I want to revisit why the New Canaan housing market is so far out balance, favoring sellers, and why prices keep rising, and why this trajectory is destined to continue. New Canaan will continue to see rising prices for two reasons: low interest rate sensitivity and strong demand tailwinds.

The market began 2023 expecting a recession and 2024 expecting six Fed cuts. Neither happened. The US economy did not slow down (around here) and the Fed pivot has provided a strong tailwind to growth since December. The Fed will NOT cut rates this year. Rates will stay higher for longer.

Low Interest Rate Sensitivity. To wit, only 60% of homeowners have a mortgage, down about 5% since the financial crisis of 2007. 95% of mortgages are 30-year fixed, not sensitive to Fed policy. During Covid most homeowners refinanced at historically low levels. After the financial crisis corporations loaded up on cheap debt (tripling from $3 trillion in 2009 to $9 trillion in 2024) They have the resources they need and are not sensitive to hikes. Those who don’t have been busy reorganizing like crazy, selling assets, not failing. Finally, a growing share of capex spending is intangibles (R&D and software). While investment is generally believed to be more sensitive than consumption to rate hikes, the depreciation rates of intangibles are substantially higher, making this category of investment less interest-rate sensitive.

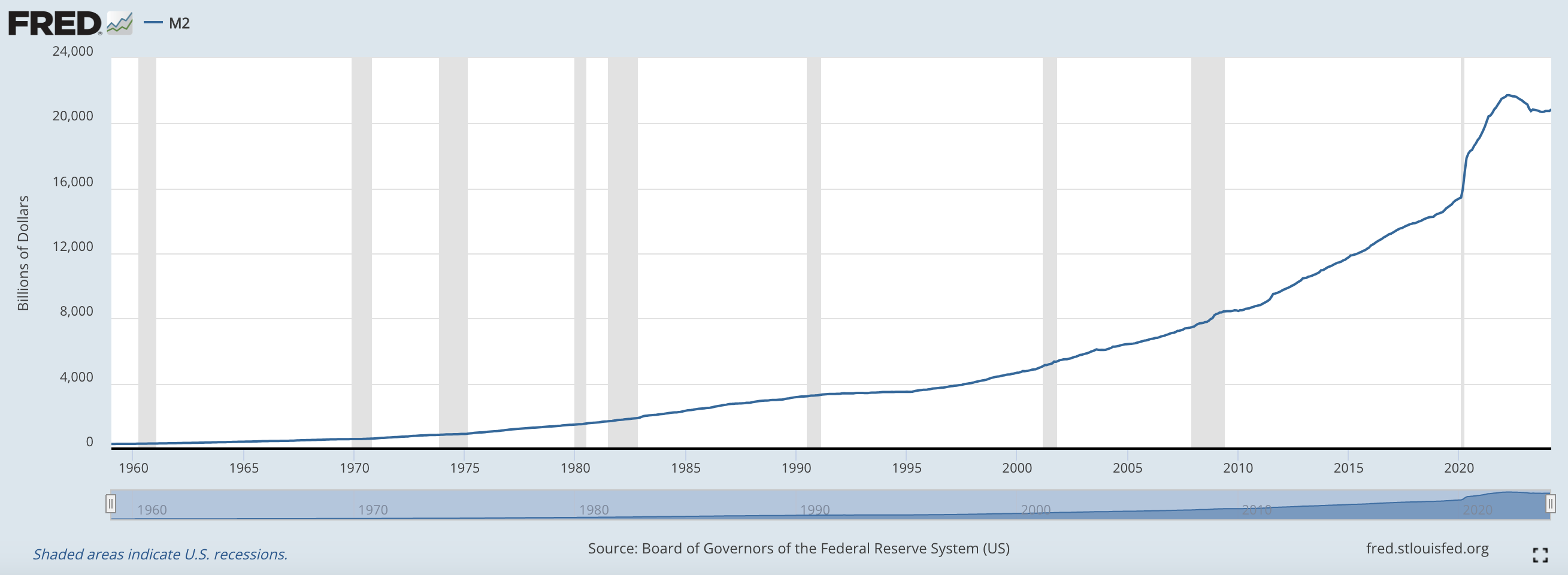

Strong demand tailwinds. Massive fiscal spending, particularly the CHIPS Act ($39 billion in 2022), the Inflation Reduction Act ($891 billion in 2022), and the Infrastructure Act ($1.2 trillion of which $550 billion is new spending in 2021) has increased the money supply. This continues to be a strong tailwind to price appreciation in our market. Excess savings has begun to rise for higher income households. Immigration is way up and around 50% of them are entering the workforce. That’s enough to show employment growth. The Fed pivot in December has resulted in a boost to both consumer and capex spending. There’s a ton of money moving through the system, some of it chasing our scarce housing stock. (See the M2 money supply chart.) Not only do higher interest rates give higher cash flow to households that own fixed income assets, but after 14 years of low rates (2008-2022) the demand for higher yields is strong from insurance companies, pensions, and retail investors. This has the effect of offsetting any negative effect of Fed hikes and is one reason for the strength of the high-end market. Finally, while I can’t use AI to build a home we are seeing the effects of AI on productivity and investment, another tailwind. The AI story is boosting household wealth and easing financial conditions.

The tailwinds show why the economy will continue to grow for several more quarters. And, as a result of low-sensitivity we know that when the Fed cuts rates it is unlikely to have a significant impact on the New Canaan market.

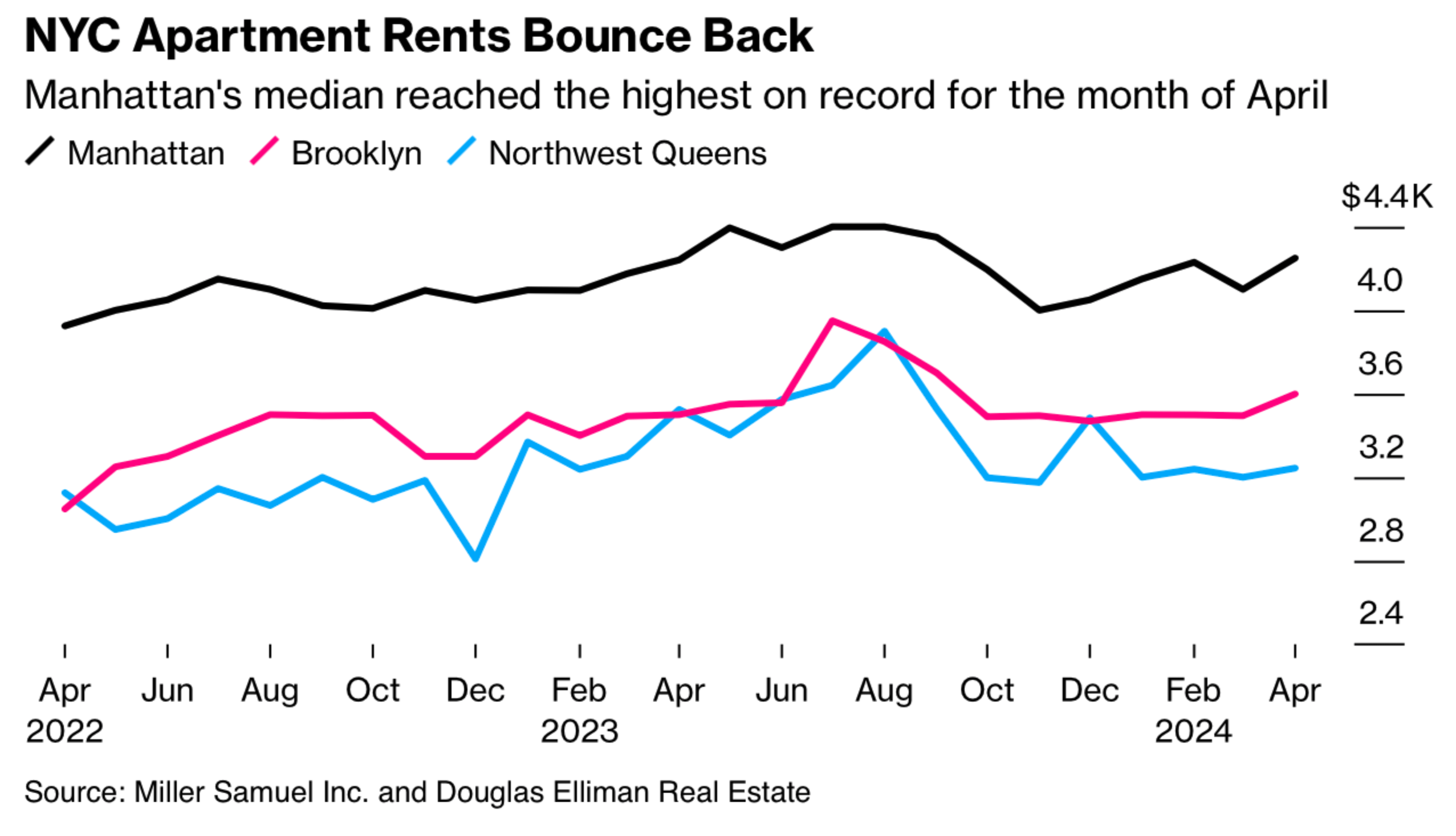

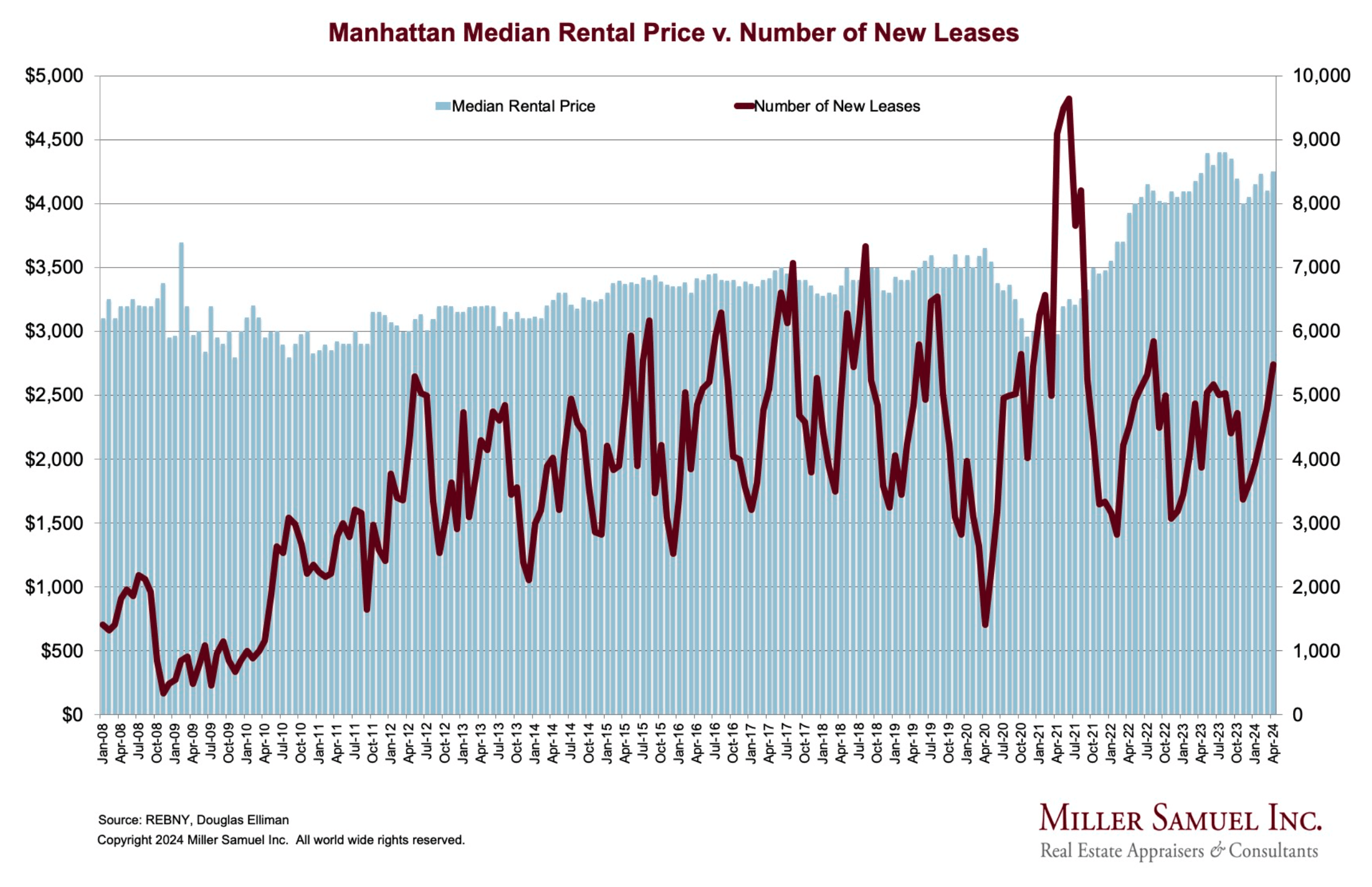

New York City Real Estate. Improving. After below-average deal volume in 19 of the last 21 months sales are picking up. Inventory is at normal seasonal levels. On average we see a 6% discount from asking. Rent? These were the highest prices ever seen in April, and the second highest deal volume for an April. Rents are rising again (in 3 of the last 4 months) but are still slightly below last year’s record highs in Manhattan. We are more significantly below last year’s highs in Brooklyn and Queens. Luxury price per foot increased annually for the second time in three months in a market that has seen expanding inventory since September 2023. Trends favor new developments where rents are rising faster than elsewhere.

Notes from the Monday Meeting.

May is only half over with 12 exciting new listings and 6 in “coming-soon” status. One serious house hunter in New York City drops everything when opportunity calls. I told her about a new listing at 1pm today and she was touring it 90 minutes later. Commitment in this market means getting on a train or an Uber from Manhattan to be the first to see a property. Of note, the $799,000 cape-cod style 2-bedroom cottage at 110 Millport Avenue is my “House of the Week”. At $612 per foot, this may be its month. It is one of only 10 houses for sale in New Canaan priced under $2 million. Condos priced under $2 million (7) include a 3-bedroom townhouse on Forest Street for $1,049,000 (the second least expensive home in New Canaan). The third least expensive home in town is 218 Park Street at $1,079,000. Perched opposite the entrance to Mead Park, this 4-bedroom house is all about convenience to downtown and I like it. I lived 100 yards away for most of the last 10 years and we made good use of Mead Park and the newly restored Bristow Bird Sanctuary trails. If a sixth of an acre isn’t your idea of life-in-the-country and you want a bit more yard to roll around in then book an appointment at 109 West Cross Road. It’s coming soon and features 1 acre on the Stamford border. Rumor mill: a sale on the horizon between $10 and $15 million. If true it will be the largest sale of the last decade and a confidence-boost for the high-end market in New Canaan. The largest sales were of the Dana Estate (aka Paul Simon property) in 2022 for $10.8 million and a 14-acre estate on Canoe Hill back in 2015 for $11.75 million. They were the only two sales for more than $10 million this decade. Other notes from the meeting include the fact that broker open house traffic is way down, while public open house traffic is generally strong.

Thanks this week to Apollo’s Chief Economist Torsten Slok on tailwinds and Miller Samuel’s Jonathan Miller and Steven Cohen for New York City data.

John Engel is a broker with the Engel Team at Douglas Elliman in New Canaan and in the last two weeks has given two slide presentations to the Rotary Club, the first on market conditions, and the second on the early history of real estate agencies here. Our Board was founded in 1951 and the Multiple Listing Service begun a few years later. New Canaan legends participated: Lazslo Papp, Chris Hussey, Carolyn Clark, and Skip Sisson.

Both presentations can be found on the Rotary Club’s YouTube page.