By John Engel

We used the rolling 6-month average to strip away some of the month-to-month volatility. Nevertheless, there are many clues as to what the Spring market holds.

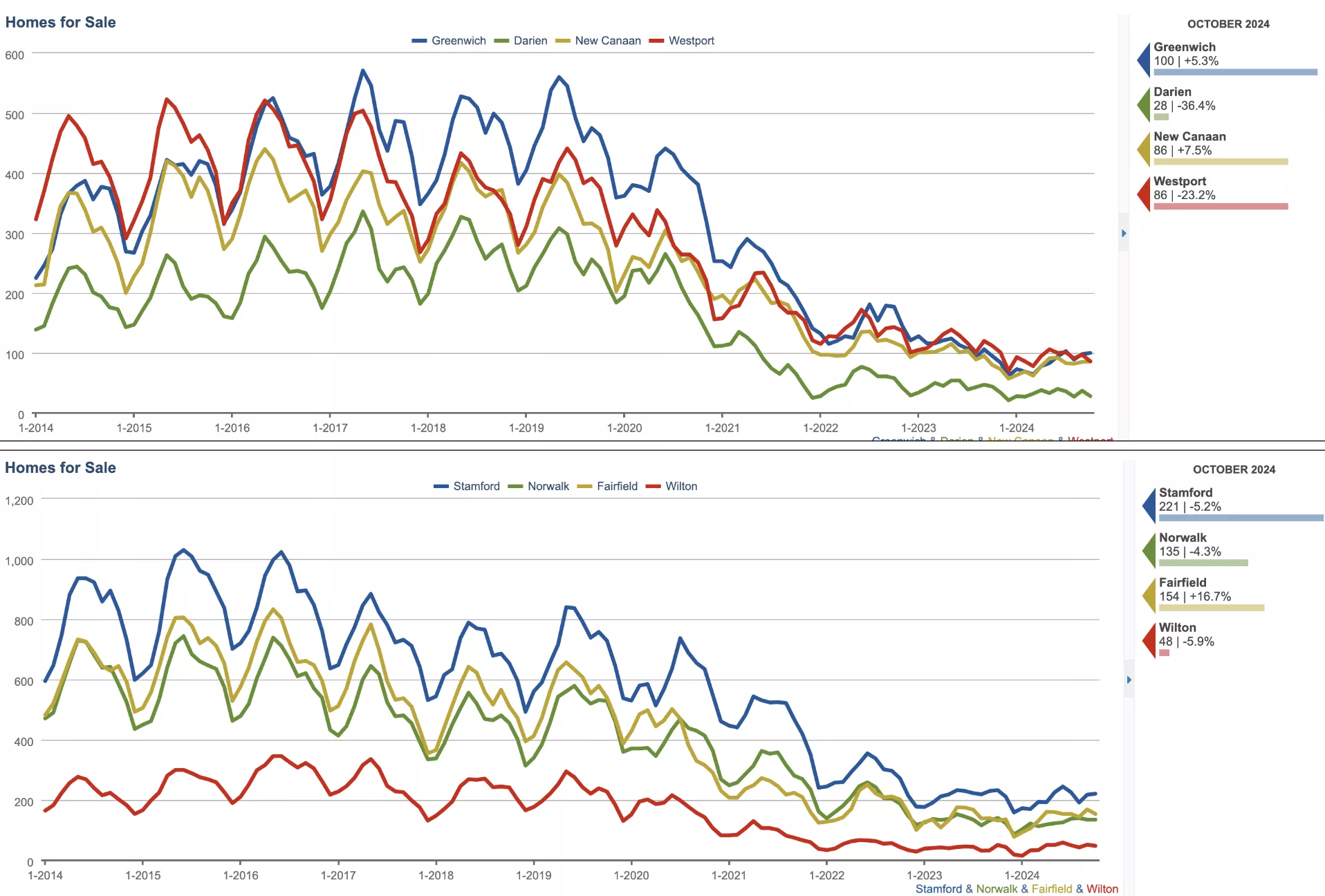

Greenwich – WEAKER. Median price fell -1.4% year over year to $1.78 million, the lowest among wealthy peer towns. The inflection point seems to be the Spring 2023 median price of $1.45 million when Greenwich median prices began to trail those of Westport, Darien and New Canaan for the first time. Dollar volume fell -8.9% year over year, and once again trails Westport, a town half its size. Homes for Sale is 100, up +5.3% this year and steadily higher since a ten-year low of 62 homes in December 2023. What’s the takeaway? Look at this as probably a buying opportunity in Connecticut’s preeminent coastal town. If you can afford to trade-up into Greenwich which boasts a quick commute, lowest taxes and good schools, then you should.

Darien – TOO STRONG. Median price is up +3.7% year over year to $1.97 million, mostly due to the profound scarcity of inventory at all levels. It’s not even close, with the 34 houses for sale in Darien representing about a third of what we find in New Canaan (87), Westport (97), and Greenwich (95). This is the lowest inventory level in over 20 years, 10% lower than the post-covid low of 38 homes in April 2022. Low inventory emboldens sellers to price aggressively, and they’re getting it, with the average home in Darien selling for 101.6%, a number that has been as high as 105%, peaking in Summer 2022, when Darien had 62 homes for sale. I ‘ll note that Darien has always (for at least 20 years) had fewer homes for sale than her peer group. But this is a profound new low and signals a market seriously out-of-balance. What’s the takeaway? Darien is not a bargain and won’t be this Spring. With median price-per-foot over $100 higher than that of New Canaan and Westport, and on par with Greenwich, we say wait for new inventory under construction in Noroton Heights and the Corbin District to bring prices back to earth.

New Canaan. STEADY STRONG. The dollar volume of all sales is up +6.9%, median price is up +7.6%, and price per foot is has risen +4.5% in the last year. With 86 homes for sale, a number equal to Westport but down -10.3% in a year, New Canaan continues to offer enough inventory, and is moving that inventory, to call it the most balanced market with modest but steady price appreciation. New Canaan’s months of inventory, currently at a comfortable 4 months and up 17% from a year ago, is higher than Greenwich (3.6 months), Westport (3.0 months) and Darien (1.6 months). New Canaan has a higher ratio of condominiums to single-family-home than the other towns, and new construction of condos in the past 5 years helps. In the last 6 months New Canaan’s 36 condo sales is 4 times higher than Darien’s 9, and 25% higher than Westport’s 28, and only 25% less than Greenwich’s 49 condo sales, a town three times the size. Median price per foot of $498 in October, and averaging $534 for the previous 6 months, was in both cases by far the lowest in the peer group, signaling that there are still deals to be had in New Canaan. What’s the takeaway? We expect inventory levels to gradually rise, as they did in 2024, but not as fast as demand, so prices will continue to rise modestly through the Spring market.

Westport. STRONG. Once the darling of Fairfield County with the highest median price ($2.1 million in September and October of 2023), the most new listings (#1 in the peer group for the last 18 months), the most closed sales (203 for the last 6 months, equal or better than Greenwich for the last 3 years) it’s time to say the market is STRONG, down from VERY STRONG. But we are seeing a few chinks in the armor, a few indications that Westport has lost a step this year. First, total dollar volume of sales is down -16.3% in the past year despite the fact that Westport led with the most new listings, homes for sale and closed sales. Looking for answers I discovered that in October the average sale in Westport came in $1.73 million, a -33% decline from a year earlier. The average house sold for $1.86, a decline of -26.6% from a year ago. October condo prices in Westport averaged $752,000, a decline of -73.1% from a year earlier. So, while houses and condos are selling, they are selling at lower price points than a year ago. Percentage of list price has come down to 100% and price per square foot has been $550 for most of the last year. What’s the takeaway? Westport is down from the stratospheric highs at the moment, a much more balanced, STRONG market, and is meeting the demand for lower price points below that important $2 million threshold. The fundamentals are in place (low taxes, great schools, a beach pass and a commute on the main line) for Westport to continue rising in the Spring market.

Stamford. VERY STRONG. The median price in Stamford is now $667,000, up 21.3% in a year and the average is up +24.4% to $792,752 indicating strength at the top of their market. Despite 130 new listings in October, they sold 88 and still only have 2.4 months of inventory, down -4% since this time last year. Median price per foot is $353, up 9.6% in a year, and still only a little higher than the Fairfield County median of $311 in October. Inventory dropped from pre-covid levels of 600 to 1000 homes to around 240 at the beginning of 2022 and has been flat for 2 years, hovering around the 200 level. What’s the takeaway? We see an increase in demand for the Stamford market this Spring, making this a hot market poised to stay hot as long as inventory remains around the 200-220 mark. The Stamford market is going to be more sensitive to interest rate movements, as a larger percentage of homes qualify for conventional loans. Expect markets like Stamford and Norwalk to benefit from the scarcity of listings in the neighboring communities of New Canaan, Darien, Greenwich and Westport.

Notes from the Monday Meeting: Fed is only 50-50 on a cut in December. Inflation rising means rates will be “higher for longer”. Home appreciation is the best protection from inflation.

John Engel is a broker on The Engel Team at Douglas Elliman and at 57 he sometimes thinks maybe he should be downsizing. But it’s the Fall and all his adult kids and their cousins and friends come over to watch football, or sit around the firepit, or celebrate Thanksgiving or stay the weekend and he is reminded why New Canaan and why a little extra space.