Connecticut requires every town to conduct a town wide property revaluation every five years to reset the “Grand List”: a list of all taxable residential and commercial property assessed at 70% of the fair market value as of Oct. 1, 2023. New Canaan, Wilton, Darien, and Norwalk are re-evaluating now. The town hired Municipal Valuation Services (known as Munival) to conduct site visits to get the facts right on every house: square feet, room count, finished basement or attic and open permit status. Munival is not assessing for value. That is the assessor’s job. They are just measuring. New Canaan’s assessor Sebastian Calderella is looking at nearly 300 New Canaan sales within the past year and using those sale values to set the assessment for similar houses. I spoke to Sebastian about what we can expect, and this is what he told me:

Connecticut requires every town to conduct a town wide property revaluation every five years to reset the “Grand List”: a list of all taxable residential and commercial property assessed at 70% of the fair market value as of Oct. 1, 2023. New Canaan, Wilton, Darien, and Norwalk are re-evaluating now. The town hired Municipal Valuation Services (known as Munival) to conduct site visits to get the facts right on every house: square feet, room count, finished basement or attic and open permit status. Munival is not assessing for value. That is the assessor’s job. They are just measuring. New Canaan’s assessor Sebastian Calderella is looking at nearly 300 New Canaan sales within the past year and using those sale values to set the assessment for similar houses. I spoke to Sebastian about what we can expect, and this is what he told me:

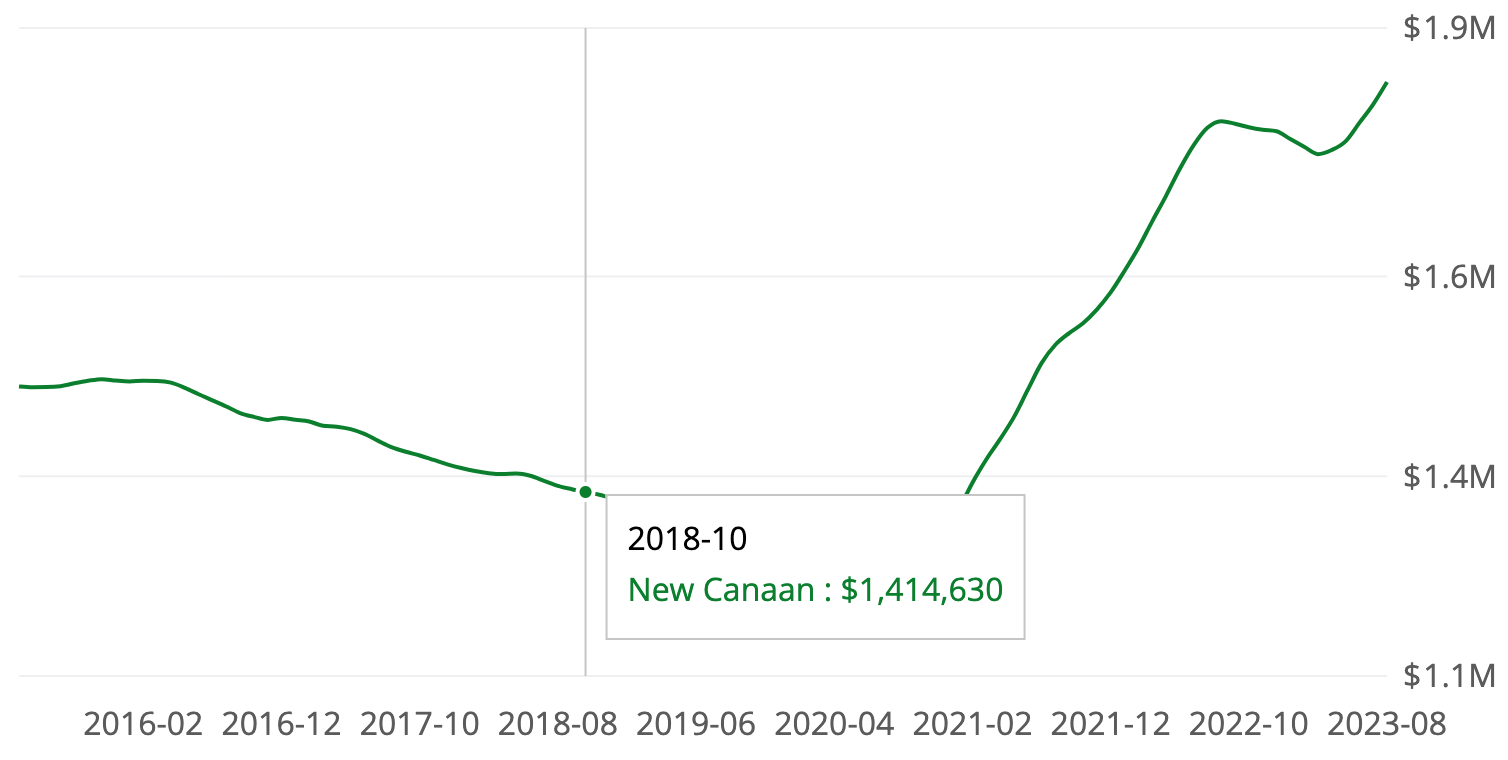

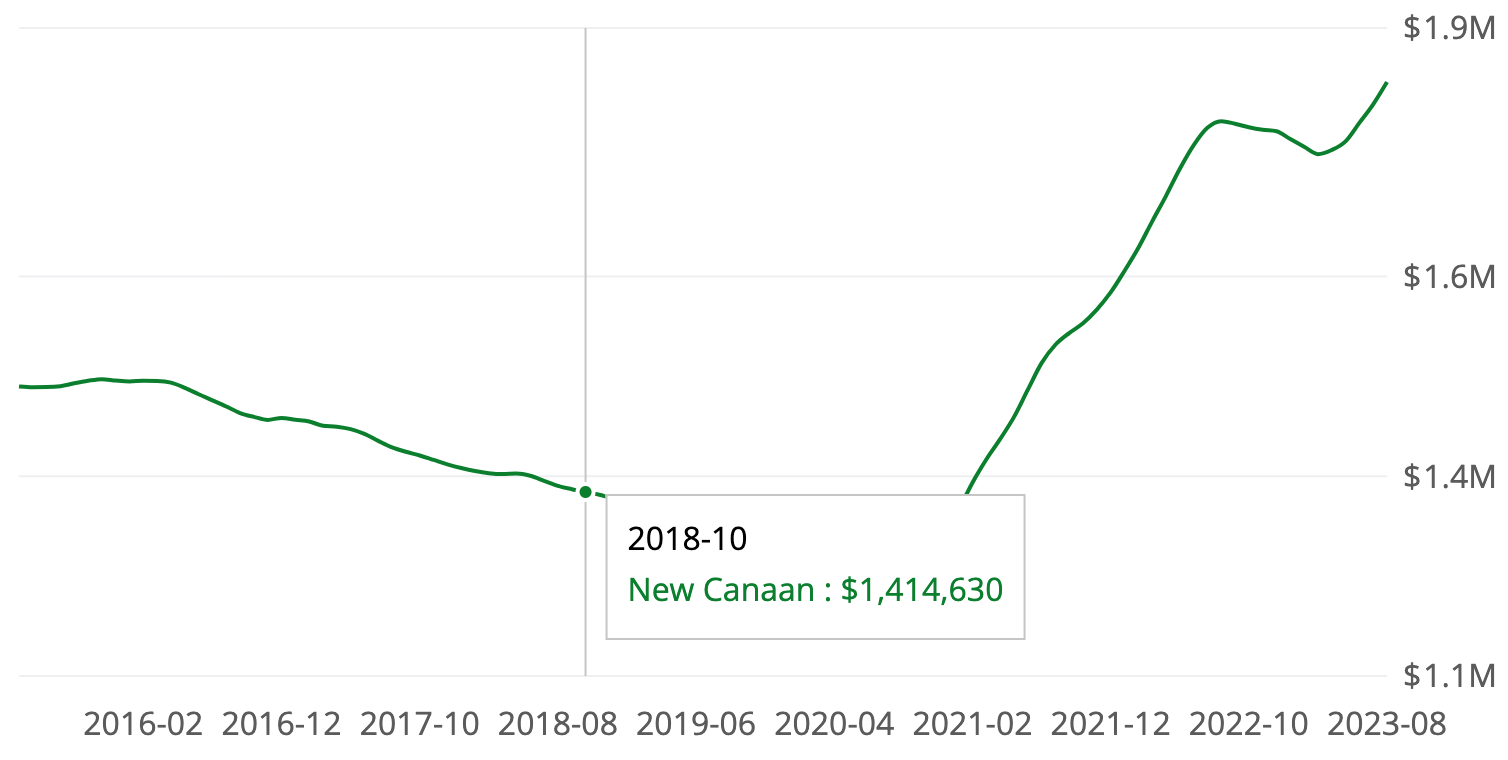

- The market for houses and condos has gone up considerably, about 30% for houses and probably the same for condominiums.

- Every assessment is as-of Oct 1 and based only on one year of sales. He might look back at sales 2 and 3 years old but only to discover trends.

- New Canaan does not have a map of neighborhoods. We tried that briefly in 2008 but it was not useful. The assessor’s office does group about 23 areas that trend together, but there is no map and it’s the department’s internal guideline. South Avenue, Behind the Y and Hoyt Farms are neighborhoods but Beacon Hill is not, too small.

- We talked about “anomalies” Those are properties that sold for a more than 10% difference from what their assessments predicted. I cited a ranch on the west side which was appraised for $1,300,000 in 2018 and sold for $2.4 million in 2020. How can this be? Maybe the facts are wrong, maybe the renovation was just that good. Sebastian said maybe that ranch wasn’t a ranch. The revaluation will reset those anomalies.

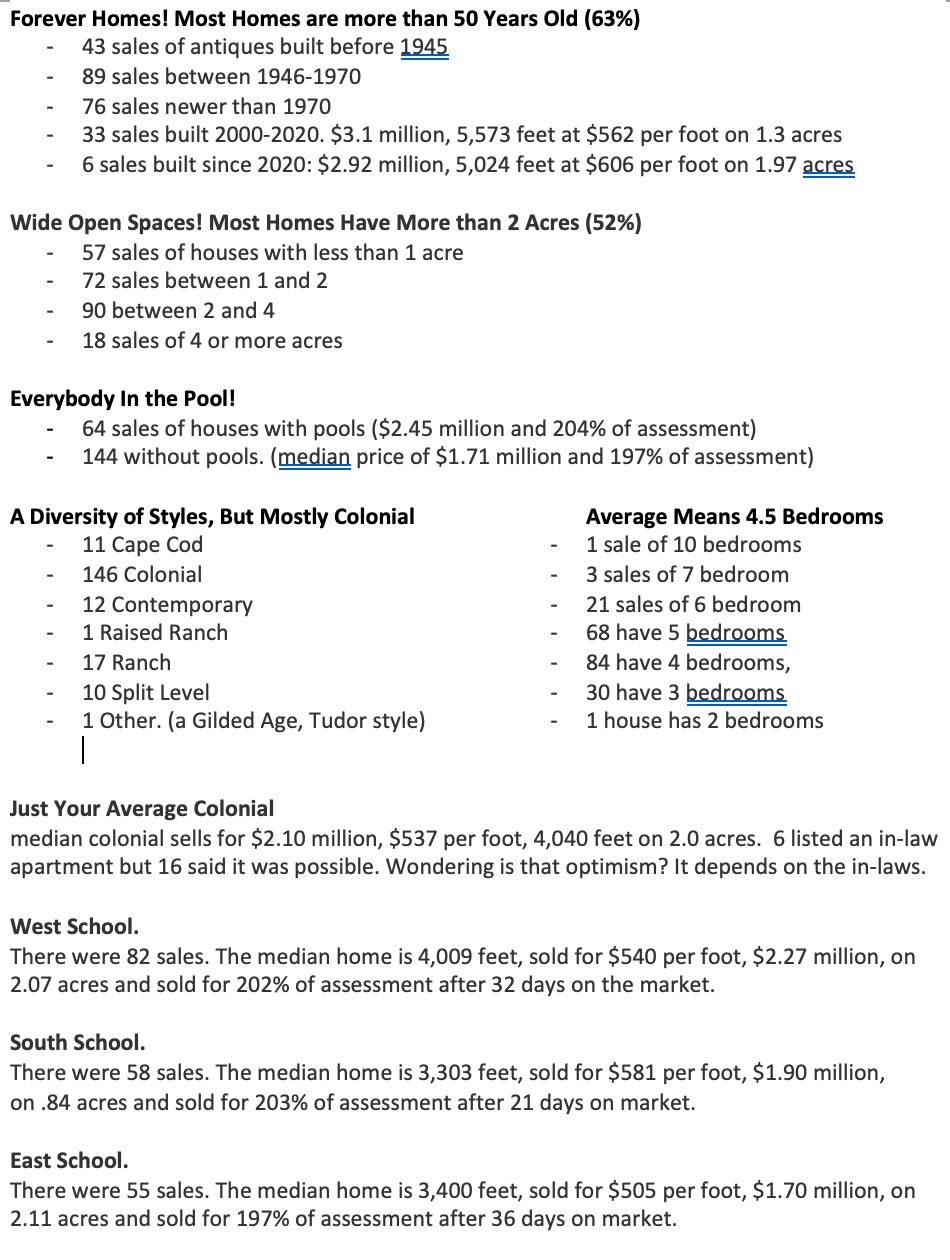

- I asked if antiques as a group can expect lower valuations. The answer is no, sometimes the market favors certain groups like antiques or moderns and we can’t make a blanket statement. Same with houses on cul-de-sacs or roads with double yellow lines.

- When we talked about South Avenue he said about the recent trend, “It’s crazy, makes no sense” versus similar roads that aren’t commanding that premium. Maybe it’s all those beautiful sidewalks? Watch out Richmond Hill, you’ll be the next hot street.

- In Wilton the the first selectman said of the revaluation, “the revaluation process would likely result in a shift in property tax burden from commercial property owners (who have seen declining property values) to homeowners (who have seen rising property values).” New Canaan has a much smaller commercial base than any of the surrounding towns, and is far less likely to see an impact from any changes in commercial values.

- In Norwalk less than 20% of homeowners were home and only half of them let the reval company in. As a result over 1000 homeowners appealed and nearly 500 took their new assessments to court. Sebastian says going to court is expensive for the town, so he’s purposely conservative, preferring to undershoot than overassess.

Revaluaton always shakes things up a bit. This may be just the catalyst to cause additional inventory to hit the market at homeowners take stock.

In 2018 we conducted our last revaluation and condo owners saw their values rise more than houses. We held a public hearing at that time and explained that condominiums had been previously undervalued and needed a reset. Very few of those condo owners appealed. Sebastian says that’s what he wants to see, evidence that his office is doing a good job.

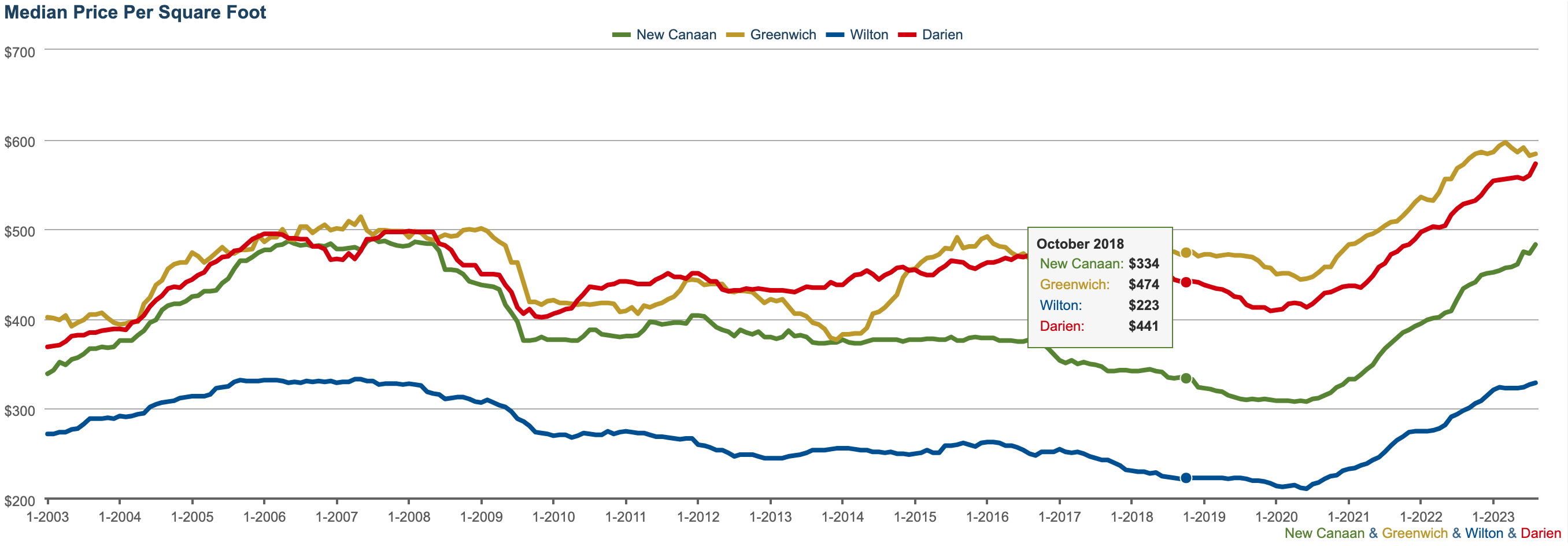

New Canaan price per foot has risen 44% since the last revaluation, from $334 to $483

I decided to try revaluing New Canaan. To do it I downloaded the last year of sales to see what I might find on the upcoming revaluation. I found the 2018 assessment to be a poor predictor of sale price. Using the New Canaan multiple listing service I found 183 home and 49 condo sales.

- Only 35 of 183 houses have an assessment of 60% to 80% of what they sold for.

- If the market rose by 30% in the last 5 years then only one third of sales meet the assessors goal where the assessors appraisal is within 10% of their new sale price. In one sample 82 of those homes underperformed and 40 overperformed, selling for more than 10% over their projected value.

- Condos are more predictable. Assuming the condo market rose 30% in the past 5 years then 22 of the 39 sales are within 10% of projected.

One takeaway is that the revaluation is a critically important tool for adjusting property values to be more in line with where houses are selling. We can’t rely on a uniform increase from the prior valuation because less than one third of houses are selling for the predicted amount. Indeed, Zillow estimates based on quantitative data like bedroom count, the year built and square footage fail to take into account the view, the quality of the land, and even condition or the quality of the improvements. Recently, they’ve made improvements to that algorithm adding additional public and user-submitted data. Nevertheless, in the New York metropolitan area Zillow predicts the value of off-market homes within 10% of the sale price only 57.58% of the time and within 20% accuracy 82.6% of the time. In Connecticut those percentages are within 1 point. When off-market homes are listed Zillow gets the benefit of a Realtor’s judgement and adjusts their estimates in line with the asking price. For active listings Zillow gets within 10% about 91% of the time in both New York and Connecticut.

Let Munival in. They are not assessing, they are fact-checking. Sebastian says he tries to give cooperating homeowners the benefit of the doubt. He is less generous in his assumptions when we make him guess.

Consequences

Wilton just indicated that property taxes are going up 6.6% this year and the mill rate there will be 30.79. That means a $30,000 tax bill for a $1.42 million house there. New Canaan and Darien haven’t announced yet but we struggle with the same inflation and budget issues. We compete with the towns around us, and mill rates are compared. Revaluation always shakes things up a bit. For example, in 2018 the typical $2 million house saw an 11% change and a $3 million house saw a 14% change. So, if a 6.6% hike is typical across Fairfield County, and this revaluation adds similar volatility, adding or subtracting an additional 10% to 15% from the typical tax bill, then many homeowners will be prompted to consider selling. While many of us don’t want to give up our low-interest-rate mortgages, significant tax changes might be one of the factors that brings our real estate market back into balance. This may be just the catalyst to cause additional inventory to hit the market as homeowners take stock.

John Engel is a Realtor with The Engel Team at Douglas Elliman. He is the new Real Estate Editor for The New Canaan Sentinel. He moved to New Canaan in 1980, attended New Canaan public schools and has served on Staying Put, the Rotary Club, the New Canaan Land Trust, on the Zoning Board of Appeals, the Town Council and is currently a member of Planning & Zoning Commission. His opinions are his own. He can be reached at 203-247-4700 or john.engel@elliman.com and welcomes your feedback.