A dead cat bounce is a temporary recovery from a prolonged decline or bear market that’s followed by a continuation of the downtrend. In other words, it’s a false optimism. Cats don’t bounce.

A dead cat bounce is a temporary recovery from a prolonged decline or bear market that’s followed by a continuation of the downtrend. In other words, it’s a false optimism. Cats don’t bounce.

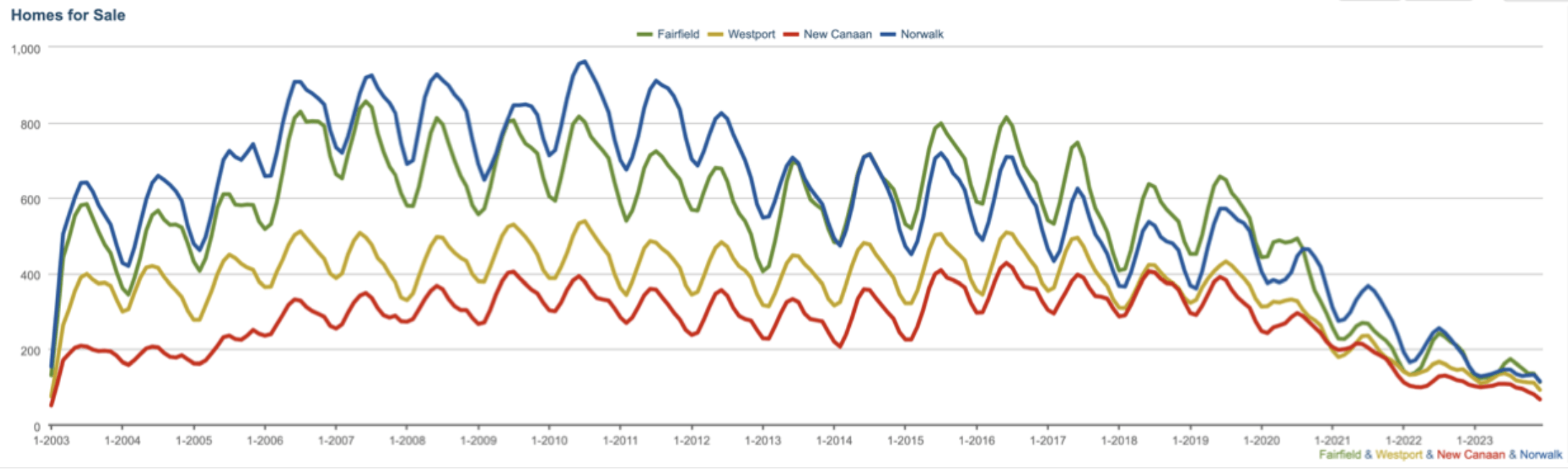

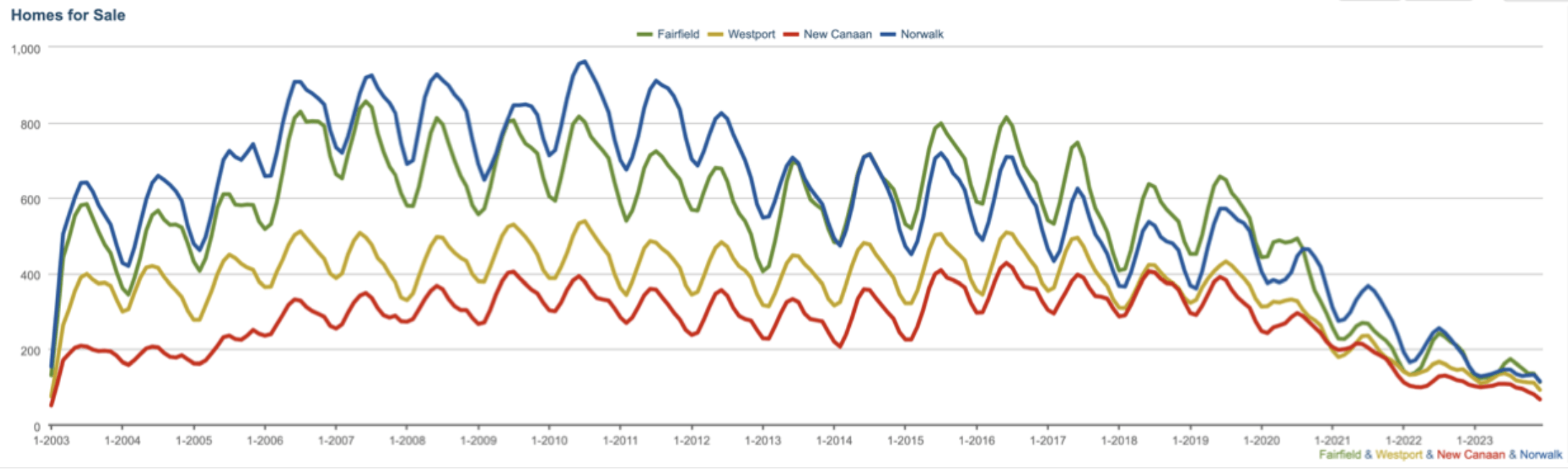

I was wondering if that is what we are really experiencing in the housing market when we hear agents and buyers speak enthusiastically of volume picking up and high hopes for new listing inventory. Is all this optimism for new inventory misplaced? As you can see in the graph going back 20-years we start every year with low inventory and inventory grows, peaking in June, and then drops steadily to a low point in February. That’s right, the low point is February, not New Year’s Day. There are only 39 houses on the market today, down from 42 last week, and this might not be the bottom. You think 39 is bad? Wilton, only has 7 homes on the market. Darien has 19. Ridgefield has 17. Rowayton has 6. Westport, 39% larger by population, has 42 listings, the only other bright spot. (I exclude listings of houses not finished, in some cases not started.)

The last two years have witnessed a disruption in the usual pattern. Norwalk and Fairfield, shown in blue and greens, continue to show seasonality in the market, but New Canaan and Westport haven’t seen a normal wave form since 2019. When buyers get squeezed out of the most competitive markets, they expand their searches. Fairfield and East Norwalk are picking up would-be buyers from Westport. Wilton, West Norwalk and North Stamford are picking up buyers who can’t buy in New Canaan. Expect inventory levels to remain low in all these towns, and for the seasonality to decrease across the board. And, of course, prices are rising and will continue to rise.

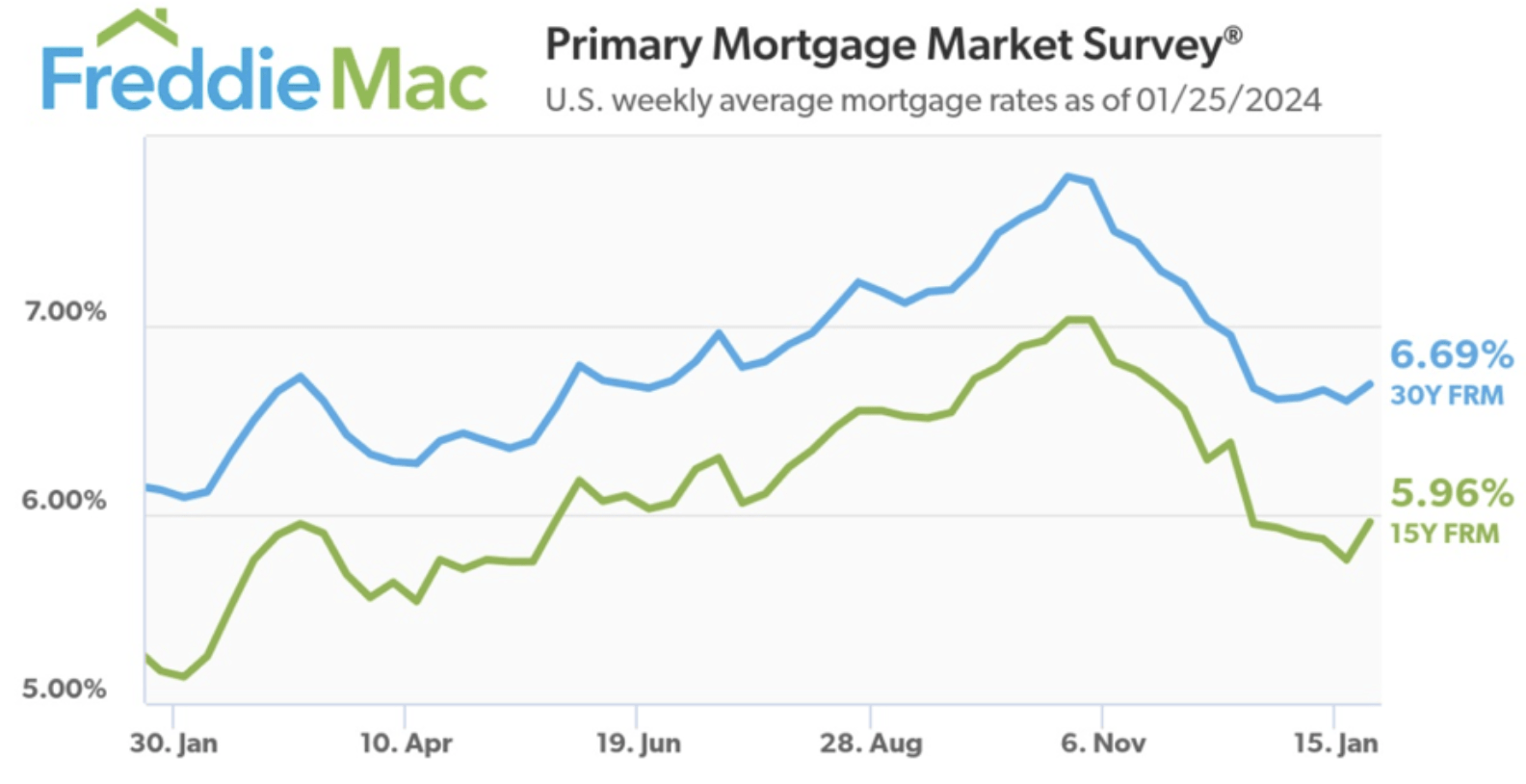

One client argued, “This can’t continue. Rates are falling.” I wish it were true, but this is an example of Dead Cat Bounce optimism. Falling rates are causing that customer to look at his out-of-state options, but like so many of us he pulls back when he sees how expensive the alternatives have become. Sales volumes are up since last January, nationally, despite low inventory levels because demand persists.

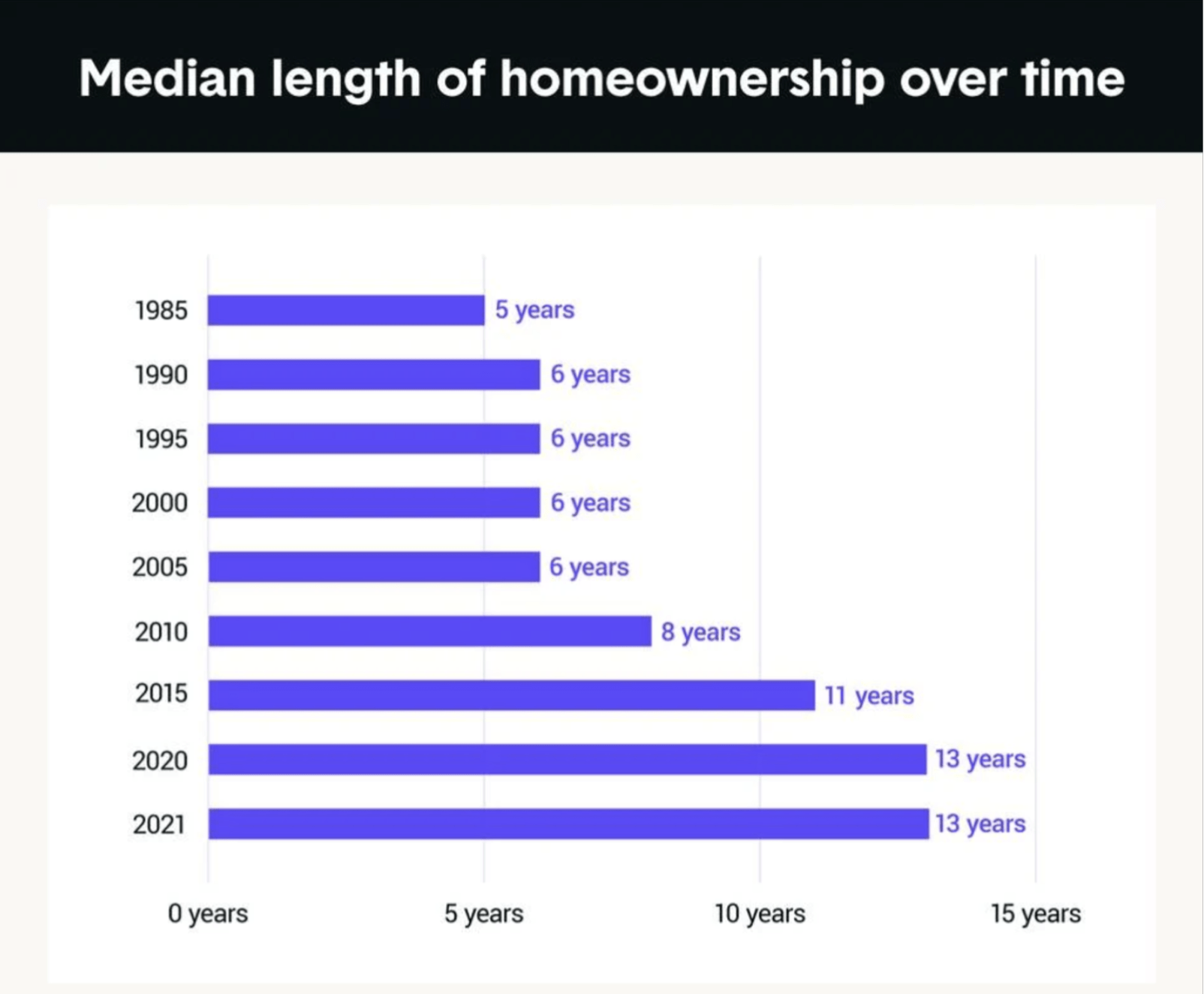

Why will inventory levels remain low? The average length of homeownership in the U.S. has doubled over the last 20 years. When I started in the business the average home in New Canaan turned over every 5 or 6 years, a figure that had been true for decades. That number has been rising steadily for 20 years, independent of interest rates, recession, recovery and presidential cycles. Two years ago, that number had almost tripled, to 13 years growing at 3 years per decade with no signs of reversing. We are all staying put longer. One more prediction contributing to the paucity of listings: instead of downsizing many Americans, particularly Baby-Boomers, will stay put, taking advantage of reverse-mortgages to tap into the equity in their homes. Mortgage experts are telling me to expect an explosion of interest in this kind of product nationwide. Lenders are also beginning to offer renovation loans, folding in the cost of necessary improvements into the first mortgage to address an appraisal hurdle.

In 2019 64.9% of families owned their primary residence. In 2022 we hit a new high, 65.9%, not seen since the 2004 peak. Millenials are buying. The chart shows the sharp rise since 2015 for young, middle-income households, particularly those under 45 and those age 60 to 85. Only those 45 to 60 experienced a small decline. Did they move in with their adult children?

In 2019 64.9% of families owned their primary residence. In 2022 we hit a new high, 65.9%, not seen since the 2004 peak. Millenials are buying. The chart shows the sharp rise since 2015 for young, middle-income households, particularly those under 45 and those age 60 to 85. Only those 45 to 60 experienced a small decline. Did they move in with their adult children?

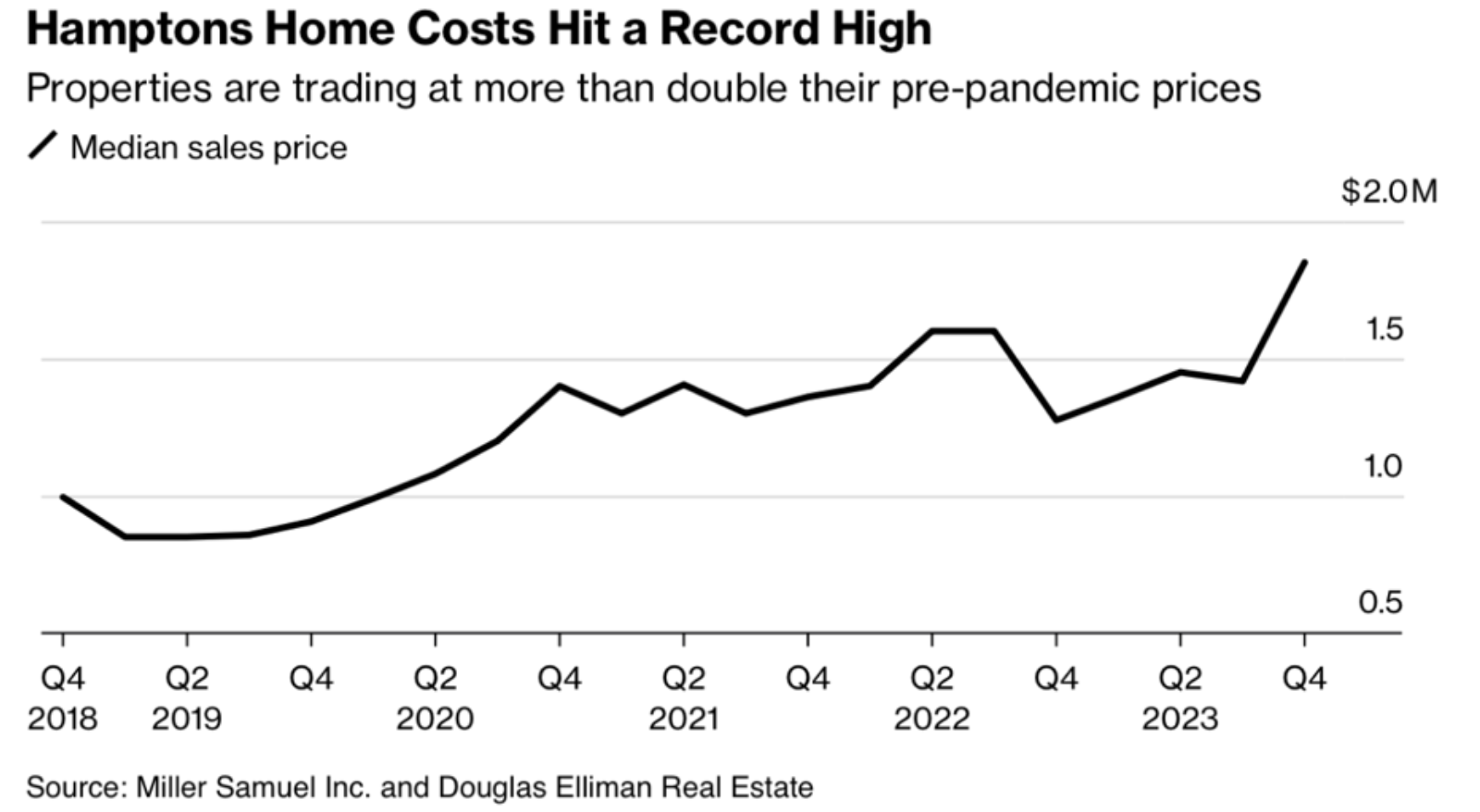

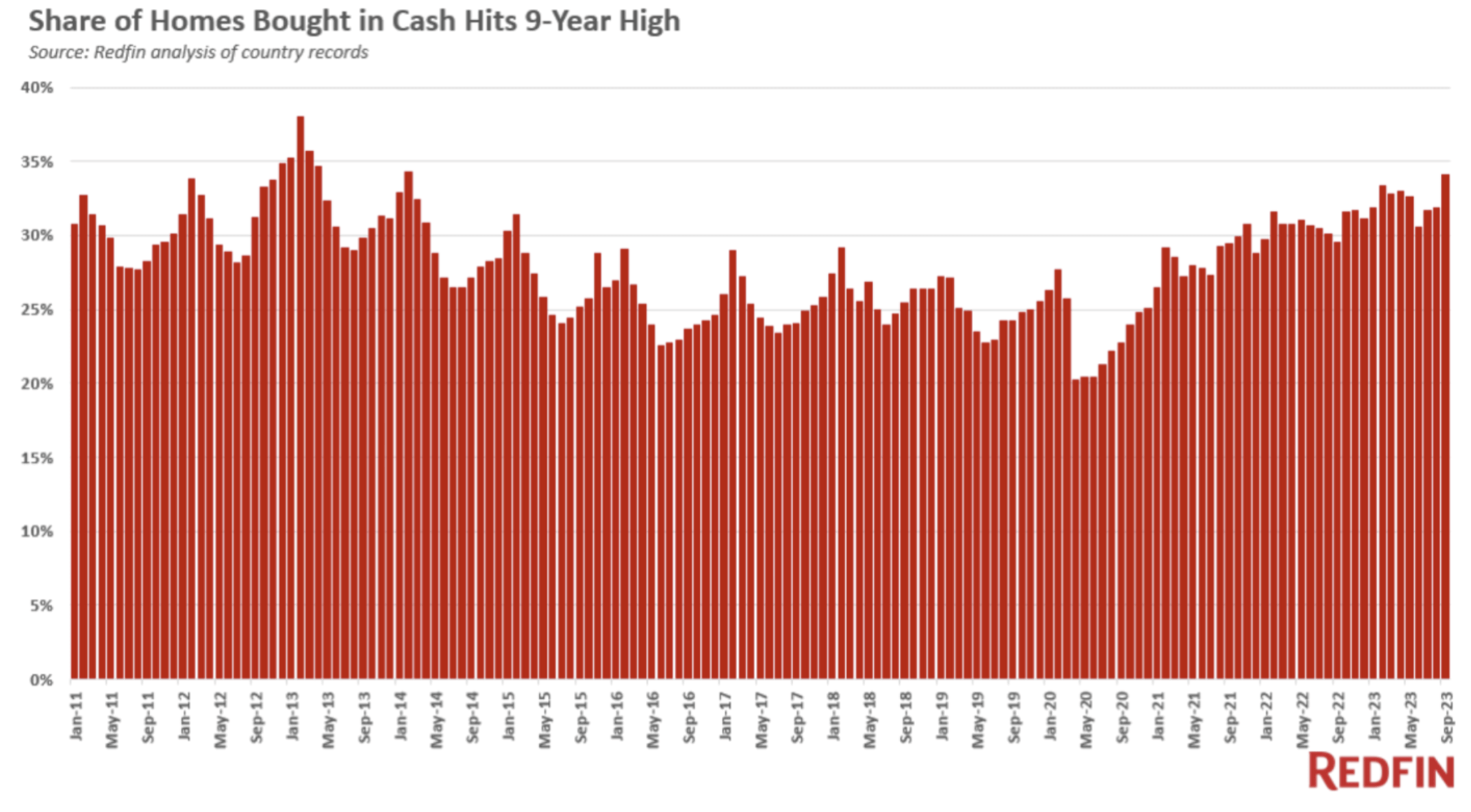

Notes from the Monday Meeting: Rates ticked down another 6 basis points since last week. Manhattan signed contracts up 40% year over year: they’re calling this the bottom of the market as rates dip and buyers jump in: 25 contracts over $4 million last week; the average condo is $9mm, co-op is $6.5mm, townhouse is $8.3mm. The Armani Residences are hot, selling near their $25mm ask. Hamptons median prices surged 45.1% year over year because of a 20% surge in sales over $5 million, representing 12.9% of that market. Meanwhile, in South Florida two thirds of all sales are cash, 96% in Palm Beach. Nationally 35% of deals are cash.

My favorite New Canaan active listing is also the least expensive: The Ogden House of 1868, at 40 Ogden Road, on 1.69 acres with a Carriage Barn, Woodshed and  Outhouse asking $775,000 and still owned by the Ogden family. Originally the home of shoemaker Orson Ogden, part of the Bowery Mill until 1927, and later a garage and furniture repair business. The tax appraisal says it’s worth $953,800 so what’s the catch? There are deed restrictions in place on any exterior alterations designed to preserve the historic value. I called Dylan Peacock of Historic New England, holder of the preservation easements, and learned that Historic New England tries to accommodate owner’s desires within the intent and spirit of the easement. A small addition or pool is not out of the question. That organization holds similar deed restrictions on the Poor Farm, Webb House and Marcel Breuer House, all in New Canaan, and 123 others. And yet Susan Blabey, the listing agent tells me the easement scares most buyers. Consider a similar situation at 8 Ferris Hill. That antique dating from 1735 was sold to a preservationist for $1.5 million in 2016 to save it from demolition, was similarly deed-restricted, and re-sold with its restrictions 5 years later for $650,000 in 2021. It’s currently being restored.

Outhouse asking $775,000 and still owned by the Ogden family. Originally the home of shoemaker Orson Ogden, part of the Bowery Mill until 1927, and later a garage and furniture repair business. The tax appraisal says it’s worth $953,800 so what’s the catch? There are deed restrictions in place on any exterior alterations designed to preserve the historic value. I called Dylan Peacock of Historic New England, holder of the preservation easements, and learned that Historic New England tries to accommodate owner’s desires within the intent and spirit of the easement. A small addition or pool is not out of the question. That organization holds similar deed restrictions on the Poor Farm, Webb House and Marcel Breuer House, all in New Canaan, and 123 others. And yet Susan Blabey, the listing agent tells me the easement scares most buyers. Consider a similar situation at 8 Ferris Hill. That antique dating from 1735 was sold to a preservationist for $1.5 million in 2016 to save it from demolition, was similarly deed-restricted, and re-sold with its restrictions 5 years later for $650,000 in 2021. It’s currently being restored.

John Engel of The Engel Team at Douglas Elliman, is thinking about his home-ownership journey, renting a poolhouse on Dogwood Lane that 1st winter for $800 a month and really stretching to buy that first fixer-upper on South Avenue for $230,000. Next was a cape on Deer Park Road, also a project. The 3rd house was a “Forever Home” on an acre in-town. The 4th was a rental, the 5th new construction. Now the Engels are renovating an antique with a meadow and pond, lucky to be in New Canaan 32 years.