How do we differentiate between moderately strong and strong in the town by town analysis below? Mostly we looked at price appreciation. Those towns which are still seeing price appreciation above 5% annually are characterized as strong. This is a better metric than days on market or percentage of asking price.

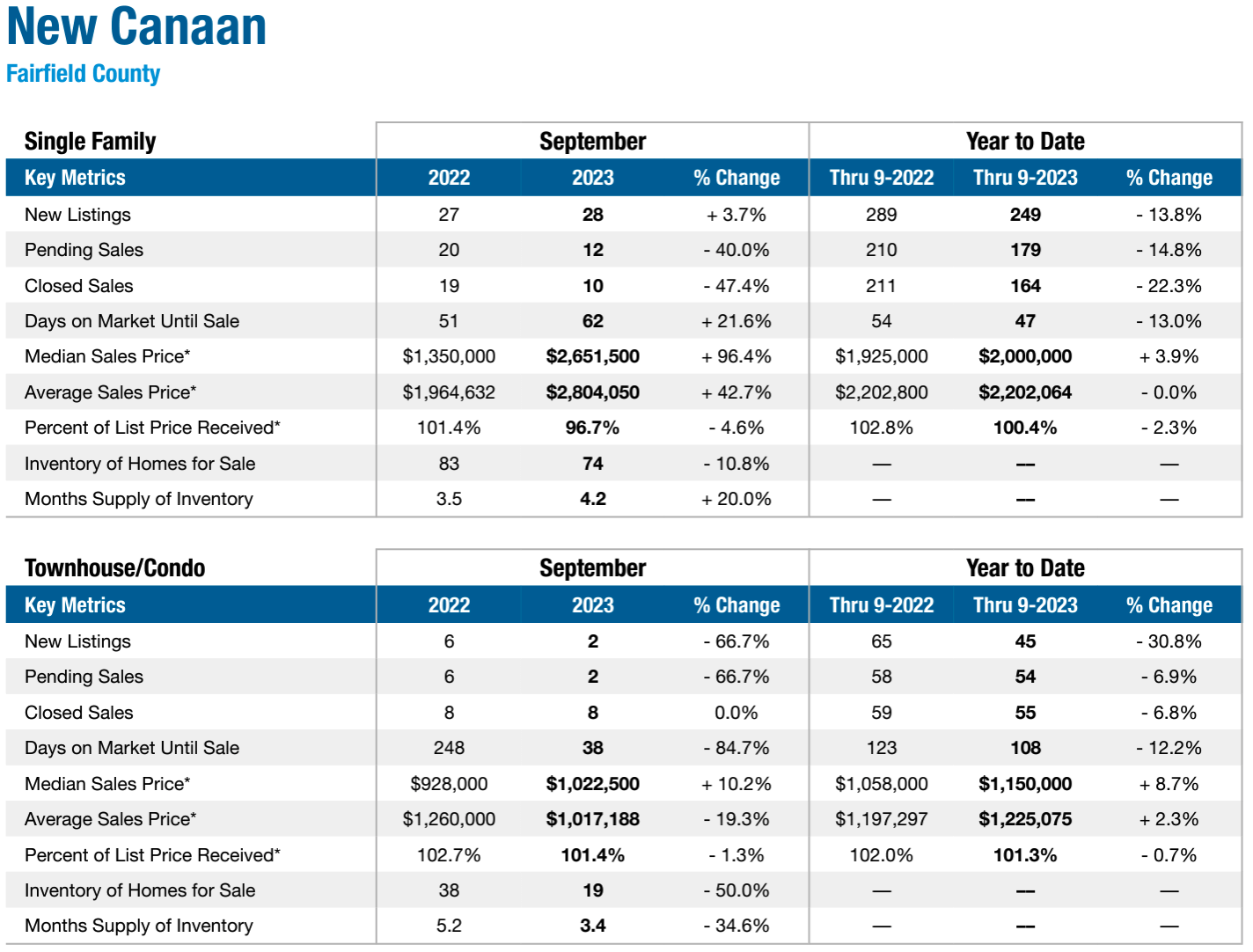

New Canaan’s market is flat and values are rising at 4.8%.

All price trend indicators rose to new records as listing inventory fell sharply. Sales fell year-over-year every quarter for the past two years. Dropping sales volume is occuring across the board, in every town. Why? For the last 15 years we have seen sales levels decline from the second to the third quarter around 15%. That’s a seasonal norm. We have to ask ourselves in 2023 is slowing activity based on:

- a seasonal slowdown, typically a drop of 15% from second to third quarter

- buyer pullback from rising interest rates and decreased affordability

- seller optimism in the face of rising prices and continued bidding wars

- a tightening of lending standards from banks pulling back

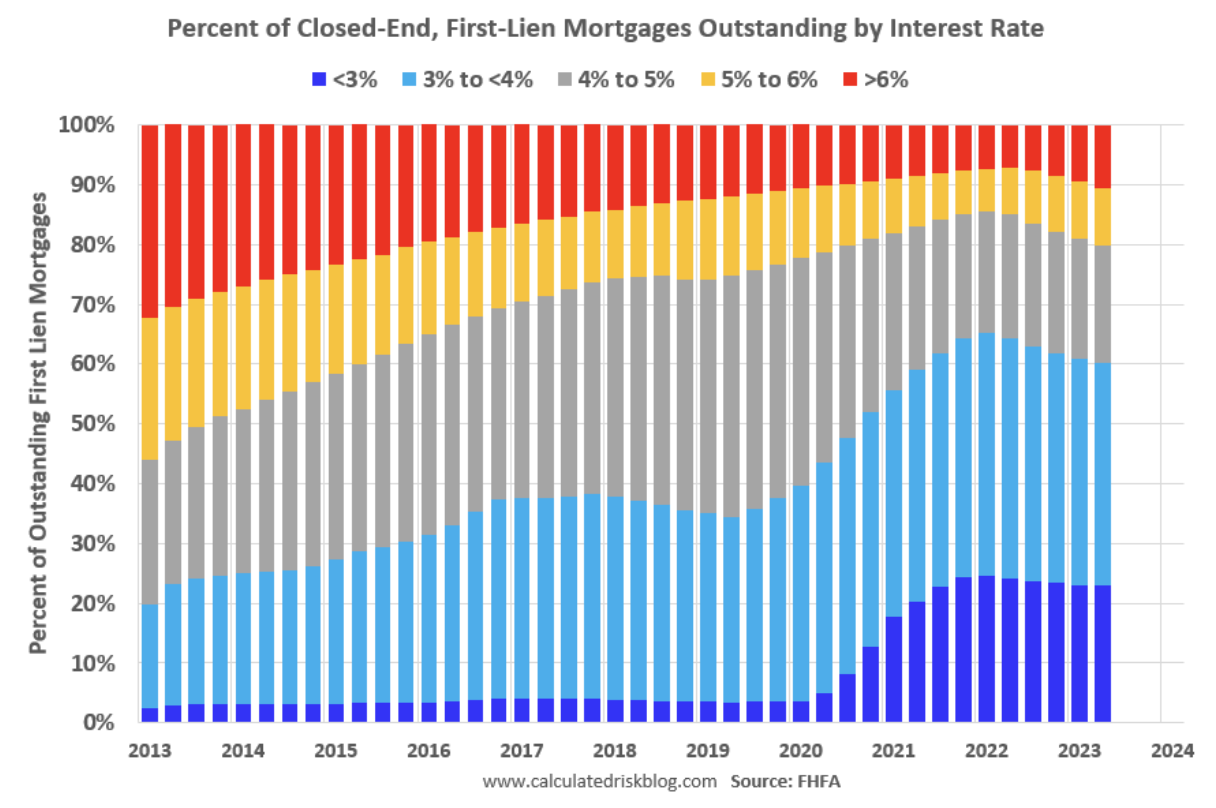

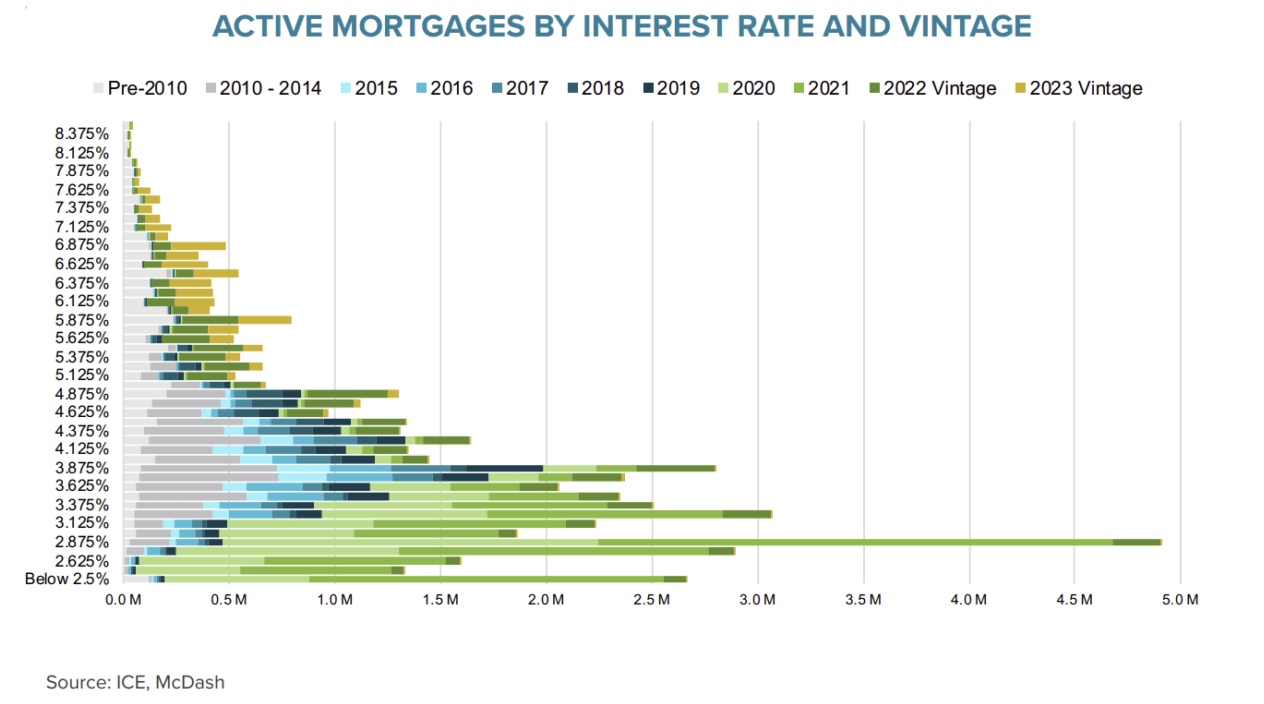

We believe it all four of these factors are at play and that the decrease in sales volume will persist into Spring. The spread between current interest rates and existing mortgages has never been greater, and the spread is widening. Labor and materials inflation is having an impact on speculative building. New product is not coming on-line in sufficient quantities, further exacerbating the problem. Finally, sellers are optimistic that the Spring will be a better market, that there is no urgency to put a house on the market in the second half of the year. My advice to buyers is use the fourth quarter to make your best deal. New listings, price changes and re-listed properties are prime opportunities. This is the season where we see a greater seller’s willingness to negotiate. Sellers, consider listing in January for a strategic advantage. Buyers will return after the holidays with the most limited choices, maximizing your profits. Timing matters.

What will it take to bring the Fairfield County market into balance with more inventory, fewer bidding wars, greater sales volume? A few possibilities:

- rising interest rates increases borrowing costs and could slow demand

- economic recession, job losses and decreased consumer confidence

- declining interest rates could prompt sellers to give up existing mortgages

- assessor revaluations are underway, raising taxes for some by 15%-20% in a single year, a shock that forces many sellers to reevaluate

- if the labor market loosens then builders might begin building. With tight labor builders are increasingly selective of the projects worth pursuing

- lower inflation, both in materials and labor, would allow greater balance

While most of us would like more balance in the real estate market, more choices for buyers, more choices for builders, we generally do not want balance when it is the result of a rapidly cooling economy. Throughout Fairfield County, in every town, at every price point, demand is strong. The volume of sales may be modest for the foreseeable future, but for those of us who own our homes, who have low interest rate mortgages, and for whom moving is not urgent, this period of imbalance is better than the alternative.

Third Quarter Market Reports By Town

Comparative Market Analysis on New Canaan, Darien, Greenwich and Westport from John Engel

New Canaan’s market is flat and values are rising at 4.8%. While average price is flat from a year ago at $2.2 million, we saw median prices rise by 3.9% this year after a September full of large sales. September saw the average climb 42% and the median price nearly double to $2.6 million from an anemic median $1.35 million a year ago. Closed sales of only 164 year-to-date is worrisome, as it represents a contraction of 23% from a number (211) last year that wasn’t all that exceptional. 55 condo sales, down from 59 at this time a year ago, is still 20% above historical norms. Expect continued strong performance from the condo market that now represents 18% of all sales.

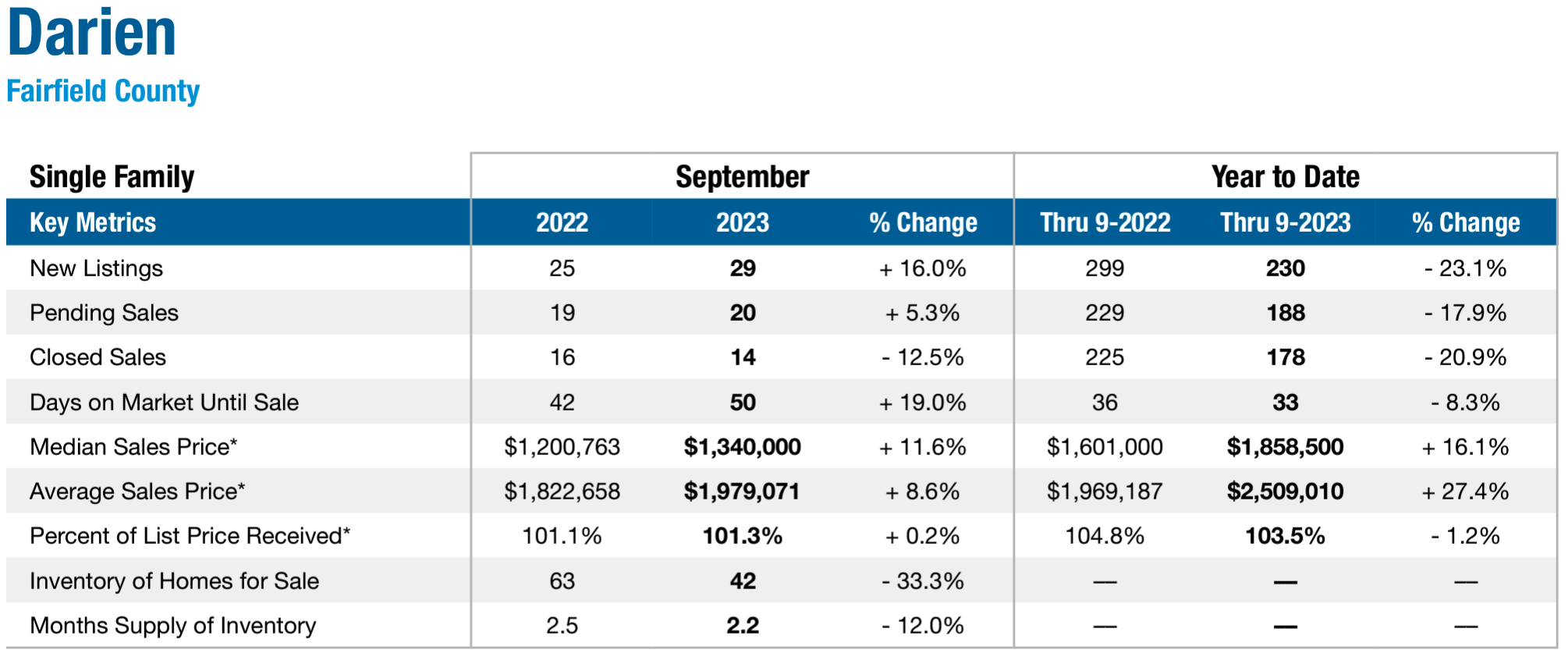

Darien is strong and strengthening with values rising by 4.5%. The year-to-date numbers show roughly 20% fewer listings and sales than last year, but September saw an increase in listings, pending sales and closed sales versus the previous September. Average and median prices are rising at a double-digit rate and represent new 20-year highs over last year’s records.

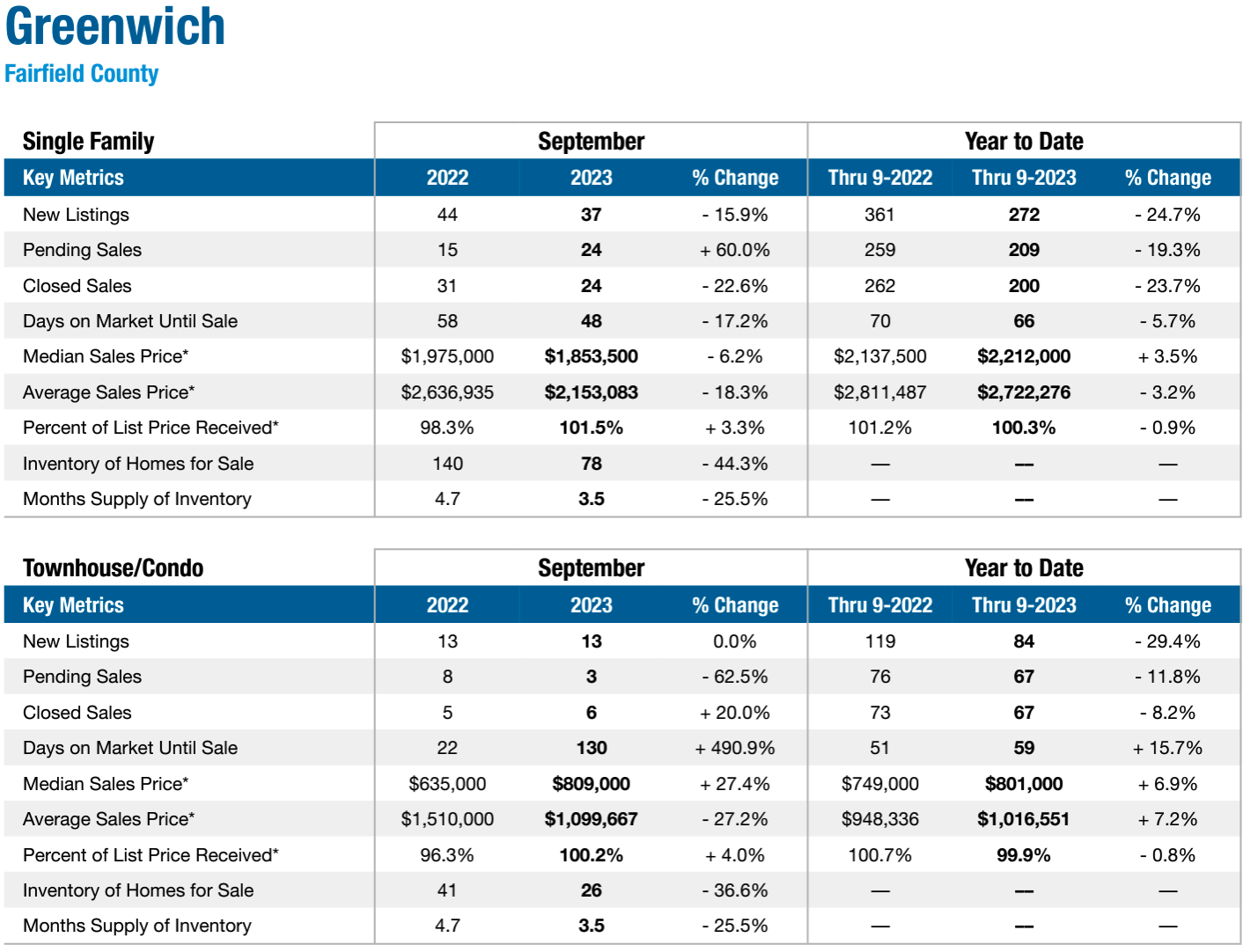

Greenwich is moderately strong. Despite a modest decrease in the average and median sales price in September we saw that average price is significantly down and median prices are about where they were a year ago. The average house is selling for 101% of its asking price. The 44% decrease in inventory to 3.5 months is likely to have a positive effect on prices. We see the Greenwich market rising at a 4.9% level. The average house takes 33 median days to pend.

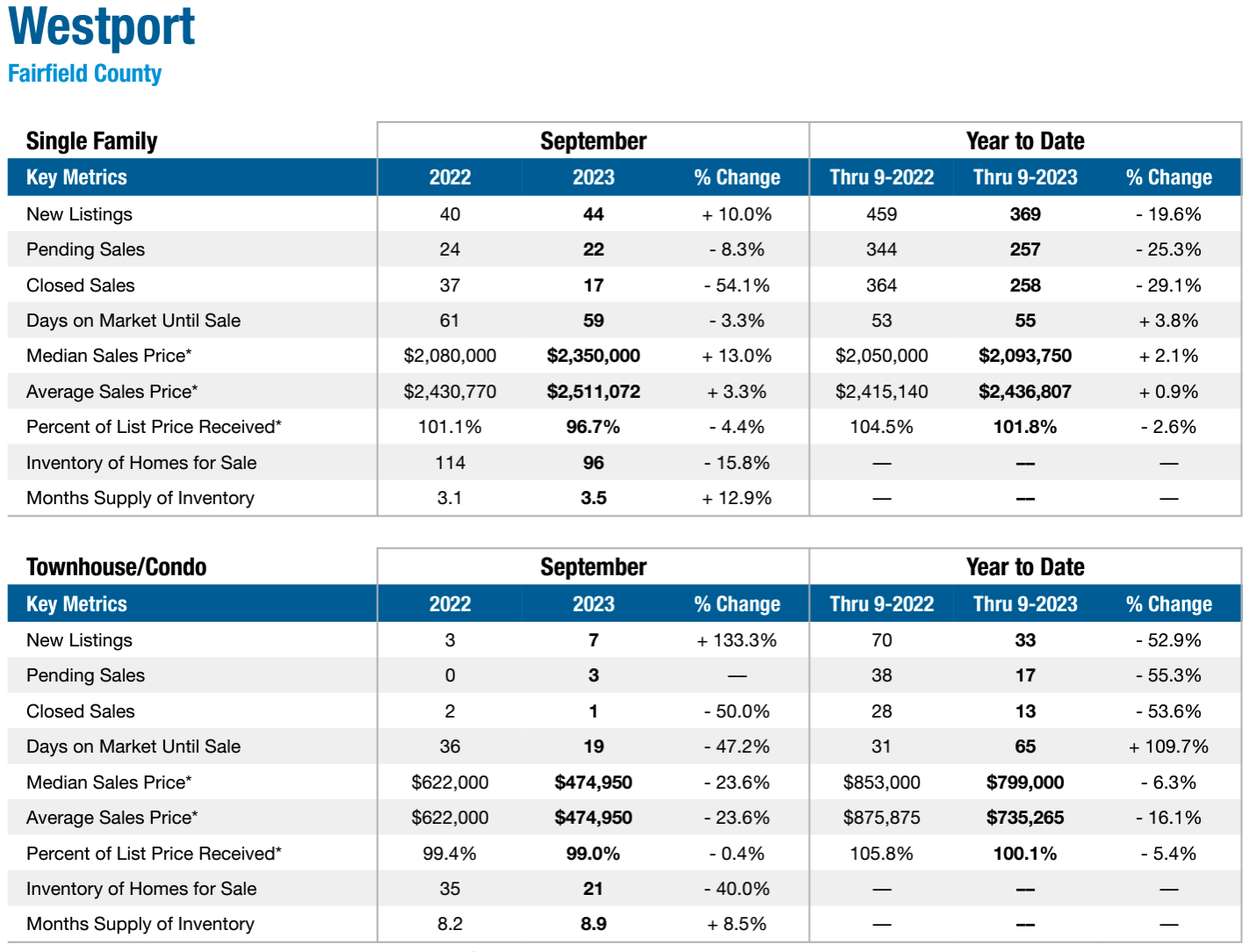

Westport, moderate, once a rocket to the moon, is slowing down. They added 44 new listings in September, but only sold 17 of them and 22 went pending. It’s now taking 31 median days to pending. Prices this year seemed to have stalled at the $2.1 million level after rising more rapidly and steadily than most since 2020. The September slowdown in activity means Westport has a healthier 3.5 months of inventory to sell, and the 21 condos available represents 8.9 months of inventory there. Suprisingly, the condo prices have fallen this year to the mid $700’s. Westport values are expected to continue to rise at a 3.9% annual rate.

Notes from the Monday meeting: the Fed is not expected to raise rates in November but with inflation at 3.7% we expect rates may rise ahead of the Spring market.

John Engel is the real estate editor of the New Canaan Sentinel, a Realtor, the son of a Realtor, the husband of a Realtor, and the father of a ballet dancer, a film editor, a college student and a clothing historian. You can find him in the Symington land trust property walking his golden retriever Callie most mornings, or seated on the right side during Planning & Zoning hearings. He graduated New Canaan High School in 1985.

John Engel is the real estate editor of the New Canaan Sentinel, a Realtor, the son of a Realtor, the husband of a Realtor, and the father of a ballet dancer, a film editor, a college student and a clothing historian. You can find him in the Symington land trust property walking his golden retriever Callie most mornings, or seated on the right side during Planning & Zoning hearings. He graduated New Canaan High School in 1985.