By John Engel

In today’s Gospel, Jesus, sounding annoyed, says, “This is an evil generation, it seeks a sign.” It made me wonder what He would have said about this generation and about the New Canaan real estate market.

In the month or so since Trump took office, in the month since the Spring market started, it seems everybody is looking for a sign. Are we going into a recession? Are we really annexing Greenland, Panama, and Canada? Are we serious about tariffs? And how will all of this affect New Canaan’s real estate market and MY equity in MY home? Give me a sign!

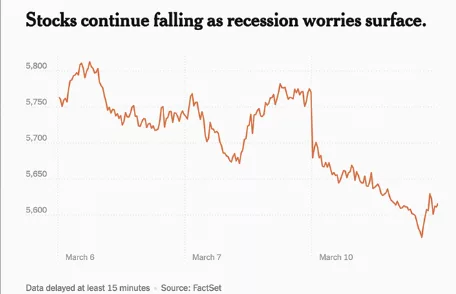

First, why are we demanding a sign? There’s so much volatility. It’s a week where Wall Street has already given back all the gains of the last six months. The S&P index fell 2.7% and the Nasdaq fell 4% on Monday. What do modern-day prophets like Warren Buffet say?

Buffet, in his latest shareholder letter (February 22, 2025) says, “Focus on Long Term Value over Market Noise.” The real estate translation of this advice is to own the best quality you can afford to hold and maintain for the long haul. Buffet writes, “Your company is 100% American, and we believe in America,” reinforcing his confidence in the resilience of the U.S. economy despite the current volatility. The fact that he highlighted long-term holdings like Coca-Cola and American Express as examples of “fishing where the fish are” is a nod to finding enduring value. The real estate equivalent is investing in Greenwich, New Canaan, Darien, and Westport, the four best performing stocks in Fairfield County, over the long term. Sound obvious? The contrarian approach would be to invest in those markets that have shown the greatest gains in the last two years, including Stamford and Norwalk, which are each up 20%. I believe Buffet is telling us to invest in the house you know you can sell in a good market or bad market. I believe Buffet is a New Canaan kind of guy.

Buffet says, “Adapt to Change.” He used the example of his shift from avoiding railroad stocks to recognizing their value as the industry consolidated, saying, “When the world changes, you must change.” The real estate lesson here came to me yesterday when a Darien seller said he was ready to list his house. He has two pools, a tennis court, a sport court, three acres of lawn, and a beautiful house. But his life has changed, his job has changed, his children are older, and this is no longer the right home at this stage of his life. Many of us are holding on to good homes because of the memories, because these homes have been good investments, because we want a place “the kids” can come home to, but I think my Darien friend has realized Buffet’s lesson, that its okay to change your mind about what is the right home, what is the right size, and be willing to let go. With only 22 houses for sale in Darien today, this seller should do well, downsize, maybe buy some of Buffet’s railroad stocks.

Let’s go back to today’s Gospel because there is an interesting history lesson in there. When Jesus said, “The Queen of the South will rise at the judgment … and She will condemn them,” it made me wonder who is this Queen of the South and what’s her story? Jesus was referring to the Queen of Sheba, who packed up her camels with gold, spices, and jewels in Yemen and traveled about 1,600 miles through the rugged Hijaz mountains to visit Jerusalem’s wise king Solomon to get the answers to “hard questions.” Traveling 20-30 miles per day, the journey took 80 days each way, assuming no major delays from weather, bandits, or diplomacy. It’s said she returned home “with all she desired.” Three thousand miles to get the answers you can get right here each week for free.

The point of the Gospel is one of frustration. Exasperated, Jesus uses several examples, including the Queen of Sheba story, to make the point that when we don’t like the advice, many of us just move on to the next prophet. He is saying, I have given you the answers and yet you stand here asking for some great sign.

So too from Buffet we hear the same advice he has always given: Invest in quality and stop trying to time the market. Be willing to let go of long-held beliefs as the situation changes. So too in real estate, the analogies are clear:

1. Don’t wait for interest rates. They should not be driving your decision. It is amazing to me how many times the word “rates” is a part of the conversation when buyers are considering a purchase. Buy the best real estate you can afford, in a well-run town, in the generally positive U.S. economy. 7.25% rates are the historical average, and most modern-day prophets are predicting that if rates move, they won’t move much.

2. Don’t hold on to a house for too long because it was a good idea when you bought it. Said differently: Don’t hold on to the wrong house too long because you’re locked into a low interest rate, because the kids might come back, or because inertia is difficult to overcome.

Things I Think I Think:

Wall Street has its worst day this week with the S&P index falling 2.7% and the Nasdaq falling 4% on Monday. Does this affect the real estate market? Yes, the Fairfield County high-end real estate markets correlate closely with Wall Street. A jittery stock market will have a negative impact on higher-end real estate sale prices in lower Fairfield County. A good deal of the wealth pouring into our real estate over the last four years came at first from pandemic-era stimulus and then from several successive years of stock market gains. Any contraction in the stock market will be felt at the top end of the range, particularly in deals over $3 million.

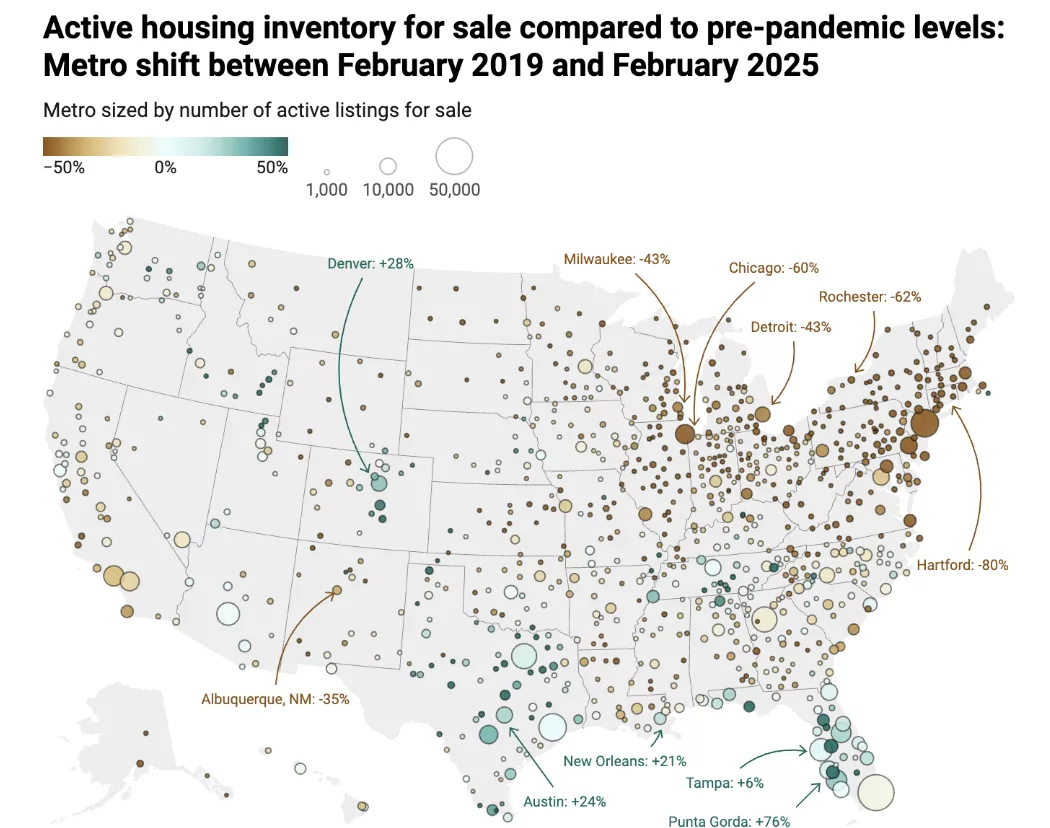

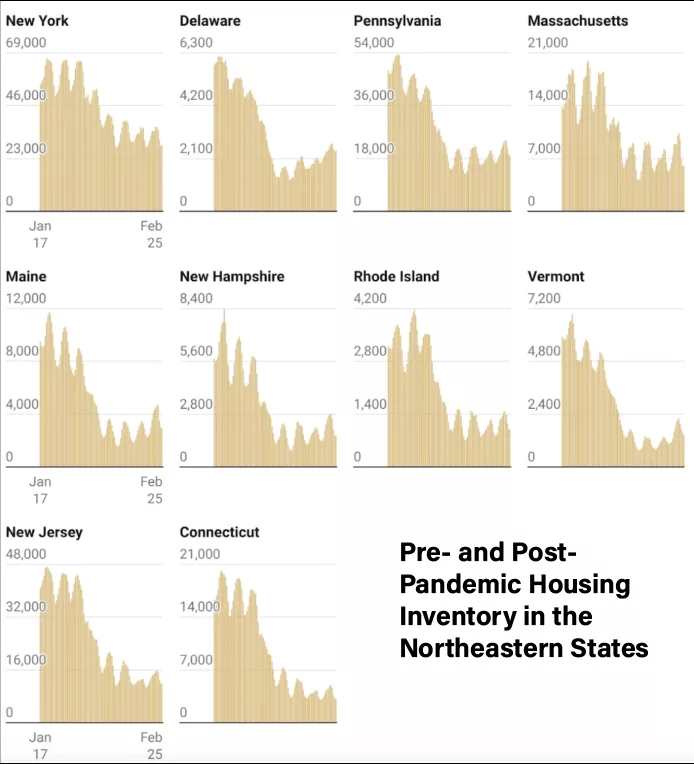

According to Fast Company magazine, housing inventory was up 27.56% this February, compared to one year earlier. That’s a substantial gain. Should we panic? No. The national picture is still one of low inventory, 23.1% below the pre-pandemic levels of February 2019. Inventory is rising, and prices are falling, but it’s particularly felt in some of the most overheated markets of the past five years, particularly in Sunbelt states. Five Connecticut real estate markets made Fast Company’s Top 10 list of markets in the country where inventory levels are 72% to 81% lower than they were six years ago. The Fairfield County (#1), Hartford (#3), Norwich (#5), New Haven (#7) and Waterbury (#8) markets lead their list of the 50 markets with the greatest drop in inventory, bucking the national trend.

Why no inventory in the Northeast, and particularly Connecticut? Connecticut was less reliant on pandemic-era migration and built fewer new homes, and we continue to build fewer homes now. I think low inventory levels will persist here, resulting in fewer transactions and agents leaving the business. We will continue to experience modest price increases in Fairfield County while the nations hottest markets (Texas and Florida) experience a correction.

John Engel is a broker with the Engel Team at Douglas Elliman in New Canaan, and he is wondering where the birds went. Two weeks ago, there was snow in his yard and dozens of birds feeding. Now, the crocus and daffodils are popping out and the birds have alternatives. No doves this week. Like the doves, John adapts to the changing seasons.