By John Engel

It snowed here this week, so I want to talk about the impact of snow (and reflected light) on real estate sales. Traditional wisdom is, wait for the snow to melt then launch the listing with beautiful spring photos. Let’s rethink that. The problem with this approach is that when the trees leaf out and the lawns green up, Connecticut gets darker. By the time the world turns green around here, 70% of buyers are committed. The good news for you late Spring listers is the remaining 30% of potential buyers still playing musical chairs will feel new urgency, but I digress.

In a cold, crisp January, the quality and intensity of the light pouring through clean, curtainless windows can be stunning. We covet the light. And, it has a measurable effect on successful showings, increasing perceived space. Which way is the house facing? Morning light differs from evening light and influences where we linger at different times of the day. We know quality of light influences our physiology, behavior, and mood, so work with it. Observe how buyers are drawn to the windows to look out. We’re starving for light at this time of the year, and when we’re confronted with brilliant natural light, we embrace it. Often, our natural first response is to cross the room, look outside, admire the view, and imagine the changing seasons. It’s the first step toward imagining the house as your home.

Back in the 1990s, during audits of retail behavior at Walmart, we studied the effects of light on consumer (shopping) behavior. It takes several hours for human eyes to fully adjust to darkness, and a full 20-30 minutes to fully adjust to seeing inside after coming from a bright outdoor environment. The biggest change is in the first few minutes as the cone cells in our eyes adapt, followed by a slower adaptation process by the rod cells, which are more sensitive to low-light conditions. Older eyes take longer.

Close your eyes and imagine your Walmart experience: crossing the vast parking lot quickly at 5 mph. Doors fly open. We stop just inside the entrance because our eyes adjust and we need to get oriented. The first few seconds inside new space, be it Walmart or your home, is that critical first impression during which we’ve moved from bright natural light to darker, interior spaces.

Walmart responded by placing greeters in the entrance to slow us down at a critical moment, in front of the most valuable retail real estate. The front foyer serves the same purpose during showings.

The takeaways: List earlier. Remove the drapes and wash your windows. Notice what the buyer sees (from the windows) and remove non-quality signals. Consider where increasing the wattage helps, replacing 60w bulbs with 100w: use warm white bulbs in most rooms, a slightly brighter light than the soft white that we see in the dining and living rooms. Consider daylight bulbs in the kitchen, home office gym, and garage. You might be surprised how a modest investment in better light can transform the presentation.

Most importantly, now that you know what’s happening, give the house a chance! Show the house deliberately, pulling back curtains and turning on every light, starting with a beginning, ending with an end, and taking time in between to look out the windows.

And Now, for Something Completely Different

That line is taken from the 1971 Monty Python film of the same name. It’s the time in the year when we consider the lessons of 2024 and predictions of 2025. (Coming soon: a column on the evolution of the prediction engine, but we’ll talk about the future in the future.)

Stock Market

You don’t have to be “in the market” to feel the effects of back-to-back years of 25%+ gains on real estate prices. We are seeing the effects of a long bull run in the market on both housing prices and the level of demand. In this area, lower Fairfield County, where a statistically significant percentage of jobs are Wall Street dependent or at least related, the effect is exaggerated. To predict the 2025 housing market, we’ll be looking at Wall Street bonus levels (expected to be up 15%-35%, the 2nd best in the last five years) and for any signs of a crack in the armor, be it unemployment levels (4.2%), changes in the bond market, or corporate earnings (S&P is currently 9.4%, up from 1.4% a year ago), surprises which might be the harbinger of changing attitudes among our wealthier buyers and sellers.

Home Equity

Currently, over 70% of Americans either own their homes outright (34%) or have more than 50% equity in their home (31%), leaving a minority (29%) owing more than 50%. This is what happens after several years of price gains in the housing market, and it is having a profound impact on housing markets nationwide, generating a significant number of all-cash purchases and the ability to borrow less on the next house. New York City and the most-competitive Florida destinations saw cash deals hit record levels last year, exceeding 2/3 of all sales. To predict 2025, we’re looking at what’s driving those cash purchases and what could cause them to stop. Consider that any disruption in the $72 to $84 trillion transfer of wealth from the boomer generation to younger generations, including changes in tax policy, rising health care costs, and inflation fears, could have a profound effect.

Chinese Bonds

You don’t hear that one every day. While U.S. 10-year treasuries are paying 4.25%, Chinese treasuries have dropped nearly a point this week, currently paying 1.60%. Thirty-year yields in Japan are at 2.2% Why should we care? It signals a banking system overflowing with cash and a market expecting slow growth and no inflation. Foreign investors, attracted by the higher rates, will increase capital outflows, driving up the dollar and putting pressure on our Fed to lower rates. We all know high interest rates hurts the American real-estate market, but in 2024 these negative effects were offset by a soaring stock market. Now, in 2025, the current drumbeat of “higher for longer” interest rate predictions by the Fed could be met by pressure from a weakening global economy.

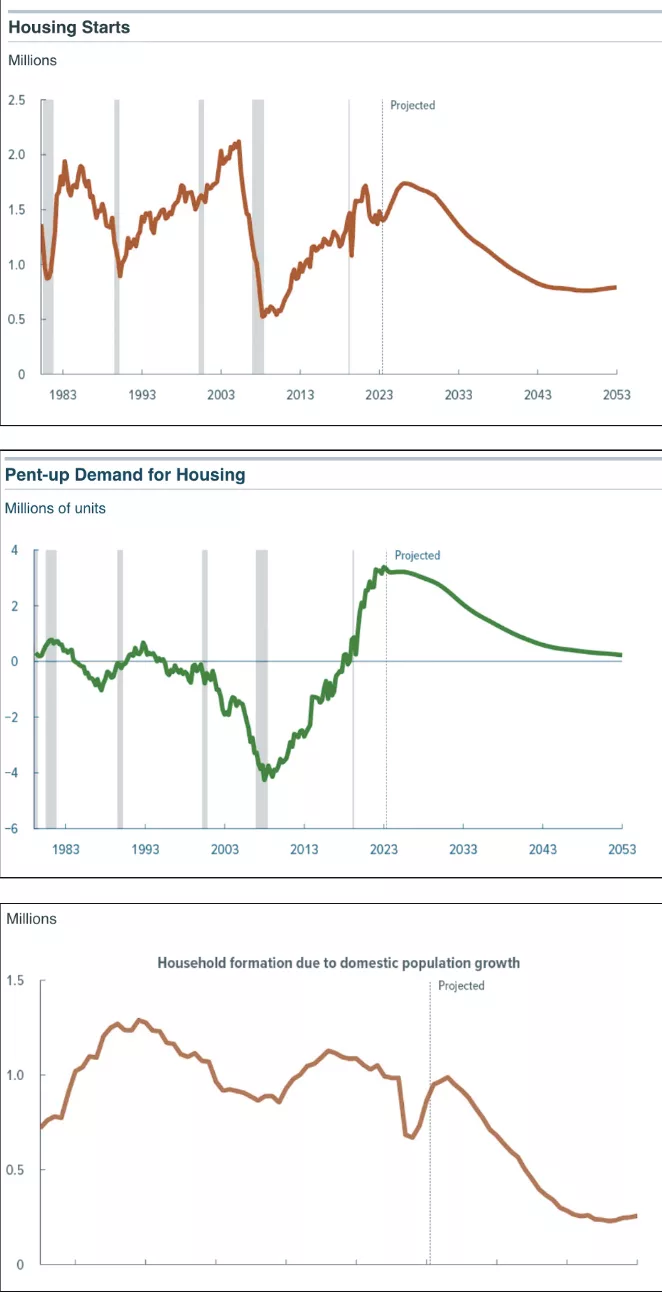

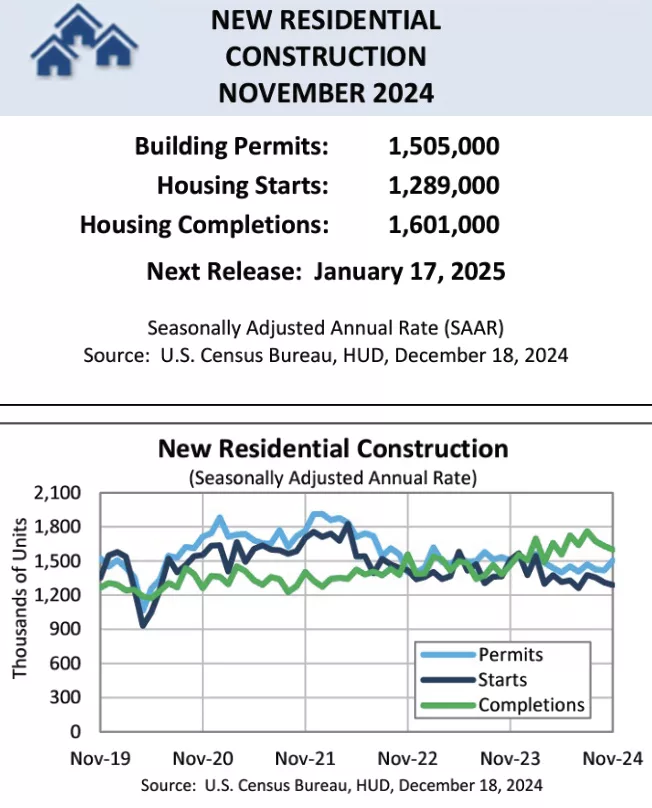

Housing Starts

Housing starts fell in Q4 below consensus estimates due to increased hurricane activity, higher interest rates, new inventory coming on the market, and the anticipation of lower rates in 2025 and decreased immigration in the future. Does a decrease in the number of housing starts in a period of sustained low inventory signal a lack of confidence among builders or is it simply a brief pause as the interest rate picture becomes clearer? Consensus expectations are housing starts will increase 14% in 2025.

John Engel is a broker on The Engel Team at Douglas Elliman and he is taking his vitamin D, credited with a 40% lower risk of developing dementia and 5 more years of life. Thirty years from now, will he still be listing houses and describing those adventures in The New Canaan Sentinel? Count on it.