Past performance is often used as a warning label to caution against assuming an investment will continue to perform well in the future: “past performance is not a guarantee of future success.” But this is election week, the correlations are strong, and you can take my predictions to the bank.

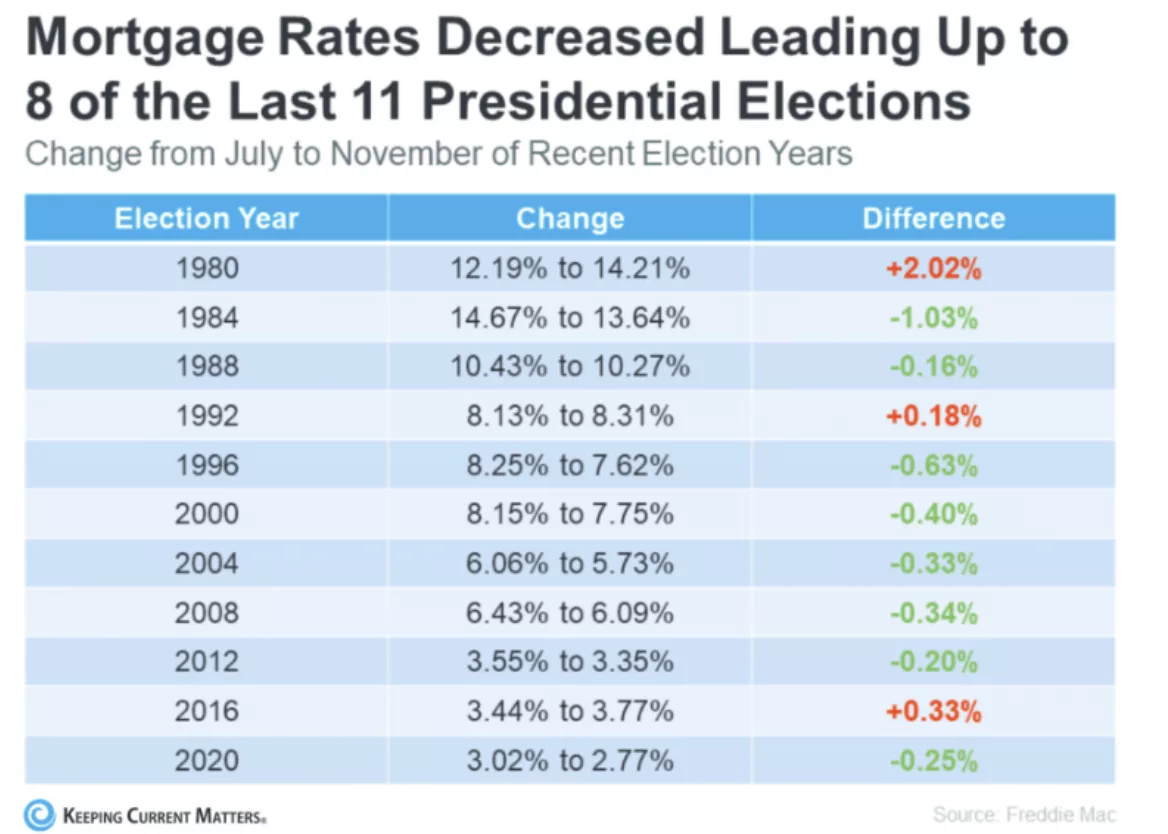

First, let’s look at activity immediately preceding and following an election. Home sales always slow in the Fall following the Spring and Summer rush. But do they slow more in a Presidential election year? Yes, they do. Briefly. An analysis of 20 years of housing data shows sales are down year over year in even years (election years) by 5.5% in L.A., 2.5% in Manhattan and 2.6% in Miami. In odd years (following an election) sales were up year over year, 4.6% in L.A., 8.5% in Manhattan and 10.2% in Miami. This is not limited to cities. Suffolk County sees sales fall .8% in an election year and rise .8 percent in off-years. The phenomenon is short lived, but immediate. Timing the market? History shows that home sales bounce back in December and keep rising the next year.

Election year vs. off-year sales volume in December to November in 4 real estate markets.

What about this year, 2024? The New York Times story “I Can’t Buy a House. I Can’t Shop. I’m Too Worried About the Election” describes a phenomenon not limited to houses but to all large purchases, including cars and weddings. A recent survey indicated that 23% of buyers are currently delaying their purchase until after the election. Of those surveyed who say they are waiting, 26% are waiting for Kamala Harris to enact her housing plans, including $25,000 first-time homebuyer assistance, $10,000 mortgage relief tax credits, and elimination of title insurance for refinanced loans. Another 15.9% said they are excited about Donald Trump’s promises to lower taxes, deregulate homebuilding and offer additional tax incentives and support for homebuyers. Trump’s proposal to eliminate the $10,000 cap on interest deductions would have a massive impact on the tristate and our local market if passed. A Redfin survey shows buyers are concerned with interest rate cuts (18.3%) and city- and state-level affordable housing initiatives (23.6%). This is true locally. Affordable housing is front and center in New Canaan’s local elections, particularly the Fazio vs. Simmons race for State Senate. It is their major policy difference: Fazio for local control (P&Z) and Simmons for Hartford control (8-30g) of affordable housing. Most importantly, a Simmons win will ensure a veto-proof Democratic majority in the Senate, 25-11, where a two thirds majority can ignore the moderating influence of the governor. The house is 98-53, not quite two-thirds. Local races matter. Vote early, vote often! (kidding, really)

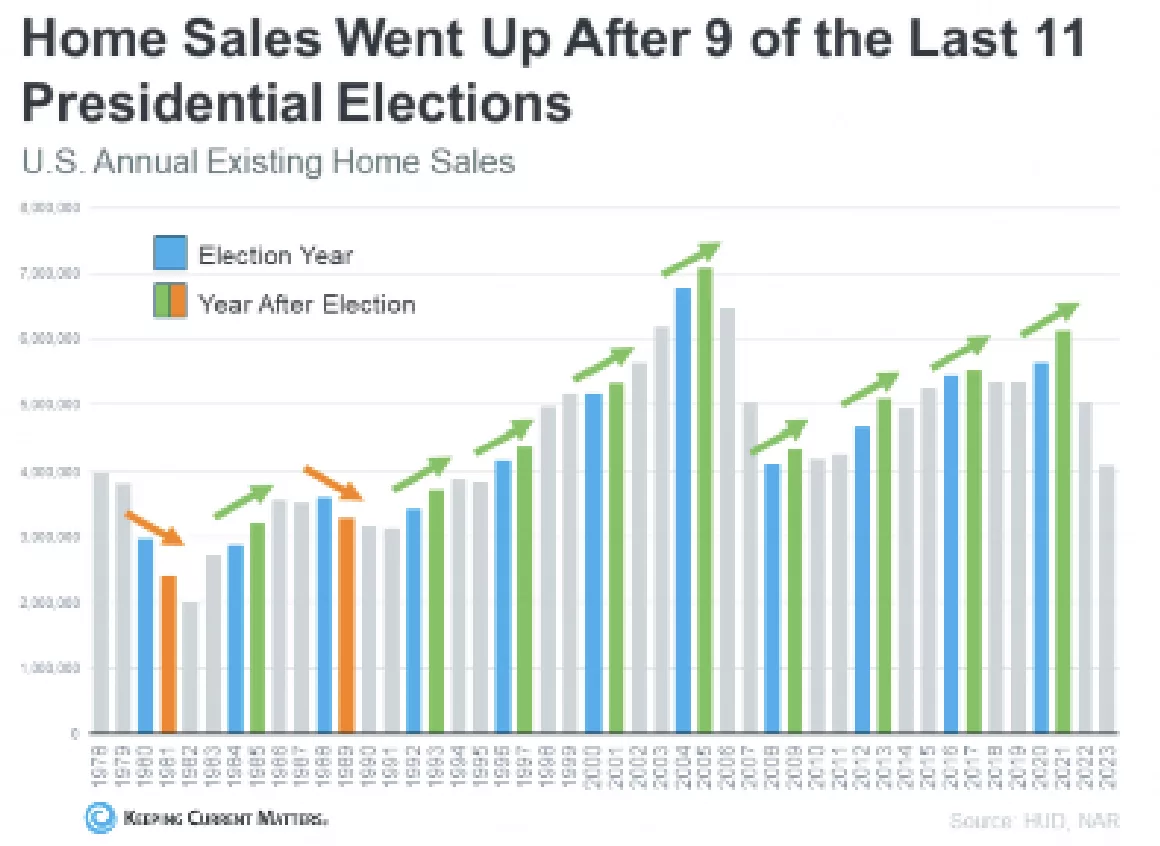

What about 2025? In 9 of the last 11 presidential elections home sales increased nationally in the following year. The only two times sales decreased after an election was in 1981 (Reagan) and in 1989 (Bush 41). In both of those cases the economy was heading into the recessions of July 1981(16 months following tight monetary policy) and July 1990 (8 months following 3 years of rising interest rates).

Presidential elections might nudge the housing market, but the effects are usually minor and short-lived. For buyers and sellers, factors like falling interest rates, a strong economy, and more inventory will drive the market far more than any election outcome.

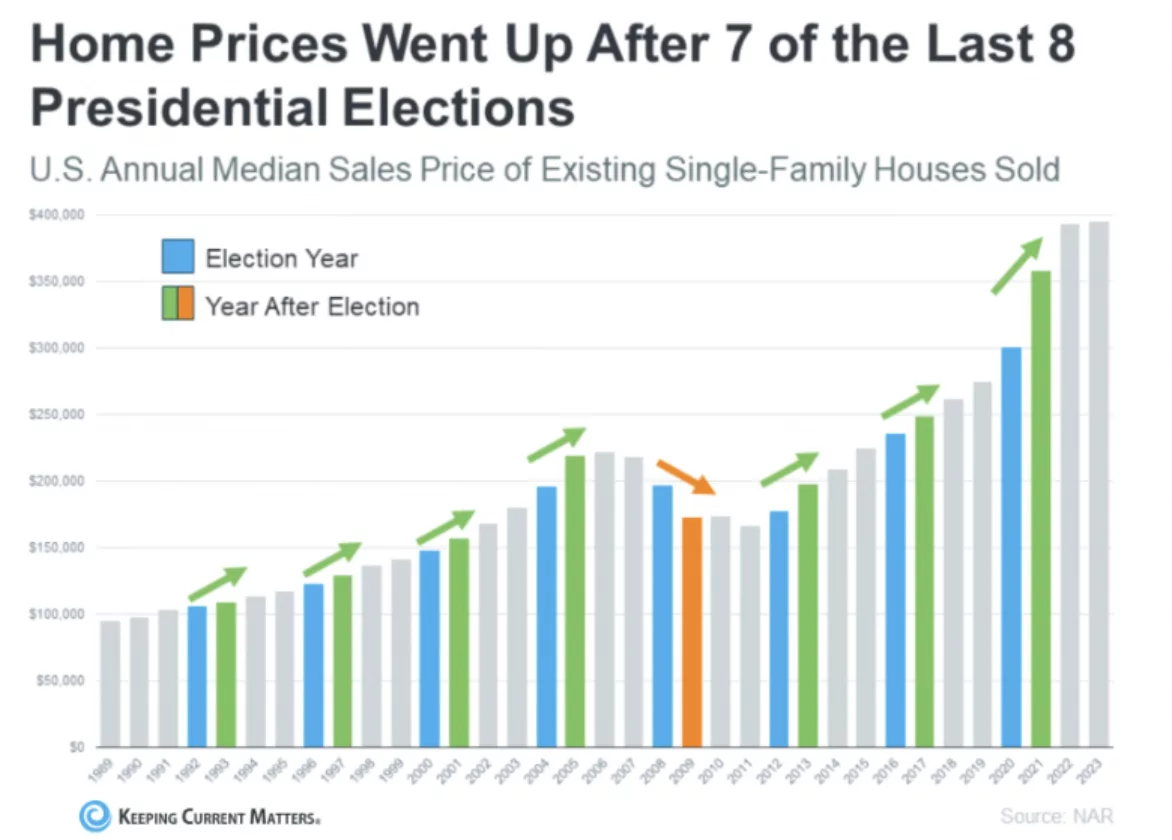

How about prices? The only time in the last 20 years that prices did not rise following a presidential election was in 2009 following the Obama victory over McCain. This was the year of the Great Recession and followed a 4.3% decline in GDP over 18 months and a rise in unemployment which peaked at 10% in October of that year. In New Canaan there were zero home sales in January 2009. For real estate prices to fall we would need to have some combination of those calamitous effects.

With home prices rising 47% in the last 4 years (through July 2024), and expected to rise further next year, Keith Griffith of Realtor.com points out that rising equity value tends to benefit the incumbent candidate for president in much the same way a rising stock market does. But, this election has no incumbent, so will Harris benefit in the same way Biden would have? Professor Eren Cifci of Austin Peay State University says she will, that the goodwill extends to the party of the President in power. Not by a lot, but statistically significant. We vote to maximize our property values, and we do so particularly at the county and local level. Homeowners are statistically more likely to vote than renters, so surging prices and an improvement in home equity in key swing state housing markets could make a difference.

Notes from the Monday Meeting: The Board of Realtors voted last week to shutter the New Canaan MLS at the end of the year but in the same breath announced discussions with Darien to create a new MLS that serves both towns. In other news Realtors are being asked to use the buddy system at weekend open houses. We can’t take our safety for granted, alone in an empty house, nor the safety of the beautiful houses we represent. It’s tough, because hosting open houses is an important part of exposing the listing to the broadest possible market, and we provide excellent service to our homeowner clients. The public open house may become extinct. Registration will become mandatory and comprehensive, no more handwritten, illegible sign-in sheets. Accountability. Safety. Service.

John Engel on the 10-member Engel Team sells western Connecticut with listings currently in Kent, Greenwich, Wilton, Norwalk, Stamford and New Canaan. This weekend John and Melissa made curtains and refinished furniture in between hosting open houses. We grew up seeing our parents work on their houses. Susan Engel needlepoints, Max winterizes his boat, Rose sews, Charlotte knits, Lillie cooks – the many roll-up-your-sleeves joys of home ownership. We get our bulbs from Colorblends in Bridgeport and are almost finished planting.