By John Engel

By John Engel

This is the most important question Realtors answer, and busy agents are answering it every day. It is particularly relevant this month while 300 residents are arguing their values in front of the New Canaan Assessment Board of Appeals. This is a case-study on how I do it:

The subject property is a 4,080 square foot 4-bedroom, 3-bathroom ranch built in 1957 on 2.5 acres. The house has 3 fireplaces, an in-ground heated pool and a 2-car garage. The location is on a cul-de-sac, with views of a pond, a level lot, professionally landscaped.

The house was purchased on July 3, 2020. The asking price was $1,550,000 and the purchase price was $1,560,000. The house went under contract in 7 days after listing. There has been no change in the livable square feet, no material changes to the amenities. The house was purchased in above-average condition and remains above-average.

The Tax Assessor has published a market value appraisal of $994,560. That is remarkably low, only 63% of the purchase price nearly 4 years ago. Why? The assessor is looking only at the fact that its nearly 70 years old and comparing it with other 70-year-old ranches in the neighborhood. Town hall raised the assessment 20% in 2022 but disregards whether a house is stylish or decorated. While a replacement pool costs $100,000+ the assessor put a value on the pool of only $9,990. Where does the assessor number come from? The assessment is primarily based on square footage multiplied by a statewide standard and not useful when calculating replacement cost. The 20% increase at the last revaluation is a little more useful, indicating what the assessor thinks happened in this neighborhood between 2018-2022.

Zillow publishes an estimate range of $1.46 to $1.75 million on the house with a Zestimate of $1,609,400 ($394 per foot). They say the average home in the neighborhood, north Stamford, is $628,990 and has increased 11.5% in the last year.

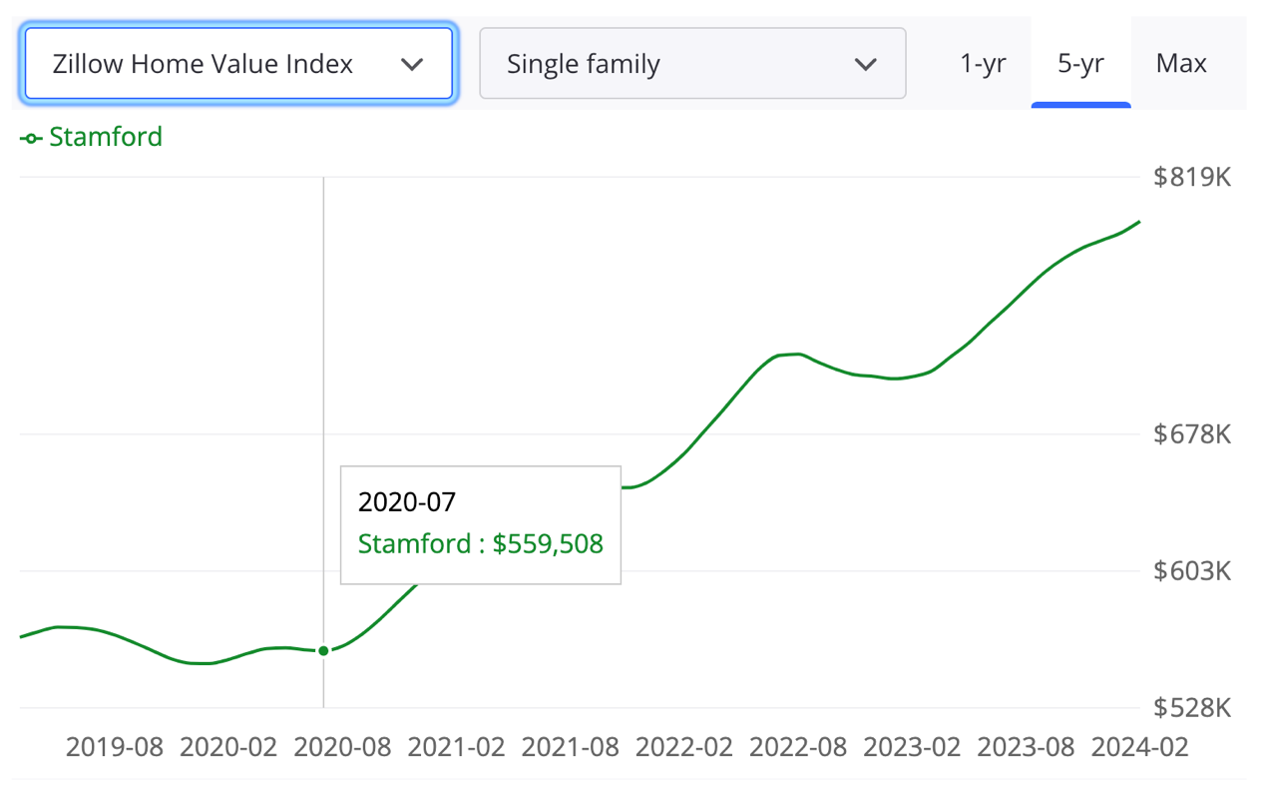

The chart to the right at the top is a Zillow chart. The July 2020 spike in that chart coincides with the moment it was listed. The green dollar sign indicates it was sold shortly after that. Once listed Zillow adjusts the Zestimate. (The assessor does not.) The jump in value shows us that Zillow knows their accuracy for off-market homes is poor and they know the best gauge is the new asking price. The nationwide median error rate for the Zestimate for on-market homes is 2.4%, while the Zestimate for off-market homes has a median error rate of 7.49%. In Connecticut Zillow is even less accurate, getting within 10% of the sale price only 57.9% of the time.

That is why we should not put too much stock in Zillow’s estimate of $1,609,400 without checking a few other sources. Zillow’s estimate is too low.

Realtor.com is relying on three valuation providers: Corelogic, Collateral Analytics and Quantarium. Their estimates are a million dollars apart because they differ in their analysis of price trends in the neighborhood, ranging from negative 11% to positive 24%.

Looking more closely, the first two are absurdly low because it does not appear that they captured the 2020 sale in their analysis, instead relying on the previous sale of $734,000 in July 2015 in an unrenovated condition. Throw those out. The Quantarium estimate of $2,147,043 is closer to where the market has moved since the 2020 sale.

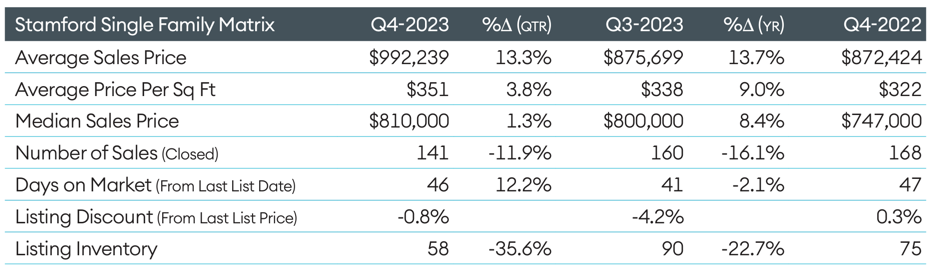

Finally, looking at the most recent Douglas Elliman market report for Stamford, Q4 2023 we see “single family price trend indication surged annually, remaining well above pre-pandemic levels” with a median sale price of $810,000, up 8.4% and average sale price was $992,239, up 13.3% year over year. The average price per foot was $351. I find price per foot to be a poor measure of value in our area. Why? Because the house only represents 51% of total value (according to the tax assessor).

Looking at current market conditions there are only 9 houses for sale in Stamford within 3 miles of the subject property between $1.5 and $2.0 million and they are all colonials. Nevertheless, using this as a sample of houses in the area, we see the median house is 5,370 feet, listed for $1,870,000, on 1.53 acres asking $346 per foot.

Using the same criteria, we did a search on the 17 sales over the last year within 3 miles and discovered the median house is 4,475 feet on 1.9 acres of land, listed for $1,695,000 and sold for $1,675,000 in 35 days on the market for $378 per foot.

Conclusion: Considering all of these analyses, the best indicator of the house value is looking at the prior sale as a starting point and making a judgement of how much the market has moved (in the nearly 4 years since the last sale). The assessor says 20% appreciation. Zillow says we’ve appreciated 42.1% since July 2020. Extrapolating, that multiple would suggest a price of $2.22 million. But, again, that’s based on the average home in Stamford (a $900,000 colonial). While the average house in Stamford might have appreciated 42.1% over the last 4 years the luxury market in Stamford has appreciated about 25% over the same period. That leads me to suggest a price of $1,950,000.

Notes from the Monday Meeting: Lots of buzz about NAR’s proposed settlement last Friday but nobody really knows anything. In the meeting we talked about Hubbard clause vs. bridge loan as a strategy when buyers are reluctant to list their home before bidding on another. Hubbard Clause is when the purchase is contingent on the sale of an existing home. There are only 49 homes for sale in New Canaan; 13 are new listings and 5 just accepted offers. Average and Median is way up in February and Year to Date. My podcast this week is on ADUs (accessory dwelling units) as an affordable housing solution. Search Boroughs & Burbs #130 on Youtube, Apple Podcasts or Spotify and join the conversation.

John Engel, broker with Douglas Elliman, is under his car. Not particularly skilled with a wrench, he tries. Justin Podlesak taught him how to install new brake lines, and now Rose, Max and Charlotte Engel help. This week the 1976 Toyota FJ40 needs a radio and seat belts, just like the ‘72 Cutlass on Parade Hill in 1983. Cars, like houses, are getting more complicated, more electronic. Uncle Frank taught John, “You shouldn’t own something that you don’t understand and can’t fix.” So, John tries.

Submit questions and comments to John.Engel@Elliman.com