By John Engel

By John Engel

So many sad stories by homeowners who have lost bidding wars. I’m reprinting their stories and my advice:

“These houses are definitely way over the price that they will be once appraised.”

Last year houses were routinely selling for double their assessment and the sales were still clearing the appraisal hurdle. Appraisers know the market is rising. Some houses purposely list at a sharp price to generate an abundance of interest. Set your expectations properly. The closed price data is lagging a rising market in which the average home is selling for more than 100% of asking price. Most buyers report losing as much as 10 times before winning one.

“I got lucky with a realtor who knew what was up and had been a local realtor for many years through very hot markets. They had a great mortgage broker that could basically pre underwrite for you. In my market I accepted that I had no choice but to waive all contingencies to compete with cash offers. This is super risky if your appraisal comes back below the offer price.”

Yes, agents are reporting that half of all offers are cash. The rest are pre-approved (not just pre-qualified) with a full commitment from underwriting. Total Mortgage reports that they are working with borrowers who need a higher appraisal by adding renovation costs to the loan and having the file re-appraised based on the anticipated improvements. It’s just one way lenders are getting creative.

“I had less rate flexibility because other lenders couldn’t compete on the closing time.”

Once you’ve dropped your contingencies, offering a flexible closing date is often one of the last concessions a buyer can make in order to compete.

“My realtor put so much work into working for me that I couldn’t believe it. If you don’t have a realtor like that, find one, but you have to be willing to work just as hard scouring the listings and being honest with them and decisive as they are.”

I can’t stress enough the importance of this intangible. When evaluating two equal offers, or even an almost-equal offer, the listing agent is looking for evidence that one of them is reliable, meeting the dates, keeping promises, and is probably interviewing those buyer agents asking them who is the lender, how qualified are they, and what’s their situation? Do not doubt the importance of developing an honest and thorough relationship with an agent, and the value of being decisive with them. Many, many houses sell to the second-highest offer when the first offer fails to perform. Good agents know this and stay in the fight to the end.

“I was only able to offer 5k over asking and I know I won by doing inspection for informational purposes only and promising to be flexible on closing.”

You may waive your contingencies but still do an inspection. Or inspect for health and safety only. And, if that inspection reveals a major surprise, you can withdraw your offer or ask that it be corrected. Typically, the inspection is done in the 48 hours after an accepted offer, while the contract might not be signed until a day or two later. Your attorney will protect the buyer from losing the deposit until comfortable with the inspection report and confident the transaction will go through. As a seller I expect my buyers to do their inspection and complete their diligence before my backup offers move on to something else. A good listing agent holds the buyers feet to the fire.

“You may also need to change your realtor! If (s)he can’t move fast and get the seller to give yes/no/feedback, (s)he may not be a strong enough negotiator in this market.”

There are two things going on here. One is the amount of communication. The second is negotiating skills. When a realtor (and client) wants to win in this crazy-competitive marketplace, they step up their communication (even if they have nothing new to say) “Moving fast” and stepping up communication beats a fat offer that might be having second thoughts and the first clue is an agent that doesn’t return calls. Remember, the seller does not know what you are thinking, so don’t make them wonder. Negotiating skills are something else. According to Chris Voss, author of Never Split the Difference, negotiation is not like combat, “Individuals want to be understood and accepted, and…collaboration and empathy are at the core of good negotiations.”

“What about escalation clauses? For example, an escalation of paying 3k over every mortgage offer or 6k over every cash offer up to…”

We still do not see escalation clauses often. There is still some distrust of them on both sides. Sellers say, “If your client is willing to come up to that number, then bid that number.” Buyers who win with an escalation clause seem to back out more often. And they always wonder, “How do I know I didn’t pay too much?” When buyers use an escalation clause instead of committing to a number, you are telling the seller that it’s about winning and knocking the other bidders out.

Best time to buy a house is November, December, October followed by January. Worst is May, followed by June, April, March and July.

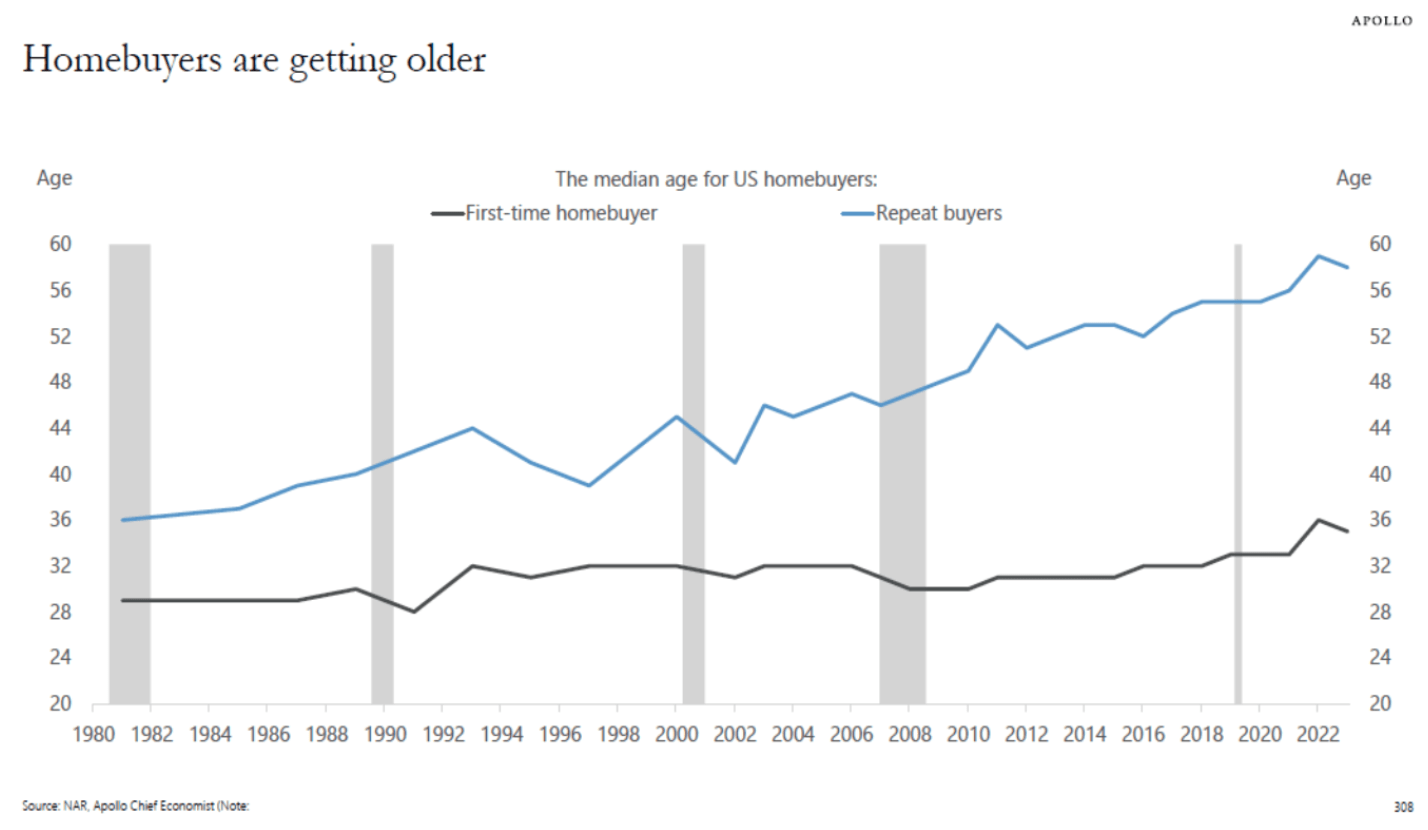

Homebuyers are getting older. The Median age of repeat homebuyers has increased from 36 years old to 58 years old in 2023, while the median age of first time homebuyers increased from 29 to 35 over the same period.

John Engel is a Realtor with Douglas Elliman in New Canaan and he wears self-tie bow ties. In 1840 touching a man’s tie knot was reason enough for a duel. The bow tie symbolizes individuality and confidence. Just ask Freud, Einstein, Lincoln, Karl Lagerfeld and Pee-wee Herman. 68% of men in the U.K. can’t tie one. 78% of sales are pre-tied. In 1996 3% of ties sold were bow, now estimated at 7%. Churchhill wore won in remembrance of his father, and so do I. Thanks, Jack Engel.