By John Engel

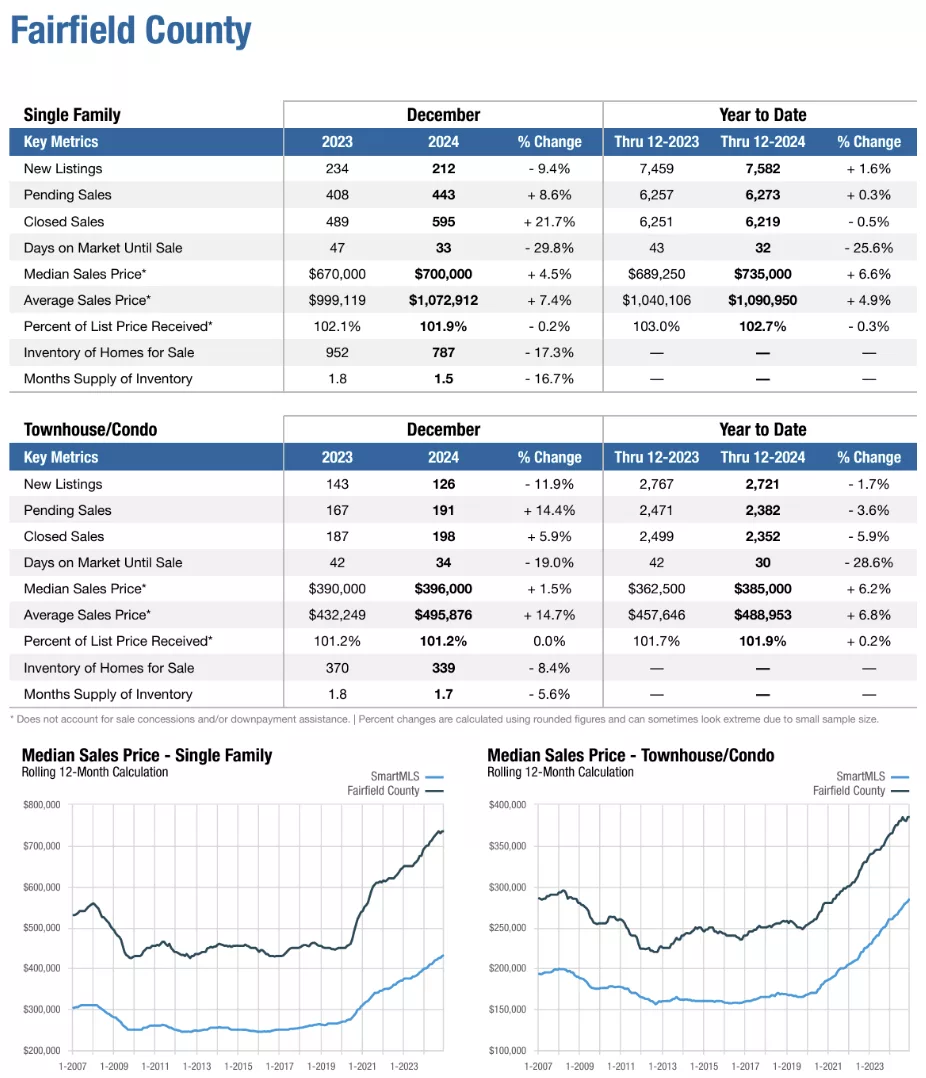

As the father of identical twins I get the question, “Are they different?” To me they are very different. To the casual observer not much. I feel that way about the end of year market report: Not much different from 2023. I find myself squinting hard to tease out some brilliant insight, some reason that prices could come crashing down or inventory could come back, but the trend lines are not exciting. House sales in Fairfield County are down only half a percent. The number of new listings? Up 1.6% but offset by a decrease in new condo listings by -1.7%. The average and median price of houses is up 4.9% and 6.6%, while average and median price of condos is up 6.8% and 6.2%, respectively. These increases are barely above inflation, not like EGGFLATION. Yes, the price of eggs in this area rose 68% last year and went up 37.5% nationally. Now eggs are exciting, real estate not so much. Too bad we’re not selling eggs.

Darien – closed sales down -17.4%, new listings down -13.9%, averages prices up 2.9%. Houses sell for 105.4% of list after 14 days on market and there were 14 houses for sale, down -30%.

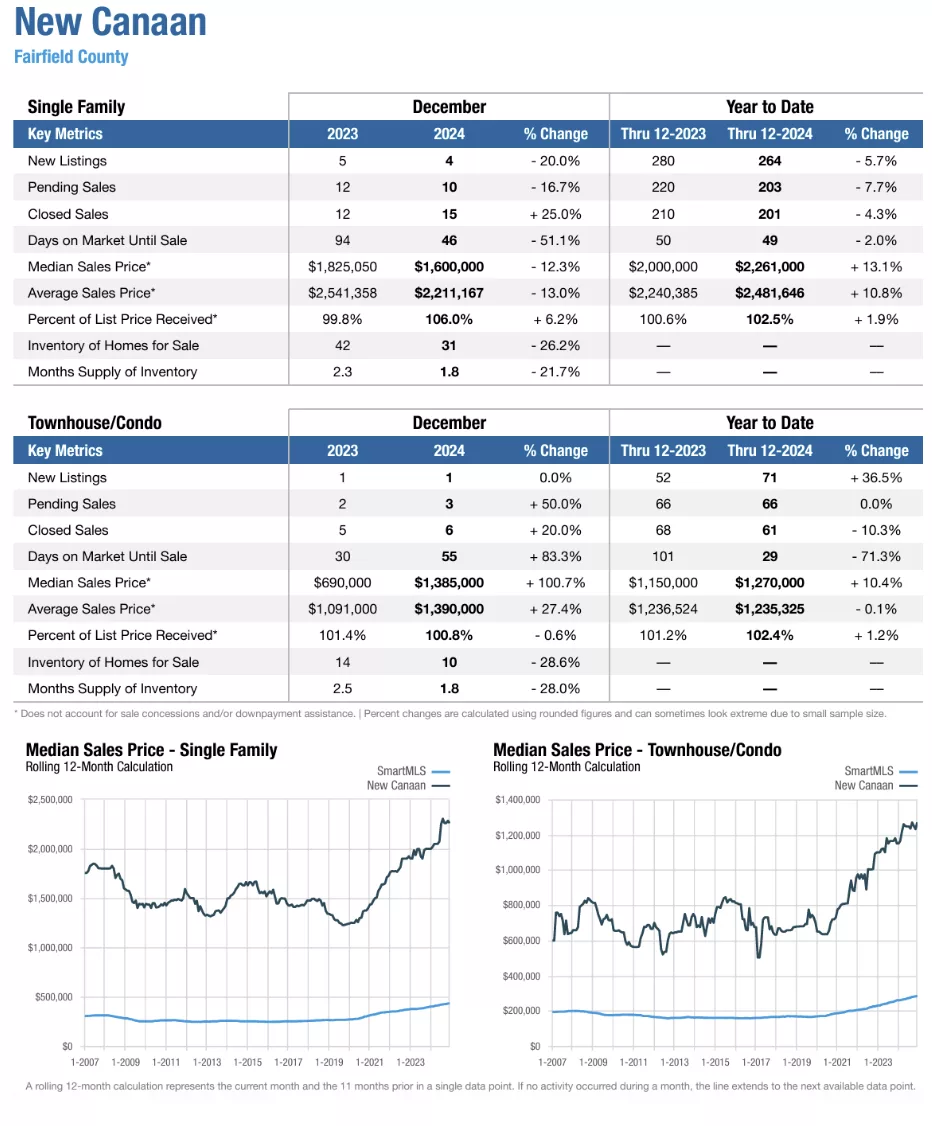

New Canaan – closed sales down -4.3%, new listings down -5.7%, average price up 10.8%, Houses sell for 102.5% of list after 49 days on market and there were 31 houses for sale, down -26.2%.

Norwalk – closed sales down -4.5%, new listings down -4.5%, average prices up 16.5%. Houses sell for 104.9% of list after 27 days on market and there were 47 homes for sale, down -7.8%.

Ridgefield – closed sales down -10.1%, new listings down -10.7%, average prices down -2.3%. Houses sell for 102.9% of list after 32 days on market and there were 17 houses for sale, down -41.4%.

Stamford – closed sales up 8.3%, new listings up 13.7% and average sales price is up 7.8% Houses sell for 102.3% of list after 33 days on market and there were 67 houses for sale, down -4.3%.

Weston – closed sales down -16.3%, new listings down -7.7%, average price up 9.5%. Houses sell for 104.1% of list after 34 days on market and there were 15 homes for sale, down -53%.

Westport – closed sales down -5.8%, new listings unchanged, up 0.2%, average price up 4.3%. Houses sell for 102% of list after 39 days on market and there were 38 homes for sale, down -25.5%.

Wilton – closed sales up 21.1%, new listings up 5.0%, average sales price up 10.6%. Houses sell for 106% of list after 29 days on market and there were 14 houses for sale, down -17.6%.

What’s the takeaway? Despite what you may have heard about the national real estate market being down, Fairfield County is doing very well, by all accounts better than the New York City real estate market which has been down for several years now. While prices have come down nationally, they continue to rise almost uniformly throughout Fairfield County.

The towns with the highest increases in average price were New Canaan, Wilton and Norwalk, all exceeding 10% growth.

The towns with the sharpest drop in inventory levels were Ridgefield and Weston with drops of 53% and 41%. Maybe that’s because towns like Darien and Wilton had already dropped below the point we thought possible, with only 14 houses for sale in each town.

I looked to the percent paid above listing price as an indicator where the demand is greatest and the market most out-of-balance. Darien and Wilton led with 105.5% and 106%, a consequence of low inventory. I’ll say it plainly: marginal changes in the interest rates and inflation don’t matter much if you have no inventory.

One expert, speaking about the national real estate market today, expects a better real estate market because of the incoming administration’s promised decrease in energy costs. I disagree. Oil is not driving this market. Oil will only affect this market indirectly, insofar as it affects inflation, interest rates, and our job prospects. If the price of oil doubled, or fell by half in 2025 I don’t think it would displace any of factors on our Top Ten list of why people move to places like Fairfield County, Connecticut:

Education: there are excellent schools in every town on this list, and as the babies of Millennials reach school age I expect an increase in inbound migration from school choice.

Be closer to loved ones: this is related to Education. When the parents move here, the grandparents follow. As the school population has risen, so too has the demand for condos.

Job: this is a major influence. People wait till they have a job to move to this area. Without a job, they often move to lower cost regions of the country. Job creation and job confidence, particularly high-end jobs on Wall Street and all the ancillary industries Wall Street affects, continue to support housing prices in Fairfield County.

A Larger or Smaller Home: cross-town moves used to account for a significant portion of our sales, now decreasing. Now, people are staying put in their homes longer. Part of this is the interest rate lock-in effect, but keeping the same house longer was true for a decade before the decrease, then increase, then decrease in Fed rates became such a factor.

Financial Challenges: in 2025 Americans have record amounts of home equity (39.3% own outright, 31.4% owe less than 50%, and 29% have a mortgage over 50%) and faced with inflation many of them want to move to low-cost areas of the country. This is the often-silent reason we are seeing people move out of this area, freeing up much needed inventory.

Income Taxes: It is hotly debated how much of a factor taxes play in migration. The big numbers of migrants to Florida, at all ages and incomes, suggest there’s more than one factor at work. A bigger influence might be “work-from-home” policies and whether that genie will ever be put back in the bottle.

Better Neighborhoods: Increasingly, since the pandemic, we cite Safety as a major reason for moving. Fairfield County is a beneficiary of that trend. 49% of New Yorkers rate the city fair or poor on safety, and 27% said they intend to leave within 5 years.

New Canaan Summary. In New Canaan the number of house listings fell -5.7%, causing closed sales to fall -4.3%. In absolute terms 201 closed sales is too few for a town of 7000 households, suggesting lingering effect of interest-rate lock-in and failure of buyers and sellers to come together on rising prices. As prices rise it takes some time for buyers to accept the new reality. We need to see several sales at the new numbers before we become numb to them. Are buyers are having trouble wrapping their minds around 4 straight years of substantial price increases? Yes, they are but houses are selling for 102.4% of list price, on average, and that fact has become a response to any low offers. While the number of condo listings rose +36.5% to 71 this year the number of closed condo sales fell -10% to 61. Is this a glut of condos in the making? No, those 61 condo sales are 20% higher than we saw before the pandemic, and they sell for 102% of list price indicating sustained demand. While the average sale price remained unchanged at $1.23 million the median price rose 10% to $1.27 million.

John Engel is a broker on the Engel Team at Douglas Elliman, and Judy Bentley asked for a ride home from the Rotary Club lunch. Always an adventure. John’s drafty 1976 Land Cruiser has no heat and it’s always a bumpy ride. John’s wife Melissa drives a sensible car.

Sources: Fairfield County statistics are from SmartMLS; equity figures from ATTOM and the census; reasons people move come from NAR and migration data from abetterct.org and the New York Post.