By Beth Barhydt

In a year marked by economic turbulence including significant inflation, Connecticut’s unfunded mandates on municipalities, and rising energy costs, the New Canaan Board of Finance has delivered a budgetary outcome aimed at providing some relief to taxpayers while addressing essential municipal needs.

On June 11, 2024, the Board approved a mill rate of 16.144 for the fiscal year 2025, signifying a significant decrease of 14.76% from the previous fiscal year’s mill rate of 18.940.

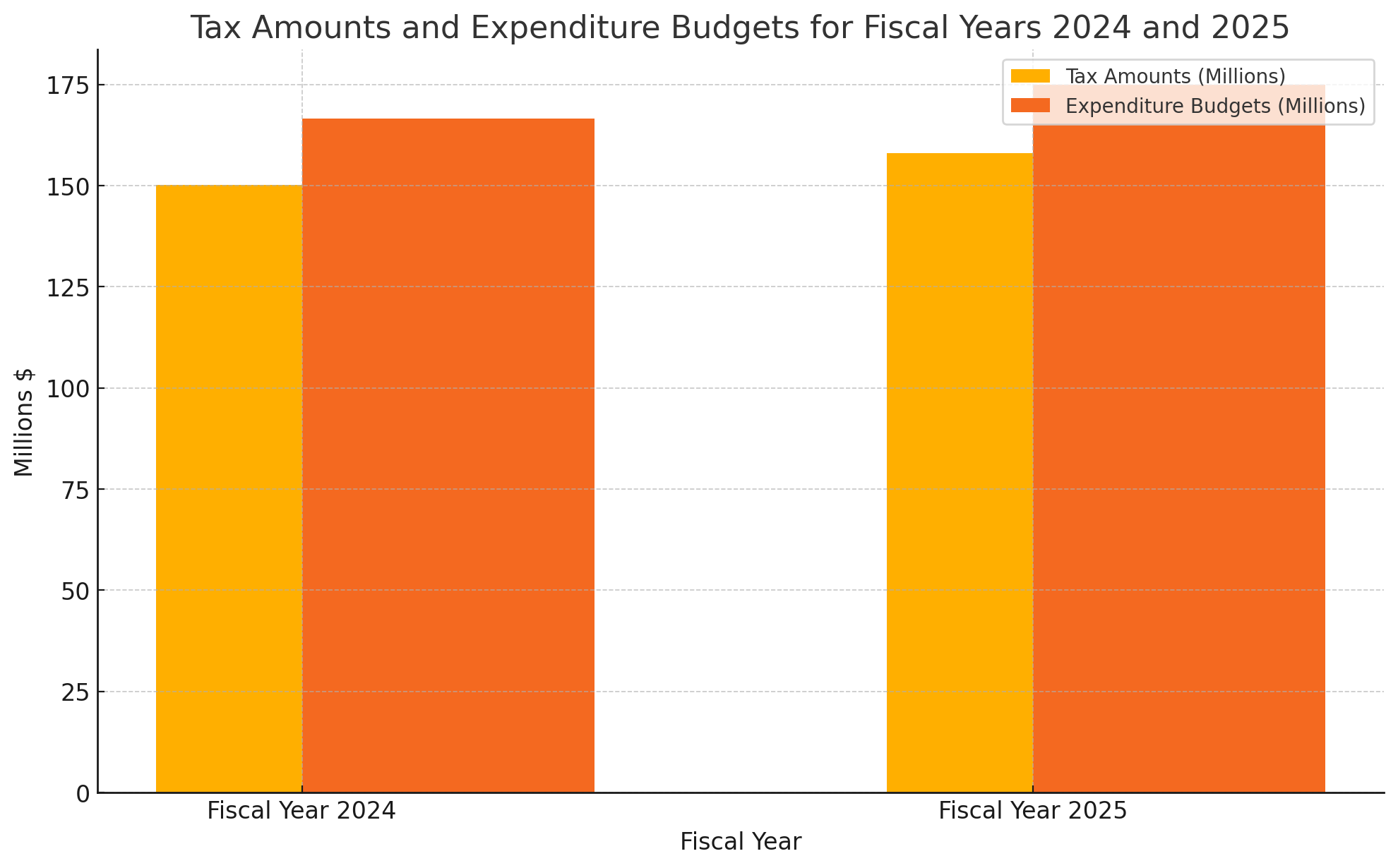

A mill rate of 16.144 translates to a tax payment of $16.14 for every $1,000 of assessed property value. The projected revenue from taxation for fiscal year 2025 is set at $158.10 million, representing a 5.27% increase from the fiscal year 2024 figure of $150.18 million. This adjustment aims to balance the financial demands on the town while accommodating a growing budgetary requirement.

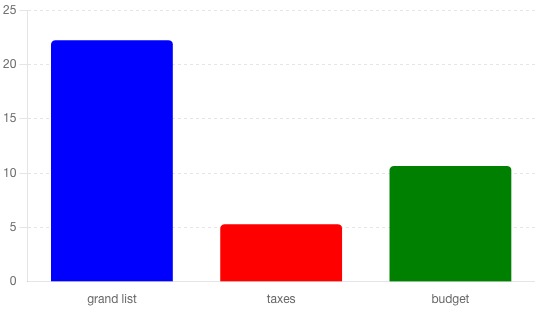

The ratification of the mill rate concludes the fiscal year 2025 budget process, which began with the Town Council’s approval on April 2 of a $174.93 million expenditure budget. This represents a 4.99% increase over the current fiscal year’s budget of $166.62 million. The fiscal plan integrates the Town Assessor’s reported 2023 Grand List, which saw a substantial increase of 23.53% to $9.90 billion from the 2022 Grand List of $8.01 billion. This expanded tax base, combined with a $5.0 million fund balance drawdown, facilitated the mill rate reduction.

Maintaining healthy reserves and ensuring a stable mill rate remain pivotal objectives for the Board of Finance. First Selectman Dionna Carlson commended the Board for their meticulous fiscal planning. “I want to congratulate and thank Board Chairman Todd Lavieri and all the members of the Board of Finance for a fiscal year 2025 Budget that resulted in a mill rate decrease of 14.76% from the current fiscal year and an increase in the amount to be raised by taxation of 5.27% in the upcoming 2024-2025 fiscal year. Many thanks to all who participated in the budget process and were committed to funding our departments to meet the needs of our community while being sensitive to the inflationary environment we face,” said Carlson.

Board Chairman Todd Lavieri highlighted the prudent financial management that enabled the mill rate reduction. “By delivering a budget surplus of $3.9 million, we are able to return that back to the taxpayers to help lessen the amount raised by taxes. The mill rate decline will mean 1,900 properties in town will see a decrease in their property taxes on July 1st, and many will see very modest increases. Properties that saw their values increase by more than 20% will see a property tax increase. Property taxes on vehicles will also decline.”

Lavieri emphasized the consistent fiscal discipline over the years, noting, “The average increase in the amount raised by taxation over 7 years, including next year’s budget, is 2.1%, a very strong accomplishment by our Town and boards over this period, especially with inflation headwinds recently. That average increase compares favorably with surrounding towns. During the budget process, we were able to cut expenses and cut capital requests while meeting the needs of our schools, public safety, public works, and many other town-related services. I would like to thank our Board of Finance, our Town Council, our New Canaan school administration, our Board of Education, and our Board of Selectmen for their hard work and guidance.”