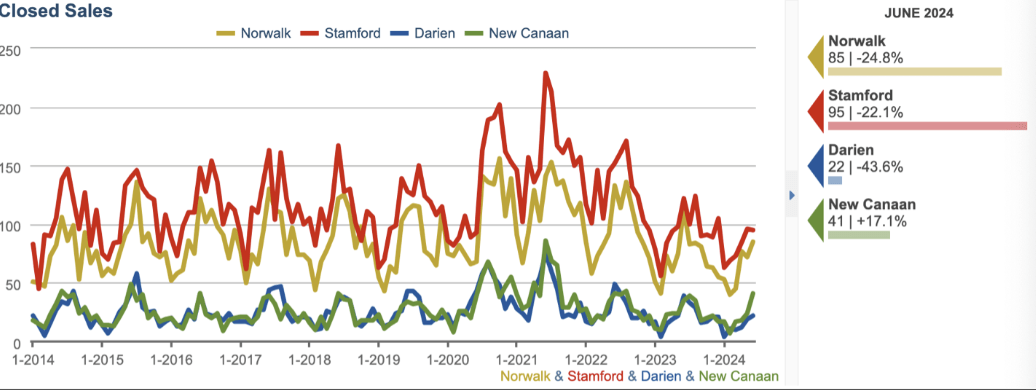

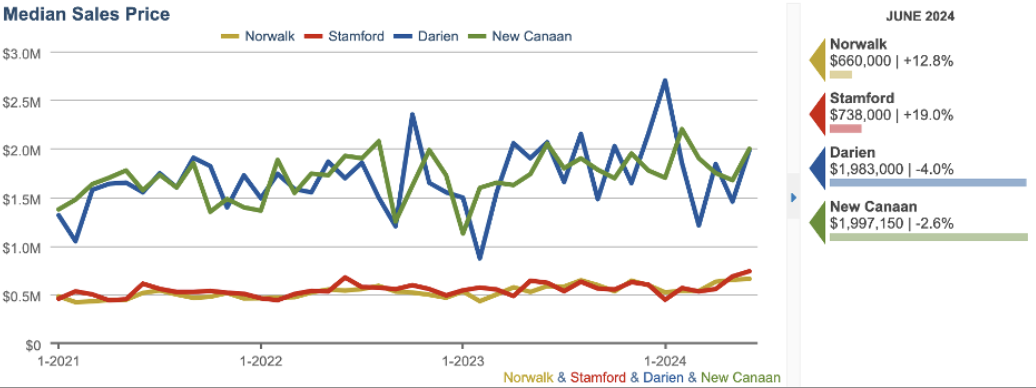

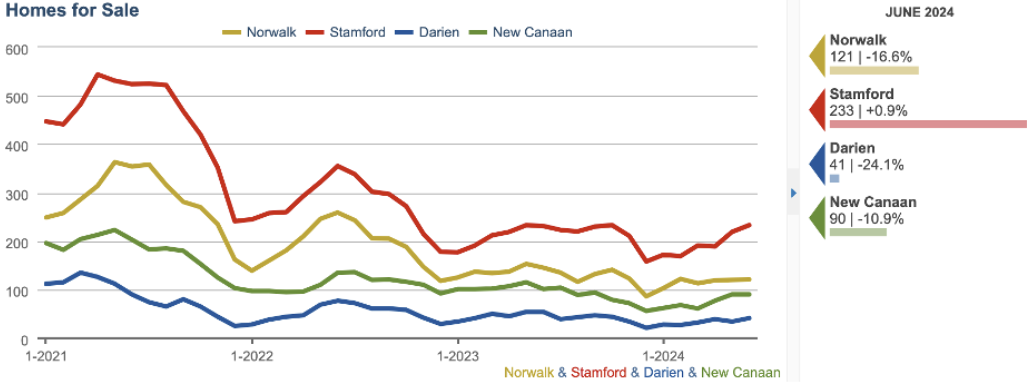

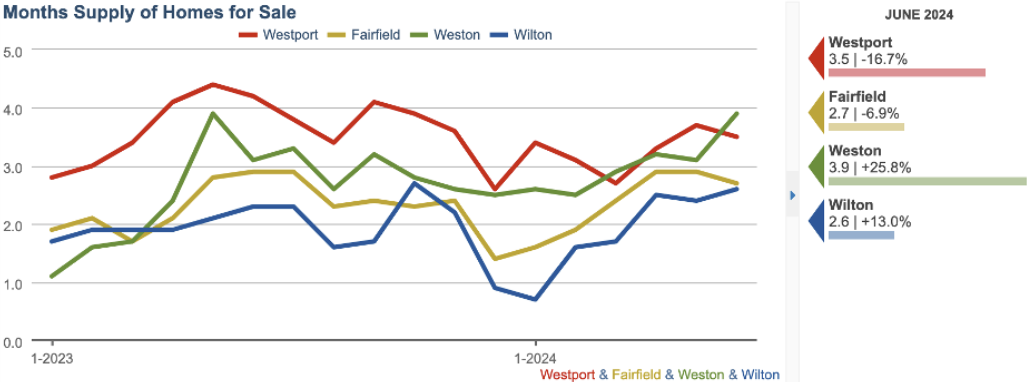

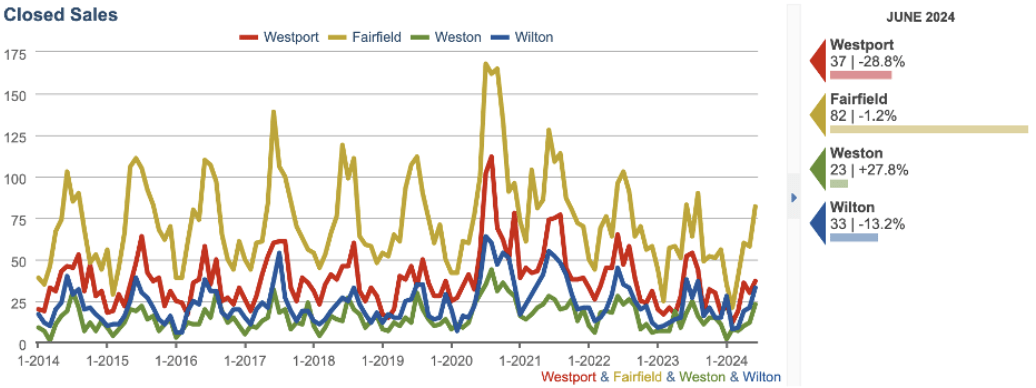

We looked at the stats for the first 6 months, comparing towns of similar size and wealth head to head in order to add some context. When we quote a number, it is a comparison with this time last year. These figures include houses, condos and co-ops. Most striking is Darien’s lack of inventory, Norwalk’s median percentage of list price of 107.7%, and Westport’s median price of $2.175 million, much higher than Darien and New Canaan. We consider around 3 months of inventory to be normal in this environment so New Canaan’s 4 months and Norwalk’s 1.8 months stand out. The graph of closed sales is seasonal, a sine wave peaking in June, but Stamford surged in December and Wilton in January, so unpredictable. Except for the Darien vs. New Canaan comparison, it seems the lower priced towns have fewer months of inventory, and are commanding a higher percentage vs. list price.

Darien vs. New Canaan (estimated population 22,020 vs. 20,862)

Darien has 41 homes for sale, down 24%, and New Canaan has 90, down 11%

Darien median price is $1,983,000, down 4%, and New Canaan is $1,997,150, down 2.6%

Darien’s percentage of list price is 101.6%, down 3.2%, and New Canaan is 102.9%, up 2%

Darien has 2.3 month’s supply of inventory, down 8%, and New Canaan has 4 months, no change.

Darien closed 22 homes in June, down 43.6% while New Canaan closed 41, up 17.1%

Norwalk vs. Stamford (estimated population 92,980 vs. 136,480)

Norwalk has 121 houses for sale, down 17%, where Stamford has 233, up 1%

Norwalk median price is $660,000, up 13%, where Stamford is $738,000, up 19%

Norwalk’s percent of list price is 107.7%, up .4%, where Stamford is 102.9%, up .7%

Norwalk has 1.8 months of inventory, no change, where Stamford has 2.5 months, up 13.6%

Norwalk closed 85 homes in June, down 24.8%, while Stamford closed 95, down 22.1%

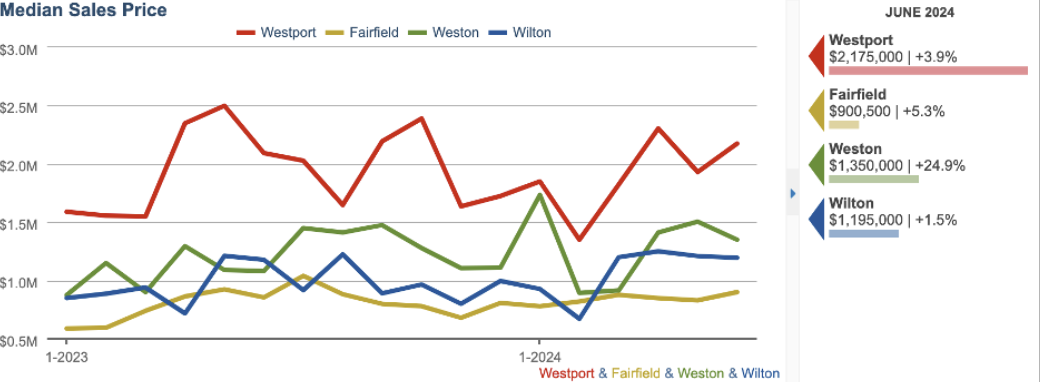

Westport vs Fairfield (estimated population 27,470 vs. 63,433)

Westport has 100 houses for sale, down 22.5%, while Fairfield has 148, down 15.4%

Westport’s median price is $2,175,000, up 3.9%, while Fairfield is $900,000, up 5.3%

Westport’s percentage of list price is 100%, down .7% while Fairfield is 102.4%. up .2%

Westport has 3.5 months of inventory, down 16.7% while Fairfield has 2.7%, down 6.9%

Westport closed 37 in June, down 28.8% while Fairfield held even with 82, down only 1.2%

Wilton vs. Weston (estimated population 18,400 vs. 10,344)

Wilton has 56 houses for sale, up 21.7%, while Weston has 46, up 7%

Wilton’s median price is $1,195,000, up 1.5%, while Weston is $1,350,000, up 24.9%

Wilton’s percent of list price is 104.8%, up .2% while Weston is $104.5%, up 3%

Wilton has 2.6 months of inventory, up 13% while Weston has 3.9 months, up 25.8%

Wilton closed 33 homes in June, down 13.2% while Weston closed 23 homes, up 27.8%

The NAR Settlement has yet to be approved by a judge, and deadlines are approaching after which the multiple listing services will no longer publish an offer of buyer-agent compensation. What does this mean for the industry? Will uncertainty have a negative effect on the market? Agents I’ve asked in both New York and Connecticut say it’s not expected to be a factor. But there seems to be concern that there will be a shift to direct deals in which more buyers will seek out the listing agent directly. The concensus seems to be that buyers and agents will look for the offer on the listing agent’s website, and that major real estate portals like Zillow, Realtor.com and Homes.com will seek to fill the void. Thinking about the question of direct deals with the listing agent, I decided to investigate, using the 43 sales in New Canaan over the last 30 days to see how many of the deals were done within the same office. The answer is 14. 29 deals involved two different agencies. And, of the 43 transactions only 4 were direct deals involving only one agent. In the past month four agencies had more than a dozen transactions. Four more agencies had more than one transaction but less than a dozen, and five agencies had one transaction each. My conclusion using this small sample is that the market is well distributed among the dozen or so agencies taking part, with the largest agency achieving a 24% market share.

The Fed made no change at the June meeting and penciled in only one cut for the remainder of the year saying the current inflation rate of 3.3% is well above the 2% target. That’s hardly news. But what struck me was that the Fed revised downward the employment and jobs figures of the previous few months and it signaled a softening of the economy. 30-year rates are around 7% and I am told by our lenders that jumbo mortgages are even less.

Notes from the Monday Meeting:

We talked, as we always do, about listings that are lingering, not selling right away. Are our sellers concerned? Are we asking for price cuts? We are now firmly in the slower summer season and sales are supposed to slow. We asked, “Does anybody expect the upcoming presidential election to affect real estate sales in our area?” The consensus in Connecticut agents is “no effect” from either the election (or interest rate movement). We expect the low-inventory environment to persist and apparently so do our sellers. In contrast, NYC agents on the call think the election has had a negative impact, citing a slow Spring market.

John Engel is a broker on the Engel Team at Douglas Elliman in New Canaan, and he is thinking about summer in New Canaan. On the one hand it’s hard to get things done when people are away. On the other hand, it’s kind of nice when you are the one getting away. Summer jobs! 8th grader Natalie tells me that C-level caddies make $60 per bag now . John caddied at Woodway back in 8th grade, but they were only paying $8 per bag. Inflation is real.

Submit questions and comments to John.Engel@Elliman.com