By John Engel

The power of demographics to explain our economy and the housing market is often understated. It may be the single biggest influence on current home prices. To understand real estate, take the growth of motorcycle sales between 1960 and 1974:

1960: 575,000 registered in the U.S.

1965: Registrations increased to 1,382,000.

1971: The number surpassed 3 million.

1974: Registrations reached 5 million.

Honda’s U.S. motorcycle sales skyrocketed from 3,200 units in 1960 to 345,000 units in 1970, during which Honda captured more than 50% of the U.S. motorcycle market.

Was it Honda brilliance? Evil Knievel and Steve McQueen? Not entirely. As a result of the post-war baby boom, the population of U.S. men aged 18 to 25 exploded during the late 1960s and early 1970s. Honda surfed an enormous demographic wave. Every 18-year-old wanted a motorcycle, and Honda filled the need. As these young men aged, got married and had children, motorcycle sales declined just as quickly after 1974. Motorcycle sales are now at the 1960 levels.

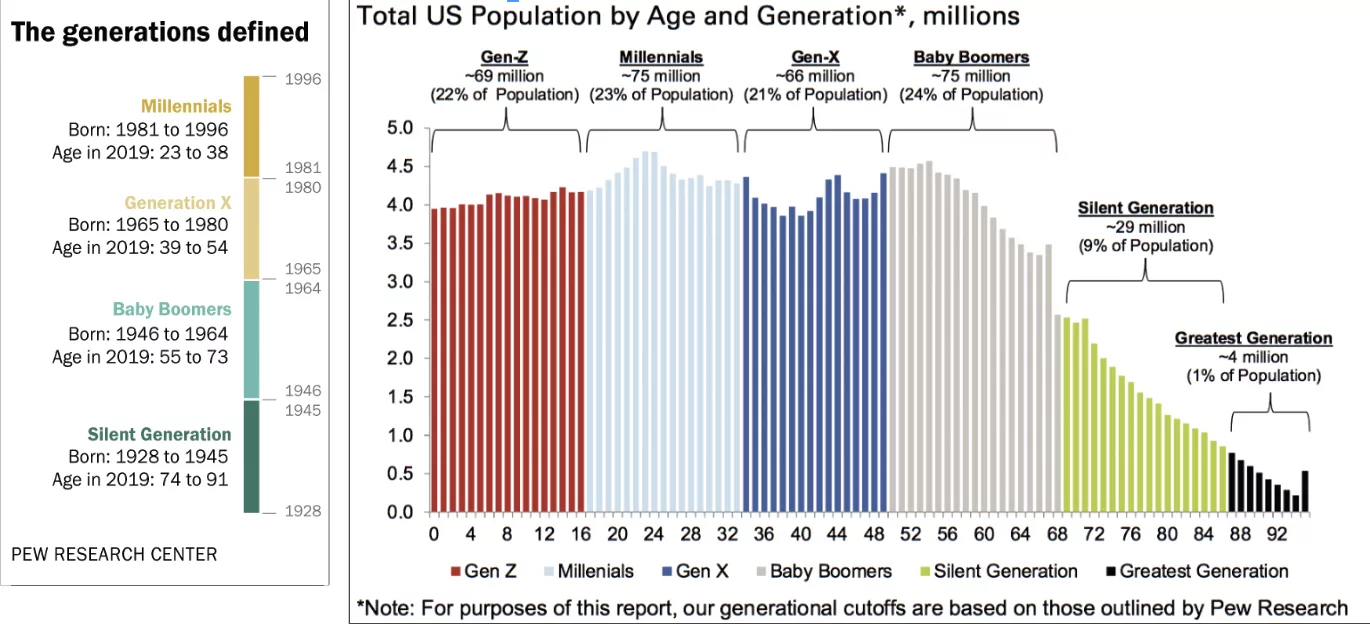

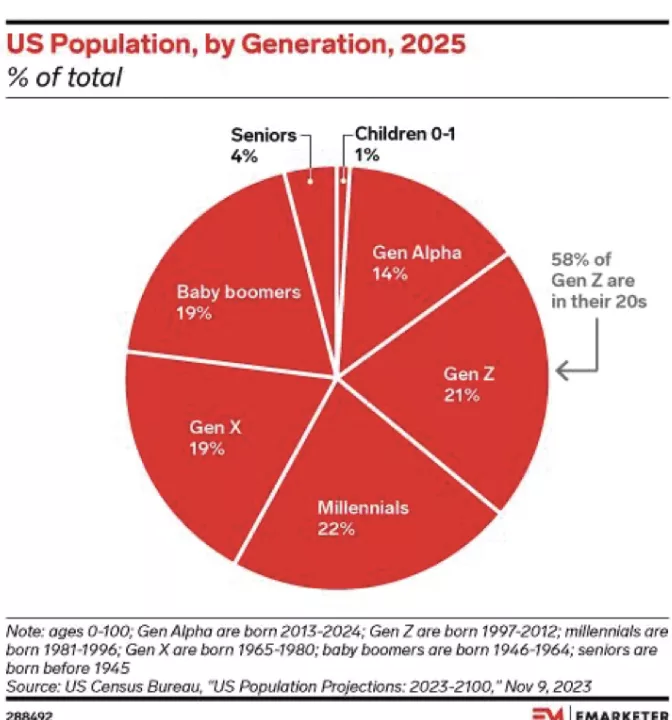

Today, the housing market across the U.S. is massively out-of-balance. Everyone is asking when housing supply will catch up with demand. The answer lies in the demographic data. The U.S. population distribution by generation for 2025 is:

• Millennials: 22%

• Gen Z: 21%

• Gen X: 19%

• Baby Boomers: 19%

• Gen Alpha: 14%

• Seniors (born before 1945): 4%

• Children (0-1 years old): 1%

This demographic breakdown has major implications for real estate, affecting housing inventory, pricing, buyer and seller behavior, and opportunities for agents and investors.

Gen Z (21%), born between 1997-2012, will be 13 to 28 years old this year, and the oldest of them are entering the housing market. The supply crisis means many of them will rent longer before buying, increasing demand for multifamily developments and rental properties. Typically, buyers this age start with affordable starter homes and condos in walkable urban areas. This accounts for surging prices last year in Stamford, Norwalk, and Fairfield. Gen Z buyers are more comfortable with technology, online transactions, virtual tours, and AI-driven property searches. They never knew 3% interest rates.

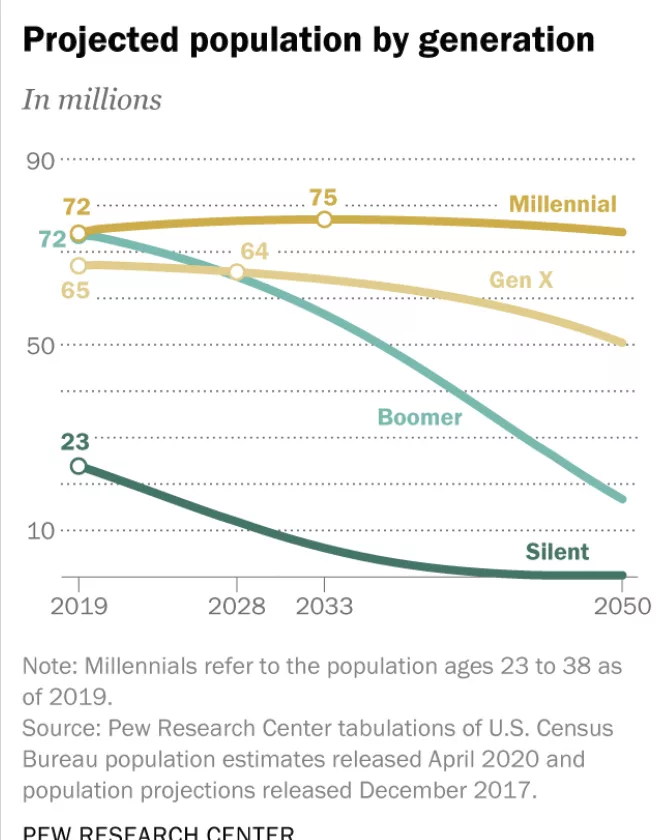

Millennials (22%), born between 1981-1996, are the dominant homebuyer group, ages 29-44. Many in this largest group who bought their first homes are now looking for larger homes in the suburbs as their families grow and children reach school age. Many in this group are getting down-payment assistance from the Seniors and Baby Boomers to compete for these homes.

Gen X (19%), age 45-60 in 2025, are the wealthiest generation and they are the ones driving the $2+ million market nationwide. They own homes with high equity and may sell to downsize or relocate. This is the group fueling high-end real estate sales in high-end towns like New Canaan, Darien, Westport, and Greenwich. Gen X is also driving the demand for beachfront, mountain, and short-term rental properties.

Baby Boomers (19%), born between 1946-1964, are staying put, holding onto homes longer (11.9 years avg, 40% for 20+ yrs). This is a major reason Millennials are facing a shortage. The result has been increased prices and a newfound willingness to buy homes needing renovation if priced right. Don’t expect this to change. The lack of downsizing will keep home prices elevated. In our market, we are seeing Boomers downsizing from homes in New Canaan, Darien, Westport, and Greenwich to small, walkable communities such as Rowayton and Southport, driving up prices there.

Gen Alpha (14%), born 2013-2024, a smaller group, are our distant future buyers, but they are affecting their parent’s choices now. Their parents are choosing school districts and home sizes based on their young children’s needs, including parks, youth sports opportunities, and safe communities. High-quality single-family homes near top schools will hold value as this cohort ages, driving continued suburban demand for the next 20 years.

Seniors (4%), the smallest sliver, born before 1945, are the Transition Market. As seniors transition into downsized homes, assisted living, and retirement communities, we will see a wave of estate sales, unlocking inventory. Many in this group choose to sell in off-market deals, yielding hidden opportunities.

Predictions:

With stable mortgage rates, expect more shared-equity programs, assumable mortgages, and alternative financing to emerge. Watch for rent-to-own to become more common. Watch for renewed interest in emerging markets.

Expect growing demand for 55+ communities, independent living, and co-living spaces. Last week, Waveny Life Care Network proposed to the Planning & Zoning Commission a 40-bed expansion of their facilities on Farm Road in a way that will not impact their ability to serve current customers.

Expect home equity loans and investment purchases from Gen Xers as they leverage their wealth.

Starter homes will be the most competitive segment as new construction is struggling to keep up due to high costs and zoning restrictions.

Notes from the Monday Meeting

A seller’s agent called a buyer’s agent and said, “I know you’ve been looking in this neighborhood at this price point. I have an off-market opportunity for you, $3.8 million.” The buyer’s agent called back and said, “We are thinking of making an offer.” The seller’s agent said, “Don’t think too hard. It’s $3.8 million. Or, it goes on the market.” The buyer paid the $3.8 million.

Next, the buyer asked to get in a month early. The seller said okay, but for $20,000. The buyer answered with an offer, “How about $15,000?” The seller said no, waited, and the buyer came back with an offer of $25,000 for the month.

This story illustrates a market in which buyers are not used to being in a position where they have no leverage. They don’t like to be told there is no room for negotiation. This particular scenario occurred in Boston last week, but similar lack of negotiation is taking place in Stamford, New Canaan, and upstate Connecticut. The old adage, “No harm in making a low offer — they can always say no,” is now no longer true; there is harm in making a low offer during periods of such extreme low inventory.

One final thought that I learned from Lee Cotton of New Canaan: “When they pass the cookies, you take one.” That means that good fortune — in this case, a hot seller’s market — does not last forever, and that some sellers do misjudge the market and wait too long. The cookies will be all gone. Those case studies I mentioned were in very specific submarkets where excessive demand had been long established.

John Engel is a broker on The Engel Team at Douglas Elliman, and he loves his manual crank pasta maker. He once saw a New Canaan friend make pasta during a dinner party in front of her guests, and he has never forgotten it. Three ingredients mixed together, then going through what looks like a Play-Doh machine. You crank the handle and spaghetti comes out. Brilliant!