Last week the Dallas Mavericks traded their 25-year-old star, Luka Dončić, one of the two best players in basketball, to the Los Angeles Lakers for “not much” compared to previous blockbuster NBA trades. Instead of calling multiple teams and asking for their best offer, they called one team, the Lakers. Fox Sports called it the #1 most surprising trade in history. Not since Jack & the Beanstalk traded the family cow for a handful of beans has the Internet reacted so negatively to a trade.

How is a lopsided trade in sports like an off-market transaction in real estate? How does a return to the “pocket listing” practices of the 1940’s benefit buyers or sellers? It doesn’t. Private listings benefit only the agent whispering privately to both. Off-market, or private “pocket” listings are about controlling the flow of information, limiting exposure to the broader market and results in a suboptimal outcome. Direct deals can never take the place of a public auction, a level-playing field, where transparency of information, and equal opportunity to compete, give both buyers and sellers confidence in the outcome and lead to a better result for both parties. And yet private deals in real estate and now basketball are happening for reasons you might not expect.

We’ll start with basketball. The theory in the sports world is that the new owner of the Mavericks has an ulterior motive. Miriam Adelson, widow of casino magnate Sheldon Adelson, is more motivated by the desire to build a new casino-sportsplex than she is to win a championship. Since she can’t get approvals in Dallas she wants to move the team to Las Vegas and alienating the Dallas fan base is a natural first step.

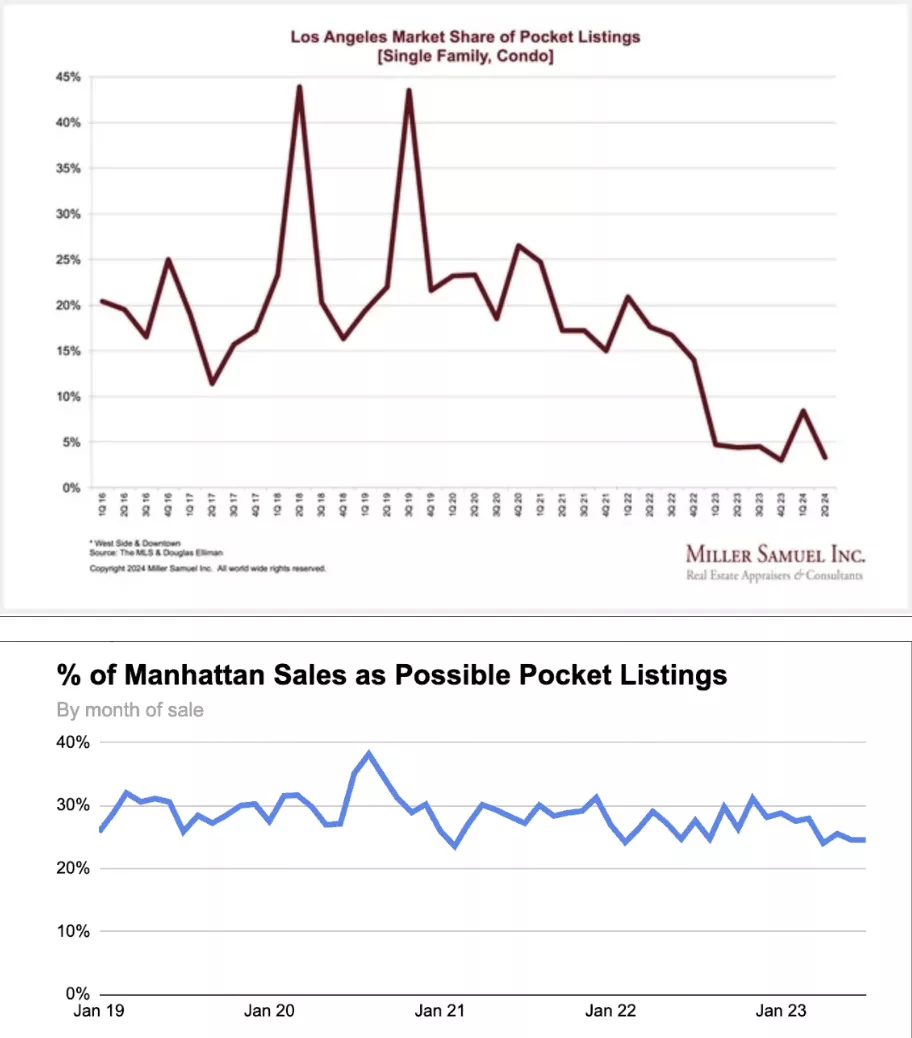

The theory in the real estate community for the re-emergence of private networks is this is the unintended consequence of the lawsuits. Clear Cooperation is the National Association of Realtors rule that a real estate agent must make every listing available to the public within 24-hours of signing. Brokerage stock prices are down industry wide. Agencies need to increase their margins to survive. Compass, the largest brokerage in the U.S. by volume, lost $83 million in the third quarter but no agency did particularly well. Compass is by far the biggest proponent of private networks, and some say the only way they survive is to double-end more transactions to improve their margins. That’s right, in a national real-estate market rocked by the lawsuits over inflating commissions, a market where the litigation wars are continuing to play out, Compass is banking on the fact that NAR’s Clear Cooperation policy will be dismantled and agents will be free to favor the interests of their own firm. Read what they say on their own website, www.compass-homeowners.com:

“The traditional way of selling your home has been part of a system that has put sellers at a disadvantage . . . by showing negative insights on their listings, such as days on market, price drops, and home value estimates.”

How crazy is that? A world in which buyers are not allowed to know such basic information as how long has the house been on the market? How long has it been listed at this price? It begs the questions, “Are you offering this house to me at the same price you’re offering it to others?” and more importantly, “Who do you really work for, if you represent both buyer and seller in a private network transaction?” We publish all relevant information on a public-facing website to give the buyer confidence in their bid, that they’ve been given a complete picture and are going into the process with eyes wide open. Anything less than complete transparency in the process inevitably leads to suspicion, lawsuits, accusations of steering, and violations of the 1968 Fair Housing Act.

Compass argues you should “make your listing available to a nationwide network of 34,000 top agents”. But, doing so excludes 97% of the market when one considers there are 1.5 million members in the National Association of Realtors. Working such a limited pool its analogous to making just one phone call and selling your house to the Los Angeles Lakers before anyone else knows its available.

Bess Freedman, CEO of Brown Harris Stevens, one of the most respected names in the business, said it best earlier this week,

“Any brokerage that advocates for only marketing listings internally is not putting the client’s interests first, but rather it is an attempt to pad its own pockets . . . Real estate is a service and information business, and by capturing information and limiting exposure, private listings minimize competition for the client. The main tenet of everything we do as real estate professionals is to serve our clients’ best interest, especially before ours. This new Compass program is antithetical to all of that.”

A recent study by PropTrack found that homeowners who choose to sell their homes off-market achieve 4.3% less, on average, and as much as 10.3% less in some regional markets.

A recent study by the National Association of Realtors (NAR) concluded that agent-assisted sales achieved a 14.5% higher price than FSBO (for sale by owner) sales.

Bright MLS conducted comprehensive studies examining the differences between on-market and off-market sales. Their initial study, covering 2019 and 2020, found that homes listed on the MLS sold for a median price 16.98% higher than those sold off-MLS.

The more recent study by Bright MLS reinforced these findings, revealing that homes marketed on the MLS sold for approximately 13% more than off-market properties. In 2021 the difference increased to 14.8%, and further to 19.7% in the first quarter of 2022.

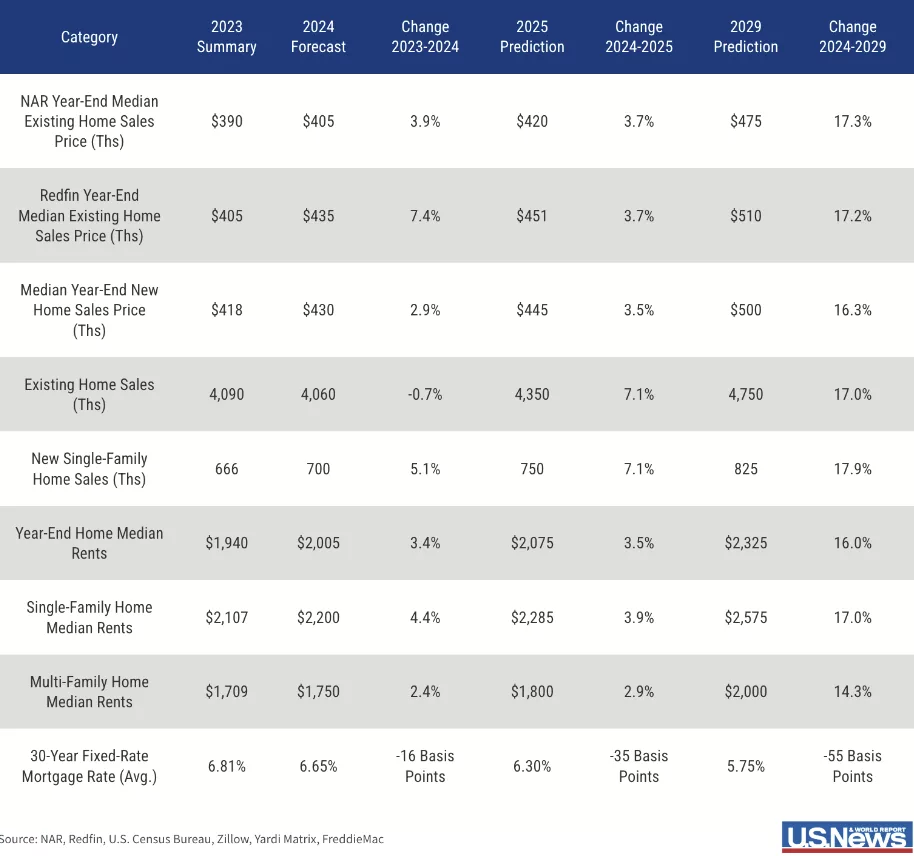

This is the week after Superbowl, the beginning of the 100-day Spring market, one that is beginning with fewer listings and is more lopsided than at any time in the last 20+ years. For the same reason homeowners are at a disadvantage negotiating with an unsolicited offer placed in their mailbox (“If you’re thinking of selling your home, please let me know”) so too the brokerage community should not pretend that a return to pocket listings and private networks promotes transparency, competition, and benefits anyone but themselves. An open market benefits sellers and buyers and is the foundation of fair housing principles.

John Engel, broker with the Engel Team at Douglas Elliman, needs a car and Leo Karl says I can lease a Blazer for under $300. Even with tariffs, inflation, 7% mortgages and $8 eggs, it seems there are a few good deals left in New Canaan. Housing? Not so much. But in Darien this week they’re offering a house for $699,000.