Everybody’s talking about the Revaluation. Next week I will publish a full-page spread showing every house in town, its change, and talk about what we’ve learned. You can link to an interactive map of the reval at https://www.theengelteam.com/blog

Median sales price in New Canaan is $1.775 million on most year end reports, up +2.9% compared to last December 2022. Comparing one month of data to the month last year makes for a spikey, volatile graph and is not useful. Indeed, Darien is up +38.7% and Wilton is down -9.7% in the same graph. Therefore, I’ll use a rolling 6-months of activity to say:

Median Sales Price in New Canaan is $1.80 million, up +6.5% annually and compares to +14% in Darien and +3% in Wilton. Breaking that down we see single family homes in New Canaan at $1.975 million, flat -.1%, while condo medians were down -7.3%. How to square that with the reval? In October 2018 the median sales price in New Canaan was $1.195 million where houses were $1.341 million and condos $676,000.

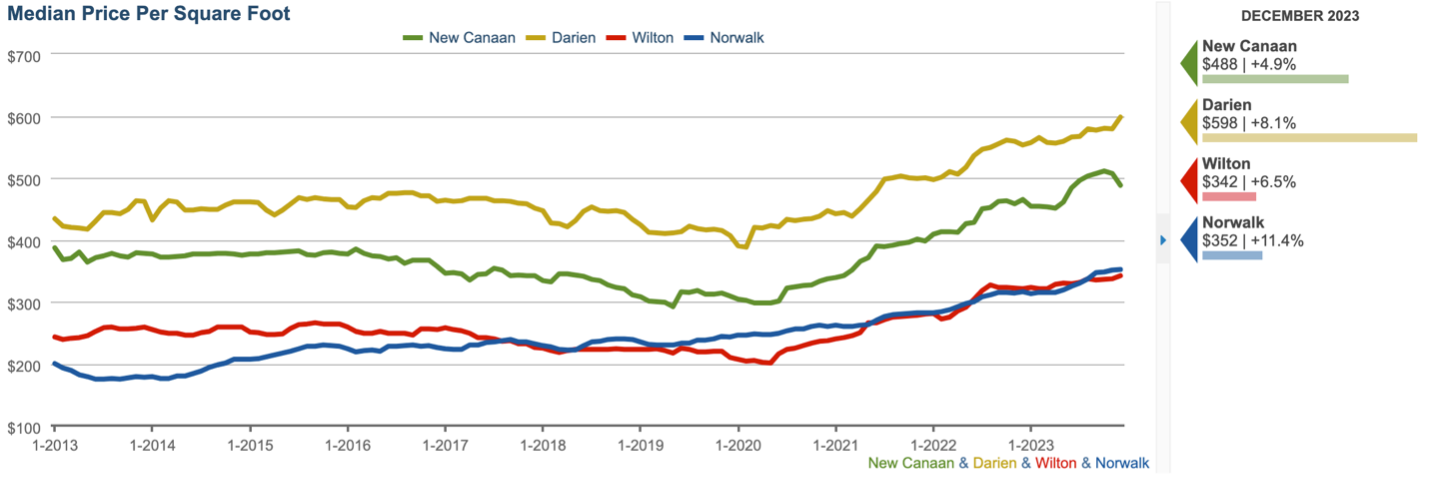

Price Per Foot in New Canaan is $488, up +4.9%. When we compare it to Darien $598, up +8.1%, we see these values move in tandem over the last decade. Why is price per foot always 20% less in New Canaan while median price is usually within a percent or two? My theory is the average house in New Canaan must be larger. In the last month the average of 19 sales in Darien is 3743 sq. feet on .84 acres whereas in New Canaan it was 4,997 sq. feet on 2.23 acres. Going back another two months the results were the same 3,246 sq. feet on .71 acres in Darien versus 3,995 square feet on 1.88 acres in New Canaan. Bigger houses and lots mean a lower price per foot. Why has price per foot in Norwalk ($352) caught up with Wilton ($342), where the price of a home is 40% greater? Possibly it is for the same reason. Over the last 90 days 50 houses sold in Wilton, on average 2886 sq. feet on 1.95 acres where in Norwalk 1660 sq. feet on .46 acres.

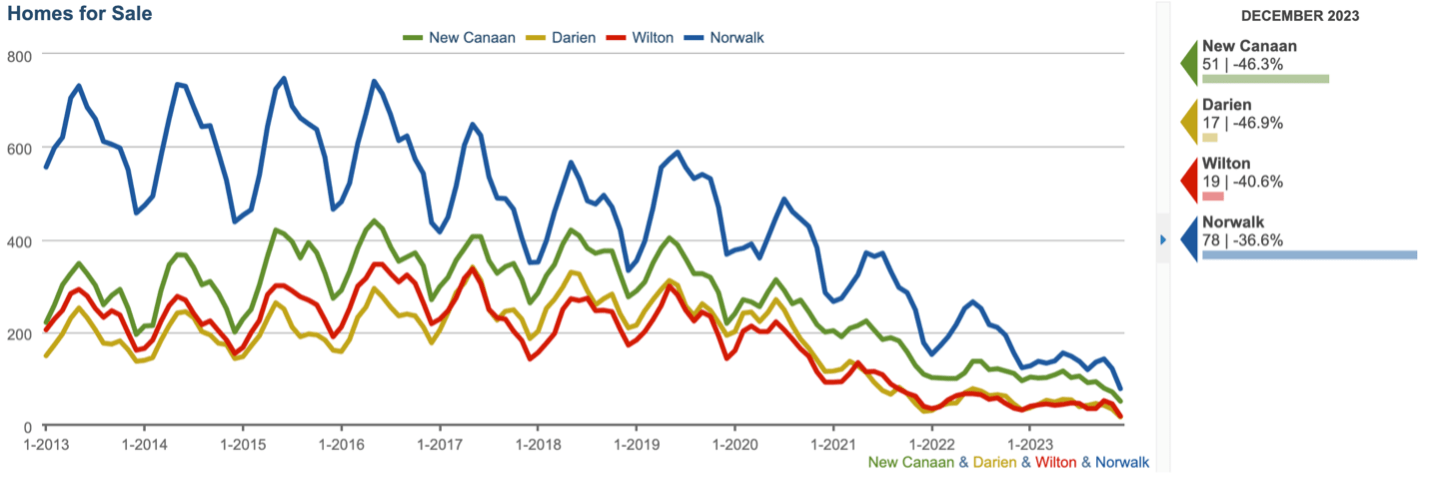

Homes for Sale in New Canaan is 51, down -46.3%. This drop in inventory is being felt across Fairfield County at similar levels, with only 17 houses for sale in Darien and 19 in Wilton, down -46.9% and -40.6% respectively. Norwalk, which has had more than 600 homes for sale for most of the decade is down to 78 homes for sale, down -36.6%. If you talk to any realtor they are optimistic that the cycle will be broken this Spring and inventory levels will rise. The reasons cited range from lower mortgage rates to the shock of the revaluation. I say that inventory levels will remain unchanged in 2024 due to 2 factors: demographics driving demand and lagging price appreciation. There are still too many buyers chasing too few houses, so while inventory remain tight and sellers will be reluctant to list if they cannot buy leading to inventory remaining tight. The second factor is related to the replacement cost. While housing prices have risen 25% in the past 5 years labor and materials and land cost has risen more. Many would-be sellers in New Canaan, happy with the price they can get for their home, are unhappy with its purchasing power in Boca Raton, Hilton Head, Austin, Vero Beach and Nashville.

Homes for Sale in New Canaan is 51, down -46.3%. This drop in inventory is being felt across Fairfield County at similar levels, with only 17 houses for sale in Darien and 19 in Wilton, down -46.9% and -40.6% respectively. Norwalk, which has had more than 600 homes for sale for most of the decade is down to 78 homes for sale, down -36.6%. If you talk to any realtor they are optimistic that the cycle will be broken this Spring and inventory levels will rise. The reasons cited range from lower mortgage rates to the shock of the revaluation. I say that inventory levels will remain unchanged in 2024 due to 2 factors: demographics driving demand and lagging price appreciation. There are still too many buyers chasing too few houses, so while inventory remain tight and sellers will be reluctant to list if they cannot buy leading to inventory remaining tight. The second factor is related to the replacement cost. While housing prices have risen 25% in the past 5 years labor and materials and land cost has risen more. Many would-be sellers in New Canaan, happy with the price they can get for their home, are unhappy with its purchasing power in Boca Raton, Hilton Head, Austin, Vero Beach and Nashville.

Median Days on Market in New Canaan is 26, down -13.3%. Just when you thought it couldn’t get any lower you see that it already has in Darien (16 days) and Wilton (23 days) and Norwalk (20 days) but it is lowest when we look at the Entire Multiple Listing Service (13 days). Shows per listing does not explain it. The only way we could achieve such low Days on Market numbers is if a substantial number of buyers were waiving the mortgage contingency and committing fully to the contract after the building inspection in the first week. Most buyers who need a mortgage are getting pre-qualified by their bank prior to making an offer, leaving only an appraisal to get a “clear to close”. It is estimated that this past year as much as 65% of all offers were cash offers, no mortgage contingency.

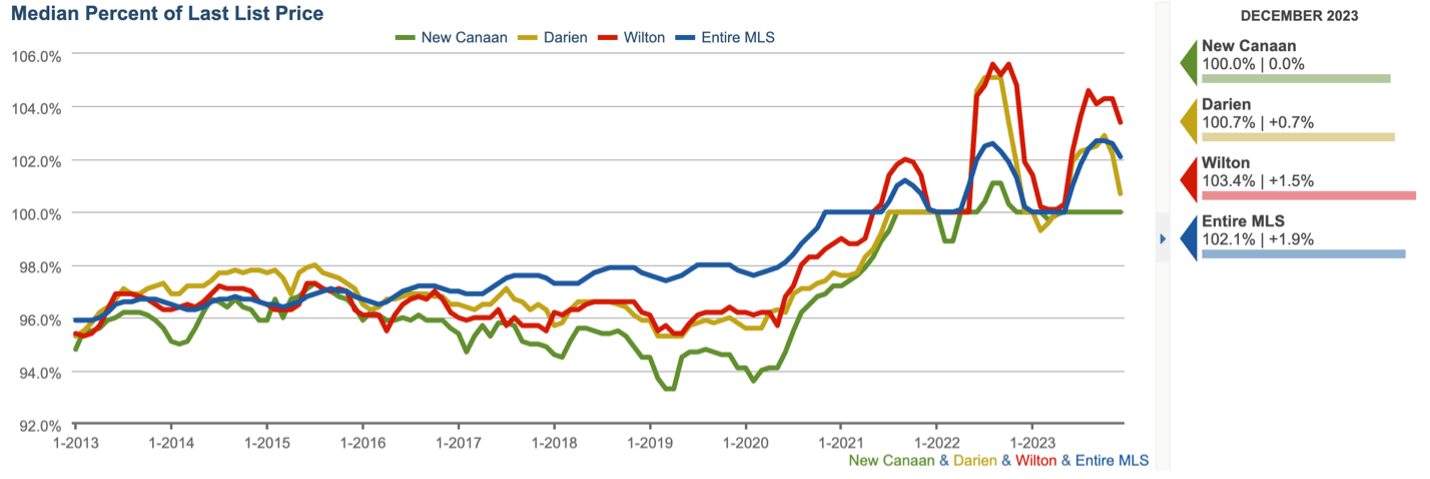

Median Percent of Last List Price in New Canaan is 100%, and that is pretty typical across Fairfield County. Some buyers, tired of losing in bidding wars, start looking at more expensive homes that have been on the market awhile, hoping that the seller’s resolve has softened. That strategy does not seem to be working, as most deals are getting done at 100% or more. In the last 60 days there have been 35 sales and only 5 of them were for 100%.

Median Percent of Last List Price in New Canaan is 100%, and that is pretty typical across Fairfield County. Some buyers, tired of losing in bidding wars, start looking at more expensive homes that have been on the market awhile, hoping that the seller’s resolve has softened. That strategy does not seem to be working, as most deals are getting done at 100% or more. In the last 60 days there have been 35 sales and only 5 of them were for 100%.

Notes from the Monday Meeting: We are re-evaluating what worked last year and how can we improve next year. A top NYC agent who usually sells $500 million each year commented that he was down 30% in sales in 2023 but it’s ok because he expected to be down 50%. Was that supposed to make me feel better? Agents are hard-wired to believe business will grow 50%. New Years is always an exciting time as we talk about all the new listings we are bringing on this Spring. Some of them are waiting on better weather while others wait for legal paperwork (probate, tax and divorce) to catch up before they can be listed. We start with big plans to blanket the world in postcards and emails but I was reminded that statistically speaking most of a realtor’s business comes from the personal relationships we have developed over decades, not the dollars spent on Zillow advertising.

John Engel is a Realtor on The Engel Team at Douglas Elliman and now is a proud father of the bride. That’s right, John Ellis of Darien proposed to Charlotte Engel in our backyard as we were having our Christmas photos taken. (She said yes.) Although the couple grew up 4 miles apart, they met attending St. Andrews University in Scotland. Her twin sister Lillian was in town enroute to the Cordon Bleu cooking school in Paris. His twin, Katherine was also there.