost-effective approach than a price reduction for the seller.

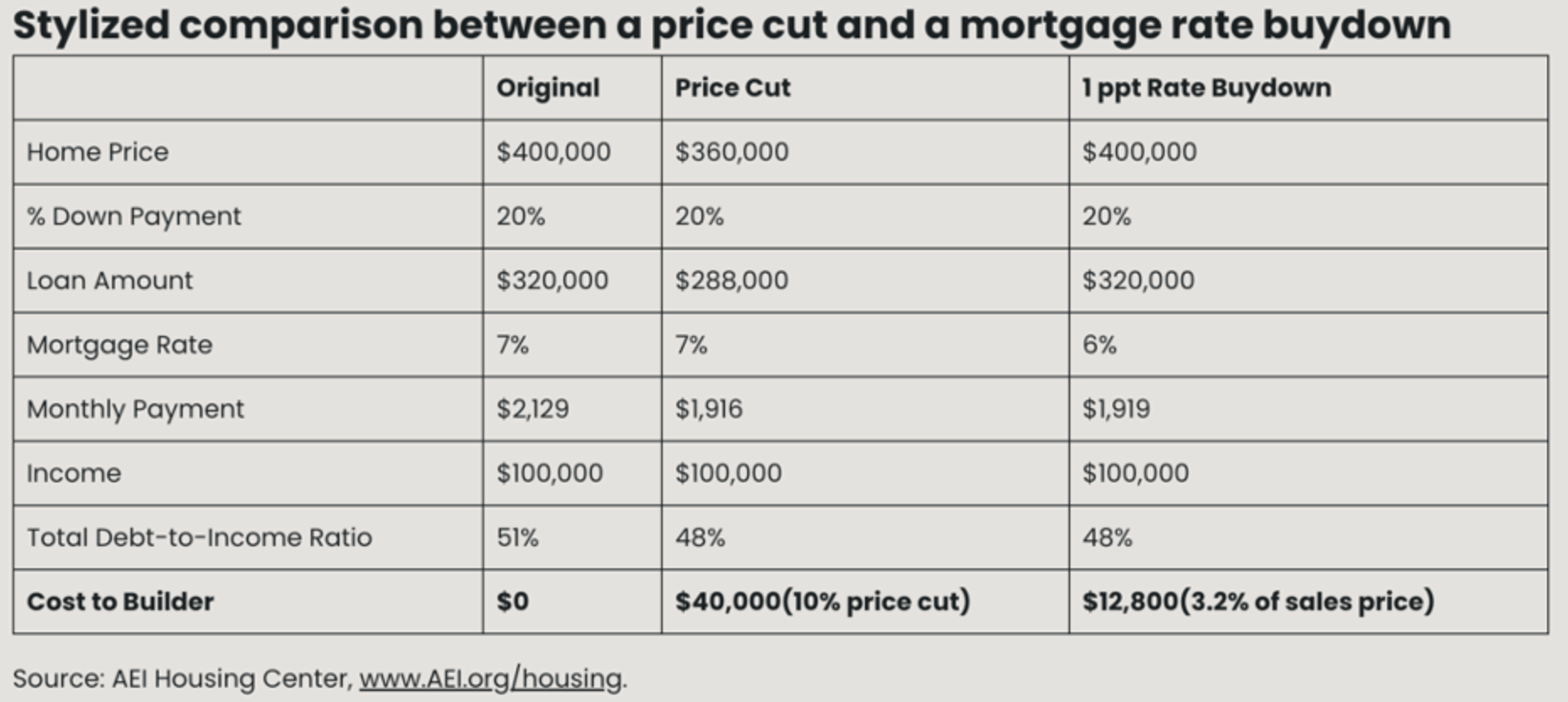

Consider this scenario: selling a $400,000 home to a buyer with an annual income of $100,000. With a 30-year fixed-rate mortgage at 7% and a 20% down payment, the monthly payment (excluding taxes and insurance) would be around $2,100. This would result in a total debt-to-income ratio (DTI) of 51%, exceeding the 50% limit set by Fannie Mae and Freddie Mac.

To help reduce the buyer’s DTI to 48%, the seller could either lower the sales price by 10%. Alternatively, they could offer to pay for a 1% permanent rate reduction (from 7% to 6%) at a cost of approx. 4 points (3.2% of the sales price) which achieve the same result. In both scenarios, the borrower’s monthly payment decreases to $1,900, bringing their DTI below 50% (see table).

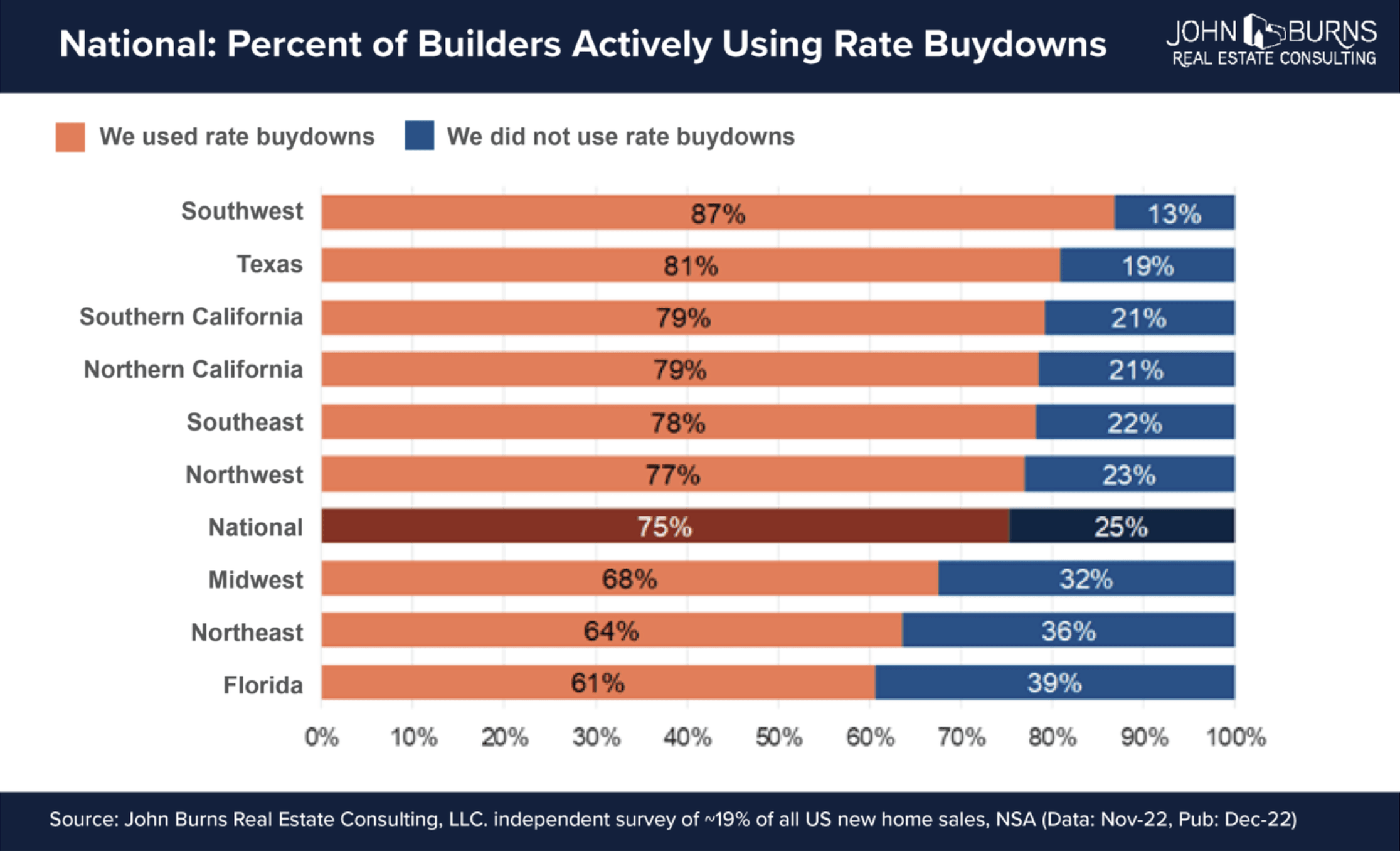

Builders often implement this strategy to avoid price cuts that could undermine future sales in a multi-family project or subdivision. They offer customized “price cuts” through different rates based on each borrower’s ability to pay. To test this theory we look to a large publicly traded builder: DR Horton is the largest homebuilder by volume. In November 2022, the average DTI for DR Horton’s FHA borrowers was 50%, regardless of their mortgage rate. Typically, we would expect lower DTI’s for borrowers with lower rates, as monthly mortgage payments and DTI’s increase with higher mortgage rates. This implies that DR Horton provided the most significant buy-downs to the most income-constrained borrowers, helping more of them qualify for financing.

By avoiding actual price cuts, past and future buyers perceive the original price as the sales price, while the bought-down rate remains much harder to discern and quantify.

According to our rough calculations, the average cost of buy-downs for new homes sold between February 2022 and July 2023 is about 1.3% of the sale price. This represents a significant bargain for builders compared to a 5% price cut.

So far, buy-downs have been effective in protecting builders from price cuts. However, home price data ends in December 2022, and since then, mortgage rates have risen from 6.5% to nearly 8% (currently around 7%). At these higher levels, it remains uncertain if rate buy-downs alone can prevent builders from cutting prices. Currently, the situation is mixed: Evercore reported that more builders raised base home prices than lowered them in October 2023, while the National Association of Home Builders survey data indicates price cuts following lower builder confidence in November 2023.

Assumable Loans

Is it possible to buy a home and keep the seller’s existing mortgage with its lower rate and payment? Yes, and in fact many sellers are not aware that their low-interest rate loan is assumable. FHA loans (insured by the Federal Housing Administration), VA loans (guaranteed by the U.S. Department of Veterans Affairs) and USDA Loans (guaranteed by the U.S. Department of Agriculture are all assumable (buyers should inquire about any restrictions that may apply to them). If you aren’t sure if your loan is assumable then ask your Realtor to help you. If you are looking for a house with an assumable loan, ask your Realtor to help you. Loan professionals probably won’t be much help since they are compensated for selling new mortgages, not finding old ones to transfer to new borrowers.

When assuming one of these loans, you’ll need to make a significantly larger down payment—at least 15%. Typically, an assumable loan does not cover the entire purchase price of the house, requiring the buyer to pay the remaining difference.

Doing an online search of New Canaan I could not find any assumable homes for sale. But a quick online search found 200 in the greater New York City area with an average assumable rate of 3.57%. There was a 660 sq. foot, 3-bedroom ranch for sale in the Hamptons for $370,000 that comes with an assumable rate at 2.85% for a monthly payment of $1,551. And another nearby for $470,000 with a 4.33% mortgage and payments of $975 per month.

Notes from the

Monday Meeting.

Timing is everything. Can we put together that deal from 30 days ago? They say “Time kills all deals” (and once dead the patient rarely revives). Melissa’s seller has now found something to buy but is Charlie’s buyer still willing? And has the buyer sold her house? We were all so sure it would sell in a weekend, but without something to buy can you blame the seller for being insufficiently motivated? Like the card game Concentration, realtors must match a buyer and a seller at the same moment in order to time a series of transactions in succession. And, you know that the pace at which we flip over cards is slowing due to seasonality in the market. Everybody wants to be settled in the Fall, but nobody wants to disrupt their summer plans. Real estate is as much about timing as it is about price. Once we mix in some emotion and ego from both parties it’s a wonder that anything comes together at all.

John Engel, realtor and Engel Team leader, interviewed author (and Miami Dolphin) Steve Shull on last week’s Boroughs & Burbs podcast (#142) and then heard football coach Lou Marinelli talk about 43 years of team-building in New Canaan. Steve’s new book “The Real Estate Team Playbook” makes the point that great performers aren’t always great leaders. It takes different skills. We see it in sports and in business, that motivating and leading a team to maximize their potential is not the same as a superstar carrying the team on his back. Specialization has led to a proliferation of teams, both in real estate and in business, which begs the question, “Is your team a team in name only?”