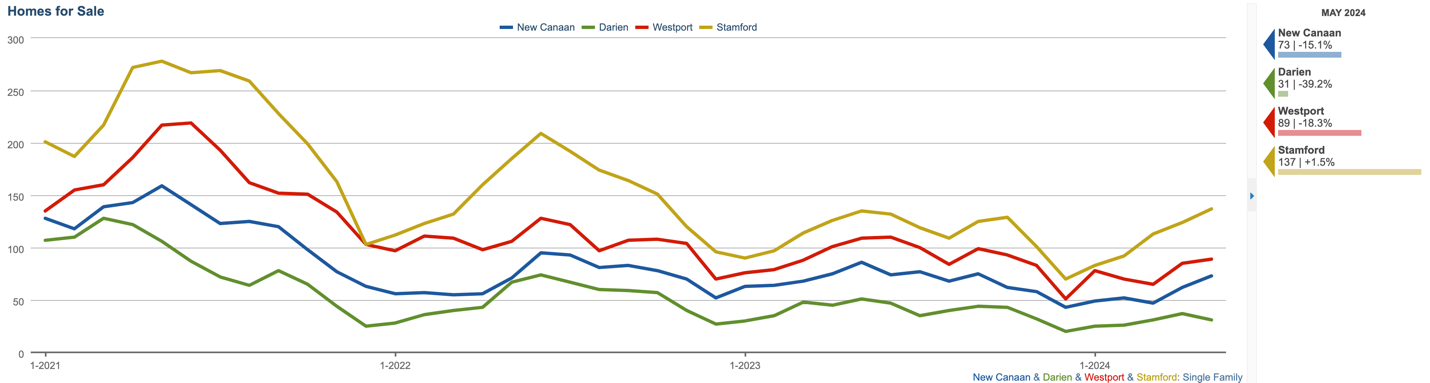

New Canaan – There are 73 single-family homes for sale, a -15% drop since last year. Last year we peaked in May with 86 and two years ago we peaked in June with 95, a steady decline. The median sold price was $2.02 million across May’s 18 sales, a price decline of -9.35% since April but the same as last year and in fact not much changed in the last two years. 42 new properties hit the market in May, a 5% increase since the previous month and down from 50 houses a year ago. Pre-covid New Canaan was averaging 68 new listings in May, but the -50% decrease these last two years to mid 40’s seems to be the new normal. To the clients asking what the Fall market will look like I can only say we’ve seen 28 new listings in each of the last 2 Septembers to make the total number of listings in the Fall 82 and 89. New Canaan currently has 4 months supply of inventory, down from 7.3 months this time a year ago. With less inventory we are getting proportionally fewer deals.

Darien – There are 31 homes for sale, a -39% drop year over year from 51 a year ago and 74 in June 2022. Considering Darien (population 21,753) is the same size as New Canaan (population 20,213), why does Darien stand out in her peer group with less than half the inventory? The two towns had identical closed sales in May (18 deals) and nearly the same sales volume over the past year (216 in Darien, 205 in New Canaan) despite the inventory difference. The answer could be in Darien’s median days on market which is almost always substantially lower (10 days, down -9.1% ) when compared to New Canaan (13 days), Westport (15 days), and Greenwich (20 days). Days on market is so shockingly low it made me wonder if demand is higher in Darien; is everything going to a bidding war? That does not seem to be the case. Houses sell on average for 100% of list price, the same in all three towns. I looked at the difference between median and average price per foot ($613 and $715 in Darien) and it suggests to me that inventory in Darien is at the extremes (Tokeneke waterfront vs. more modest Noroton Heights) when compared to New Canaan ($486 and $465 per square foot) and Westport ($498 and $528 per square foot). The average in all four towns is substantially higher than the median on account of a few outstanding sales in each. Finally, Darien has a median living area of only 2,710 square feet when compared to Westport (4,407), New Canaan (4,893) and Greenwich (5,174) leading us to conclude the average house selling in Darien is much smaller for about the same price.

Westport – There were 15 sales in May at a median price of $2.0 million and $626 per foot. The median price per foot rose 17% to $626 for houses that are typically 3,651 feet. Westport rose gradually from a $1.2 million median before covid to the $2.0 level in March 2022 and like Darien and New Canaan has been flirting with a $2.0 million median ever since. The number of homes for sale dipped below 100 for the first time at the end of 2023 (71 active in December) and is only now back to 104, a -25% decrease year over year. With a population of 28,115 Westport should have 23% more inventory than Darien but it has 335% the inventory. Westport and New Canaan have been tracking vert close for two years, 39% larger with 16% more inventory.

Stamford – Stamford is very exciting, an outlier in several categories. With a median sold price of $900,600 in May is it any wonder that there is only 2.09 months of inventory? The average list price to sold price ratio is now at 105.8%. 56 properties sold in May while 96 properties came on the market and 91 changed their status from active to pending, leaving us with 104 active listings (the same as Westport, less than a quarter Stamford’s size). It’s hard to imagine there were 544 total listings in Stamford 3 years ago, 278 of which were single family homes.

Greenwich – According to Greenwich Board of Realtors there were 156 active listings, 85 new listings and 38 sales in May. The absorption rate, 4.24 months of inventory, is about where it was last summer after dipping to 3 months this past winter. The median list price is $3.72 million, up 8% year over year, while the average list price is $6.32 million, up 6% year over year. The average sale price, $3.47 million, is up 8% since last May. Median sale price, only $2.54 million, is down -15.3% since last year, indicating to me more sales at the high end. Specifically, we’ve had 11 sales over $7 million, same as last year, and 32 sales between $4 and $7 million, about the same as last year.

Notes from the Monday Meeting. My team is bringing on two new listings this week, is fretting about two others that don’t seem to be getting enough activity, and readying four more listings to be listed soon. We try to draw conclusions about why seemingly similar houses are having vastly different experiences in the market. The “Substitution Principle” is a basic law of economics that says the upper limit of value tends to be set by the cost of acquiring an equally desirable substitute, assuming no untimely delays. Similar houses should perform similarly. Ha, that would be too easy. If that were the case and pricing was easy Zillow would still be in the home-flipping business. No, what seems like a perfectly reasonable substitute to me will not always work for you. The “substitute” house, on similar west-side cul-de-sacs, of similar size, age and layout, should behave similarly in the market but they do not and searching for differences I find it often has to do with differences in the kitchen. The kitchen is by far the most expensive room to create or to renovate in most of our homes. Aside from sleep, the kitchen is the room where most of us spend the most time. I believe that the kitchen “works” or does not work is more often the key factor determining success in the market. In a 2021 survey 41% of Americans said they would choose white for their kitchen cabinets, down from 67% in 2018.

John Engel is a realtor and broker running The Engel Team at Douglas Elliman in New Canaan. This week we say goodbye to our New Canaan High School intern, Lexi, and say hello to our UCONN intern, Sidonie. Why don’t more young people begin their careers in real estate? It’s a perfect blend of technology, finance, marketing and people skills. Maybe we need more on-campus recruiting! Real estate is the most valuable product (and largest employer) in most towns, not just New Canaan. Real estate is a career John Engel came to later in life after leading troops in the Army, selling for a marketing firm, and starting an Internet agency and Paper.com.